Its Energy Storage's Time to Shine

Power storage has been a major topic of discussion within energy industry circles, particularly in connection with renewable energy, as technological advances appear poised to bring with them a new level of innovation. Affordable storage would allow for more renewable power sources on the grid, create a path for customers to leave the grid, and even allow for new innovations around dynamic loads in energy.

The inconvenient truth is that until recently, energy storage didn't have any financial justification. The idea of value was there, but there was no actual value to create. Rooftop solar power systems create energy and can offset demand from other sources. The best energy storage systems can do is move demand from one hour of the day to another, but doing that was so expensive, it didn't make financial sense.

What's changed recently is that utilities are starting to put rate structures in place that will make energy storage more economically viable. Ironically, their moves -- designed to reduce the appeal of solar -- are providing the impetus for innovation in theenergy storage industry.

Image source: Getty Images.

Where storage is hitting the grid today

The initial uses of energy storage systems have been primarily in commercial buildings and utility applications. A commercial building can use storage to reduce demand charges -- fees based on the peak consumption in a building every month. And utilities are running pilot programs and even using stored power to patch holes in the grid, as Southern California Edison did earlier this year when it couldn't provide enough peak power to customers after the Aliso Canyon natural gas leak. Tesla (NASDAQ: TSLA) swooped in and quickly built an 80 MWh energy storage system to fill the gap.

These are important applications, but they're also just the tip of the iceberg. As costs fall and technology improves, we'll see energy storage play a bigger role across the country.

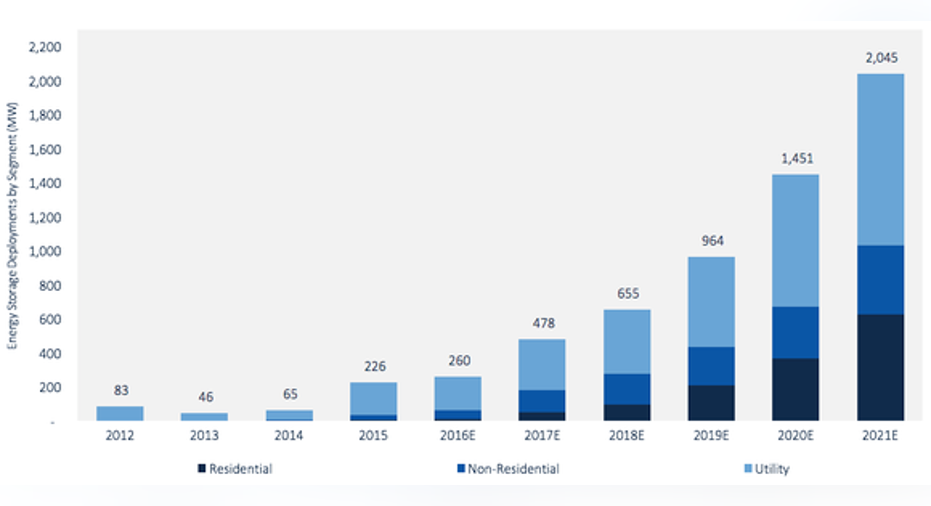

GTM Research estimates that 260 MW of energy storage will be built in the U.S. in 2016, but that figure will jump to 478 MW in 2017 and 2,045 MW by 2021.

Image source: GTM Research.

Developers are just starting to scratch the surface of energy storage's potential.

What the future of storage looks like

The economics of energy storage start to make sense as the price of batteries come down. And that's when we'll see greater adoption.

In residential solar, customers will be able to use storage systems to consume more of the energy generated directly from their rooftop systems, rather than selling it back to utilities. This was the intention of Tesla's Powerwall, and with San Diego Gas & Electric and Pacific Gas & Electric -- two of the largest utilities in California -- transitioning from traditional net metering to the time of use rates in Net Metering 2.0, there will be more value to be extracted from good storage systems. Sunrun (NASDAQ: RUN) and SunPower (NASDAQ: SPWR) are also bringing their own storage solutions to homeowners, so look for the adoption of residential energy storage to grow tremendously in 2017.

Commercial energy storage will continue to be driven by demand-charge reductions, but we could see more energy storage systems installed for self-consumption as well.

The segment to watch in 2017 is really utility scale storage. We will likely see large batteries distributed throughout the grid, capable of relieving pressure on the grid locally. I also expect energy storage will begin being included in renewable energy bids in the future. The large concentration of solar in California has already led to a power consumption pattern that has been dubbed the duck curve: Demand on the grid drops off during day, followed by a large increase as the sun goes down (taking solar out of the equation) and most people get home from work. Energy storage systems built in conjunction with renewable energy plants can help make the duck curve less dramatic for the grid.

Energy storage may start turning a new leaf

The energy storage industry is in a similar position to where solar was in 2010. The economics are starting to justify it for some applications, and costs are rapidly coming down, opening new opportunities in the market. That in turn will lead to new innovations and product offerings. In short, 2017 may finally be energy storage's time to shine.

10 stocks we like better than Tesla Motors When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Tesla Motors wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of Nov. 7, 2016

Travis Hoium owns shares of SunPower. The Motley Fool owns shares of and recommends Tesla Motors. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.