Flight to Safety: Investors Snap Up Bonds as Summer Risks Loom Large

Broad U.S. equity averages flirted with record highs this week, but Wall Street’s optimism ran dry by Friday as investors around the world renewed the hunt for safe havens.

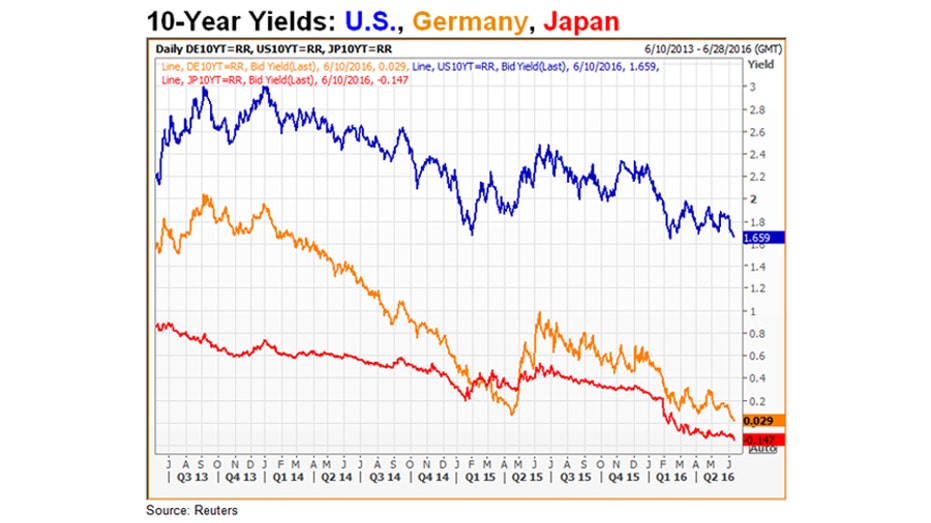

Global bond yields, which move inversely to prices, notched fresh lows overnight pushing the U.S. 10-year to settle at its lowest level since May 2013. Meanwhile, the yield on the 10-year German Bund sank to a record low of 0.01%, while the Japanese 10-year yield pushed even further into negative territory, hitting a new low of -0.150%.

To further illustrate the point, data from Bank of America Merrill Lynch show equity markets last week saw $2.6 billion in outflows, while $7.9 billion moved into the global bond market, the most in nine weeks. But the moves don’t’ necessarily mean investors aren’t willing to take any risks: High-yield bonds, which carry elevated risk levels given their credit ratings of less than investment grade, have seen the largest inflows in 11 weeks, totaling $2.6 billion.

“Government bond yields are making new lows globally and risk assets are declining under the pressure of slow economic growth and Brexit fears,” Dennis DeBusschere, senior managing director at Evercore ISI, said in a note Friday.

The middle of June brings the potential for two major risks for the U.S. economy and the global landscape overall. It all starts next week with the Federal Reserve’s two-day policy meeting, followed by a referendum in Great Britain where voters will decide whether their nation should leave the European Union. A vote in favor of the so-called Brexit could roil global financial markets and tighten financial conditions further. Stocks across Europe posted sharp declines Friday as the pan-European Euro Stoxx 600 shed 2.4% while U.K. equities dropped 1.9%.

Ahead of that vote, global investors are not anticipating a change in U.S. monetary policy in the form of an interest rate increase at the Fed’s June 14-15 meeting, though the central bank has been known to surprise the markets. Fed funds futures, a tool used to predict market expectations of changes in U.S. monetary policy, indicate just a 2% chance the Fed will move rates higher at this month’s meeting for the first time since December. Markets are pricing in odds of 23% by July and a 56% of at least one rate rise by December.

Still, DeBusschere said risks for a downturn in the U.S. economy haven’t been completely removed.

“The yield curve has fallen to new cycle lows, indicating a deteriorating outlook for growth,” he said. “If credit spreads start to move wider and inflation expectations decline, U.S. risk assets would have significant downside risk.”

Bill Gross, who manages Janus Capital’s $1.4 billion Janus Global Unconstrained Bond Fund, said in a tweet Thursday that the moves lower in global yields are a red-hot warning of what’s to come, flagging risks of ultra-low interest rates, which cause a more determined hunt for yield and has so far sent traders around the world into higher-risk and longer-duration debt.

Gross: Global yields lowest in 500 years of recorded history. $10 trillion of neg. rate bonds. This is a supernova that will explode one day

— Janus Capital (@JanusCapital) June 9, 2016

“Global yields lowest in 500 years of recorded history. $10 trillion of negative rate bonds. This is a supernova that will explode one day,” he said.