Why Cisco Systems Could Have a Great 2017

Networking hardware giant Cisco Systems (NASDAQ: CSCO) has been cautious when talking about its outlook for the new year. The company is anticipating a revenue decline during its fiscal second quarter, driven by what the company calls "a challenging global business environment." CEO Chuck Robbins pointed to macroeconomic uncertainty as well as uncertainty surrounding the political and regulatory environments following the election as the main reasons for the weak guidance. The company is taking a conservative approach and not modeling any improvement in these areas going forward.

Cisco's guidance may be too pessimistic. Analysts from Cowen & Co. recently surveyed 118 IT executives in the U.S. to gather clues about how the IT spending environment would evolve next year. While there was some uncertainty among those surveyed due to the results of the election, Cowen found that the majority expect IT budgets to grow next year. Networking infrastructure was viewed by the executives as a high priority, suggesting that Cisco may be in better shape than its outlook suggests.

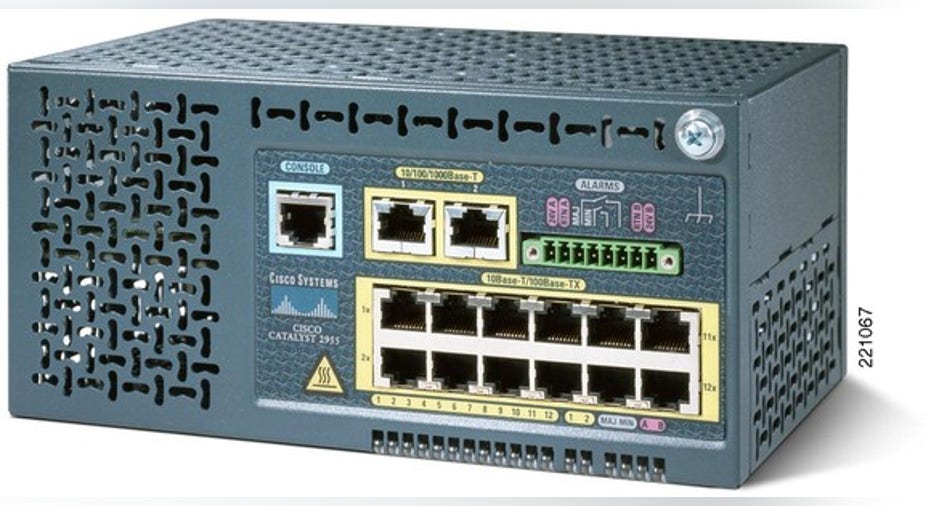

Image source: Cisco Systems.

Good news for Cisco

According to the survey, 75% of executives expect IT budgets in 2017 to be higher than in 2016, with average growth of 6%. Networking is viewed as an area that will grow its share of the total IT budget, with 58% of executives expecting networking to eat up a larger portion of IT spending next year. Just 2% are expecting a decrease.

Networking spending may grow substantially faster than overall IT spending growth. 38% of surveyed executives expect an 11% increase in networking spending next year, while 59% expect a 6% increase. Cowen pointed out that these numbers aren't quite as strong as in its May 2016 survey, but they still point to solid networking spending growth in 2017.

Cisco also came up in the survey questions, and the results paint a picture that conflicts with the company's gloomy outlook. Thirty-five percent of executives plan to spend more with Cisco in 2017, while 36% expect to spend the same amount, and just 3% expect to spend less. When asked which vendor they currently use for "digital initiatives," Cisco was the response 62% of the time.

The Cowen analysts summed up the results of the survey:"Undercutting what appears to be the widely held view among investors of the imminent demise of Networking, responses to our 4Q16 IT Survey indicate a relatively favorable outlook for the Networking industry in general and for CSCO in particular."

What to watch in 2017

Cisco's switching and routing businesses -- the core of the company that accounted for 45% of revenue during fiscal 2016 -- have been volatile in recent quarters. Switching revenue was flat in fiscal 2016, with some up quarters and some down quarters, and routing revenue slumped 4%.

Image source: Cisco Systems.

Neither is really a growth business at this point, but the survey results suggest that both businesses could produce some growth in 2017. This comes at a good time two of Cisco's smaller growth businesses, data center and collaboration, hit a wall during the first quarter. Both segments suffered a 3% year-over-year revenue decline, raising some questions about their ability to drive growth for the company going forward.

What Cowen calls "digital initiatives" in the survey likely encompasses many things, but security may be the most important for Cisco. The company's security business continues to grow at a double-digit pace, in part driven by acquisitions. With demand for cybersecurity expected to grow briskly in the coming years, Cisco is in great position to benefit.

While the results of Cowen's survey don't guarantee that Cisco will have a great 2017, they provide a data point that should make Cisco investors a little less concerned about the company's lackluster outlook.

10 stocks we like better than Cisco Systems When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Cisco Systems wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of Nov. 7, 2016

Timothy Green owns shares of Cisco Systems. The Motley Fool recommends Cisco Systems. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.