Barrick Gold Doubled in 2016. Will It Soar Even Higher in 2017?

With prices rising as much as 21% last August, gold looked like it was bouncing back last year from the slide that it has endured since 2013. Donald Trump's election put an end to that, though -- from the election to the end of December, the price of gold fell nearly 11%.

In the midst of this volatility, however, shares of Barrick Gold (NYSE: ABX), a global leader among gold stocks, climbed more than 106%. Let's dig into the company's performance in 2016, and see what we can expect in 2017.

Image source: Getty Images.

Golden highlights

One of the company's priorities in 2016 was to streamline its operations so that it could still produce free cash flow if the price of gold dipped to $1,000 per ounce. Though the company hasn't reported its Q4 earnings yet, as of Q3, the company reported that it had exceeded its target, generating free cash flow at a gold price below $1,000 per ounce.

Barrick's skill at keeping its expenses down was partly responsible for this success. The mining industry's version of operating expenses -- all-in sustaining costs (AISC) -- provide good insight into how efficiently a company is operating. And in this regard, Barrick was quite successful.

As of Q3, management estimated that AISC for fiscal 2016 will total between $740 and $775 per gold ounce. By comparison, Newmont Mining (NYSE: NEM), one of Barrick's leading competitors, has a fiscal 2016 AISC estimate of $870 to $930 per gold ounce.

Because digging the yellow stuff out of the ground doesn't come cheaply, mining companies often rely on debt to keep the shovels shoveling. Consequently, a company carrying a heavy debt load can quickly find itself in trouble if the price of gold falls too far.

Barrick Gold's management, which is sensitive to this, has committed to a medium-term debt-reduction strategy of lowering its total debt by $5 billion from fiscal 2015 to fiscal 2017. Barrick reduced debt by $3 billion in 2015, which led to a debt-reduction target of $2 billion in 2016. And as of Q3, it had achieved 71% of that target. Moreover, on the Q3 conference call, management reported that it was "tracking well" to the yearly target.

Growth catalysts in 2017

Turning toward the new year, we don't find any singular events that will affect the company's performance. One initiative that will be worth following, however, is the company's work with Cisco Systems (NASDAQ: CSCO). John L. Thornton, Barrick's executive chairman, recognizes the partnership has tremendous potential.

In the press release, he states, "Harnessing the potential of digital technology will unlock value across our business, helping us grow our free cash flow per share." And in 2017, the two companies will work to develop Barrick's Cortez mine -- one of Barrick's core mines in Nevada -- into Barrick's "flagship digital operation." Though progress at Cortez will not have a profound effect in 2017, it will be an auspicious sign that further successes await as other mines are digitized -- successes that will, in time, result in larger financial gains.

Besides monitoring progress with Cisco, investors can watch for Barrick's success in achieving its financial targets. Arguably, the strong performance of Barrick's stock was a result of the company's strong performance in strengthening both its balance sheet and cash flow.

Image source: Barrick Gold.

As a result, continued success in shoring up the balance sheet and improving cash flow may translate to a rise in shares. For example, in its Investor Day presentation from February, management forecasted gold production to total between 5.0 million and 5.5 million ounces of gold. In addition, management estimated AISC to total between $740 and $790 per gold ounce.

A golden valuation?

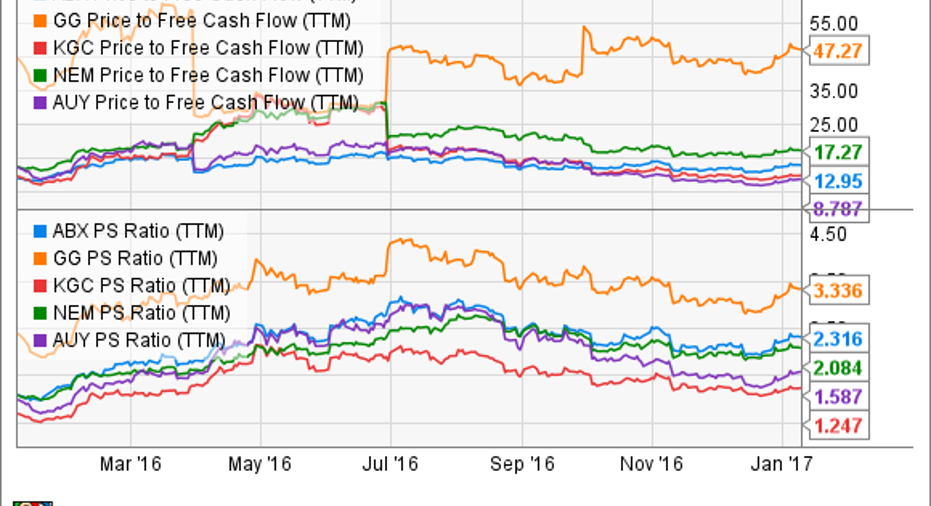

We've looked at what's behind Barrick and what's ahead, so let's turn our attention now to its stock. Since the company hasn't reported positive net income since 2011, the traditional price-to-earnings ratio won't provide much insight. Instead, let's consider the stock in terms of its free cash flow on a trailing-12-month basis.

Over the past year, the stock has traded as low as 8.5 times free cash flow and as high as 17.0 times free cash flow. Currently, shares are trading at about 13 times free cash flow -- almost exactly the midpoint of its range over the past year. This suggests that shares are reasonably priced.

Considering only one valuation metric seems inadequate to properly gauge the stock, so let's also look at it's price-to-sales ratio on a trailing-12-month basis. Trading at about 2.3 times sales, shares seem to be a little bit higher than the midpoint of its high and low for the year -- but not by much.

ABX Price to Free Cash Flow (TTM) data by YCharts.

To provide more context for the stock's valuation, let's consider it alongside its peers: Goldcorp, Kinross Gold, Newmont Mining, and Yamana Gold. In terms of free cash flow, Barrick's valuation certainly seems fair. Although it may seem a little pricier than its peers, the stock's valuation in terms of sales doesn't raise any red flags.

ABX Price to Free Cash Flow (TTM) data by YCharts.

Overall, considering where shares are trading today, the stock seems fairly priced.

The takeaway

Although shares of Barrick Gold had a great run in 2016, there's no guarantee that it will continue into 2017. At this point, in fact, it seems that Wall Street has gotten this one right by not baking in too many expectations, or punishing it unfairly. With its eyes on the future -- a digitized future -- and a circumspect approach to managing its debt, Barrick Gold is a reasonable consideration for investors looking to gain exposure to the gold industry.

10 stocks we like better than Barrick Gold When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Barrick Gold wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of January 4, 2017

Scott Levine has no position in any stocks mentioned. The Motley Fool recommends Cisco Systems. The Motley Fool has a disclosure policy.