Skechers U.S.A. Thinks This Market Can Be a $1 Billion Business

Skechers USA's (NYSE: SKX) third-quarter earnings report sent its stock into a tailspin recently as all of its businesses segments stalled. But there's one market in particular the footwear maker has particularly high hopes for, so much so that it thinks it will be a billion-dollar business within five years.

Image source: Skechers U.S.A.

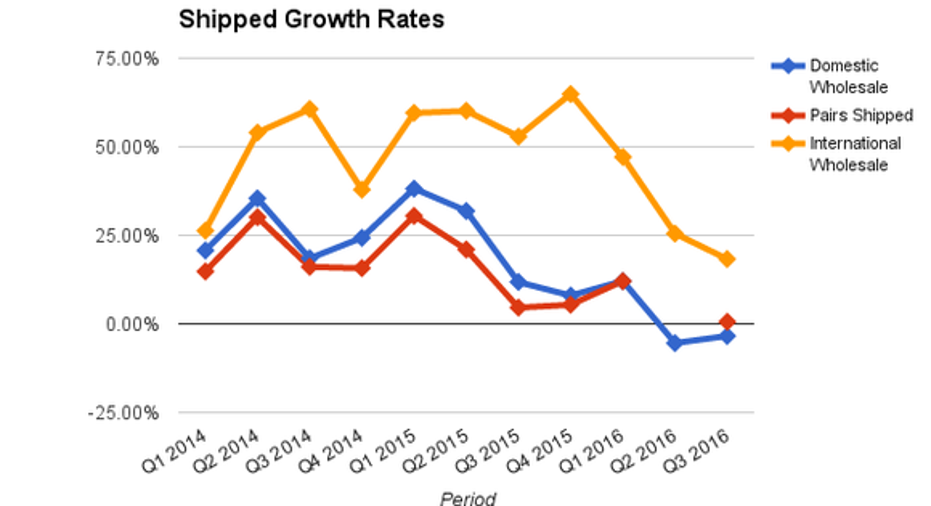

Kicking it into low gear

Results for the past year haven't been pretty. Growth rates in the domestic wholesale business turned negative, the number of pairs of shoes shipped were flat year over year -- and may also turn negative if trends continue -- and Skechers' international wholesale business is in the midst of a midair stall.

Data source: Skechers quarterly SEC filings. Chart by author.

That had sales and profits falling below Wall Street estimates for the period, but it also led the footwear maker to offer guidance that was well below the consensus.

The U.S. retail market is depressed. Last year City Sports declared bankruptcy, followed by the parent of Eastern Mountain Sports and Sports Chalet, Vestis Retail Group. And then the biggest bankruptcy of the sportswear market, Sports Authority, came in earlier this year.

A shrinking pie

And when sporting-goods retailers aren't declaring bankruptcy, they're closing stores or reducing their size. Foot Locker (NYSE: FL), for example, has reduced its Lady Foot Locker chain to about 140 stores at last count, down from almost 160 at the start of the year and nearly 200 stores at the start of 2015.

There there's the matter of where consumers are shopping these days. Sports Authority, for example, couldn't keep pace with consumers who preferred the overall experience from shopping atDick's Sporting Goods(NYSE: DKS)-- which is buying some of the bankrupt retailer's assets -- as well as at Cabela's and Bass Pro Shops. So rather than having a retailer that specializes in footwear, branded footwear is competing not only against other brands but also other clothing items.

Yet because there are outlets that are still doing well, including Dick's, REI,Finish Line, and Foot Locker, it suggests there are deeper problems facing Skechers.

Image source: Getty Images.

A homegrown problem

Athletic sportswear and footwear is a $70 billion industry, split about equally between the two, and 2015 was one of the better years in recent periods, with footwear sales growing by mid-teen percentages.But SportScanInfo data says the industry may be weakening, as athletic footwear has fallen for three straight weeks at the end of October.

Like Skechers, though on a less grand scale for the industry leader, Nike (NYSE: NKE) has encountered some strong headwinds, with North American futures orders growing only 1% in its fiscal 2017 first quarter, compared with estimates of more than 4%. In particular, it's being hurt by the brand resurgence ofAdidas, which grew brand sales in North America some 31% in the first half of 2016, and byUnder Armour, which is a late-comer to the space but has been recording gains and taking market share.

That may explain why Skechers is looking overseas for succor. Its international wholesale business now accounts for more than 40% of the footwear maker's sales, and when you include retail outlets, it's almost 48% of total revenues. COO and CFO David Weinberg says global markets "represent the greatest growth opportunity," with China perhaps the biggest of all.

This is where Skechers hopes to plant its feet

Although the near term remains uncertain, within four or five years Skechers sees China becoming at least a billion-dollar market. Sales there surged from $85 million in 2014 to $220 million last year, and Weinberg noted on the earnings conference call that year-to-date sales are up 78%. Further, he said Skechersdid more business in China in the just-ended quarter than it did in all of 2014.

A number of international markets, including China, enjoyed sales growth of 50% or more in the latest period, pushingglobal retail business up 16% year over year as same-store sales improved 3.2% for the period.But China alonehas shipped more than 2.8 million pairs in the quarter and opened 82 freestanding Skechers retail stores.

Data source: Skechers SEC filings.

Skechers operates 1,716 retail stores worldwide, 556 of which are company owned, but there are now 341 stores in China, most of them run by franchisees. It now hasapproximately 1,860 points of sale in the country and what it deems to be "an extremely strong e-commerce business" that's growing at high double-digit rates.

Skechers faces a lot of challenges going forward, not least of which is the deceleration of the U.S. retail market, as well as not being the only one eying China as a chance to expand sales. But the country may be big enough to support a number of footwear manufacturers, as Euromonitor International projects China will grow at an average rate of 7% annually for the next few years.

That means Skechers may just be able to pull off a turnaround in the coming years as it walks China into a $1 billion market opportunity.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Rich Duprey has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Nike, Skechers, and Under Armour (A Shares). Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.