Here's How the Stock Market Works

If you're new to investing, the stock market can understandably seem confusing. However, understanding the stock market doesn't need to be too difficult. While it's impossible to explain every detail of how stocks and the stock market works in a single article, here's an overview of the basics.

Image Source: Getty Images.

What is a stock, and how are they traded?

In a nutshell, a stock represents ownership of part of a company. For example, if a company issues one million shares of stock, and you own one share, you "own" one-millionth of that company. Generally speaking, the goal of buying a stock is to own a piece of the company's future profits.

When a company needs to raise capital, it can issue shares of stock for sale to the public through an initial public offering, or IPO. The stocks can then be sold, bought, and resold on a stock exchange like the New York Stock Exchange, or NYSE. Stock exchanges are places where investors come to buy and sell their shares.

Each stock listed on an exchange has a ticket symbol -- typically an abbreviation or variation of the company's name. For example, Apple trades under the stock symbol "AAPL", and Citigroup trades under the symbol "C".

Investors trade stocks through a brokerage account, which are offered by many major financial institutions. Here's a guide to several brokerages including commissions and account minimums, as well as some further guidance that can help you open an account.

Common stock vs. preferred stock

There are two basic types of publicly traded stocks, common and preferred. Common stocks are what most people think of when they hear the word "stock." They can go up and down based on a company's performance, and many pay dividends that can change over time in order to distribute some of the profits to shareholders.

Preferred stock, on the other hand, works more like a fixed-income investment. Preferred shares are sold for a certain price (known as the par value), and pay a specific amount of money to shareholders every quarter. Because the dividend payments of preferred stock are fixed, they tend not to fluctuate in value as much as common stocks. For example, if a company's profits beat expectations, the common shares may climb in value. However, preferred shareholders get the same amount of money no matter what, so the share price is unlikely to move significantly for this reason.

Who determines the price of each stock?

Without getting too technical, the price of a stock at any given time is determined by supply and demand. If more demand exists than there are shares available for sale, the stock's price will rise until the two forces are equal. On the other hand, if there are lots of sellers of a stock, but few buyers, the price will fall until more buyers come in.

Stock prices fluctuate constantly during market hours, and can be especially reactive when company-specific news is released. In the U.S., the major stock exchanges are open from 9:30am until 4:00pm on most weekdays.

How to read a stock quote

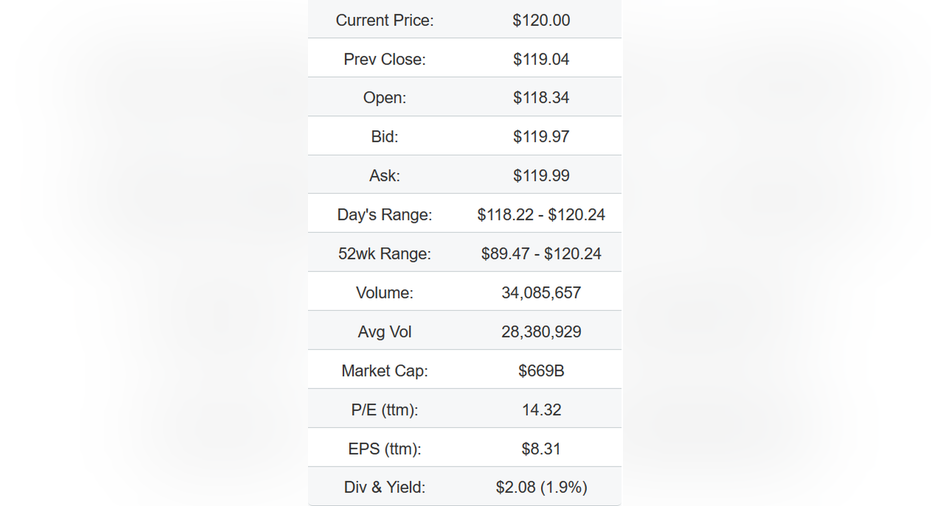

The format and exact information contained in a stock quote varies, but there is some information that is typically included with every stock quote. For example, here's an Apple stock quote from The Motley Fool:

Image Source: The Motley Fool.

Some things (like current price) are self-explanatory, but here's a quick breakdown of some of the other terminology:

- Previous close: The last price the stock traded for on the previous trading day.

- Open: The stock's price at the market's open today.

- Bid: The highest price someone is currently willing to pay for the stock.

- Ask: The lowest price someone is currently willing to sell the stock for.

- Day's range: The highest and lowest price the stock was bought and sold for during the current trading session.

- 52wk range (also known as the 52-week high and low): The highest and lowest price the stock traded for within the past year.

- Volume: The number of shares that were bought and sold during the current trading session.

- Average volume: The average number of shares traded per day. This can help you determine if the current day's volume is unusually high or low.

- Market cap: The collective value of all outstanding shares of the stock.

- P/E (ttm): The price-to-earnings ratio, a common metric used to value stocks.

- EPS (ttm): How much the company earned (profited) over the past 12 months.

- Dividend & Yield: The stock's dividend per year (if any), expressed as both a dollar amount and percentage of the current share price.

What is the Dow Jones and S&P 500?

The Dow Jones Industrial Average is perhaps the best-known stock index in the world. A stock index tracks a certain group of stocks to indicate the overall performance of the market, or a portion of the market. For example, the Dow Jones Industrial Average (more commonly known as "the Dow") tracks the stocks of 30 of the largest U.S. corporations. The S&P 500 is another index, and tracks a broader group of 500 large companies.

There are many different stock market indices, some of which track companies of a certain size and others that track a specific part of the market. For instance, the S&P Small Cap 600 tracks smaller U.S. companies. You can use a stock index to track market performance, although the performance of a stock index doesn't necessarily mean anything to an individual stock.

If you're ready to take the next step...

The best thing you can do as a new investor is to learn all you can. Here's a discussion specifically tailored to beginners, and be sure to check out some of the other great content on The Motley Fool, particularly the Knowledge Center for lots of basic investment knowledge and the IRA Center if you're investing for retirement.

The $15,834 Social Security bonus most retirees completely overlook If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after.Simply click here to discover how to learn more about these strategies.

Matthew Frankel owns shares of Apple. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2018 $90 calls on Apple and short January 2018 $95 calls on Apple. The Motley Fool has a disclosure policy.