Why 2017 Could Be This Little Known Stock's Best Year Yet

Machine-vision company Cognex Corporation (NASDAQ: CGNX) is not a cheap stock by either current valuations or near-term analyst estimates. Moreover, the stock has more than doubled in the past year, leaving investors wondering whether there is more to come in 2017. Arguably, Cognex needs to beat analyst estimates to move significantly higher this year, but I think there's good reason the company might just do that, and here's why.

Cognex Corporation is a growth stock

Cognex's machine vision solutions capture and process images in order to help corporations operationally guide devices to properly execute functions--think of a robotic arm being guided toward assembly of an automobile.With that in mind, there are three key growth drivers to focus on for 2017:

- A recovery in industrial production in the U.S. is likely to lead to a freeing up of capital spending among manufacturers -- something highly likely to benefit Cognex's factory automation solutions.

- Cognex's largest customer is Apple Inc. (NASDAQ: AAPL), which accounted for 18% of revenue in 2015, and a similar kind of deal with a consumer-electronics company, or even additional deals with Apple, would lead to a step change in revenue.

- Cognex has been expanding its total addressable market (TAM) in recent years and has ample growth opportunities in areas such as logistics, mobile terminals, and 3D vision.

Image source: Getty Images.

U.S. industrial production

Most forecasters are predicting that U.S. industrial conditions will improve this year. For example, FedEx Corporation (NYSE: FDX) predicts that U.S. industrial production will increase to 1.3% and 2.2% in 2017 and 2018, from a decline of 1% in 2016. If this occurs, then Cognex is likely to be a major beneficiary, because its Americas operations have been the weak spot in the company's sales efforts in the past couple of years.

For example, back in the second quarter of 2015, CEO Rob Willett spoke of a modest year-on-year increase in factory automation revenue from the Americas and said "spending by manufacturers in the Americas has slowed and we have experienced delays in closing some large projects." Fast-forward to the last set of earnings in October, and Willett outlined how "spending by U.S. manufacturers in many industries remains lackluster."

Cognex's factory automation solutions help guide, inspect, gauge, and identify automated processes and as such are largely reliant on capital spending. It's the first thing likely to get cut in a slowdown and also the first to be increased when companies feel more confident.

More Apple and Apple-like deals to come?

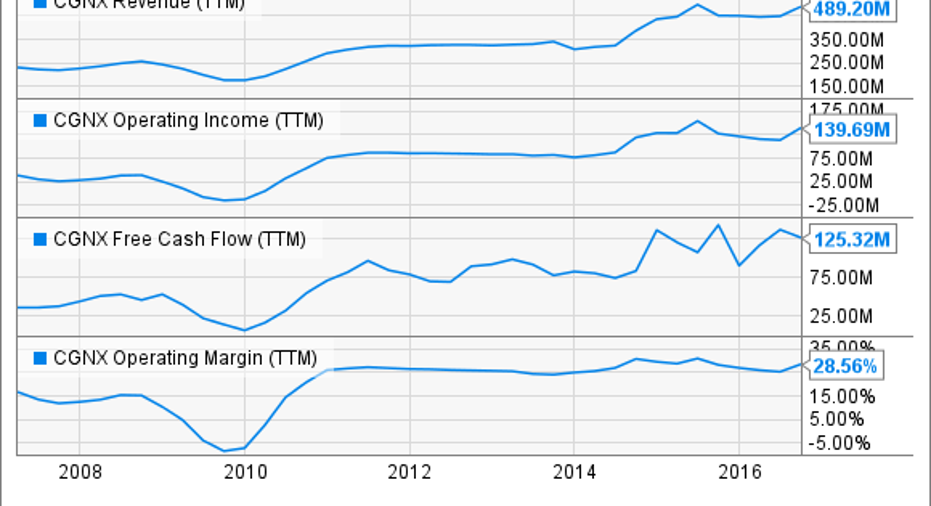

Cognex's management sees consumer electronics and logistics as two key areas of growth, and it's worth taking a step back to see how transformational the Apple deal was. In 2012 and 2013, no single customer accounted for more than 10% of Cognex's revenue. However, after the Apple deal was inked, the consumer-electronics giant accounted for 16% of 2014 revenue and then 18% in 2015. Here's what the step changes in revenue, income, and free cash flow (with no significant impact on margin) look like:

CGNX Revenue (TTM) data by YCharts

More revenue from Apple is somewhat contingent on new product introductions, and the iPhone maker has been significantly increasing capital expenditures and research-and-development spending in recent years:

AAPL Capital Expenditures (TTM) data by YCharts

New growth areas

Cognex's CFO Richard Morin recently outlined the company's TAM at the Needham Growth Conference, the key points of which you'll see in a moment. For reference, Cognex's trailing yearly revenue is only $489 million, meaning Cognex is selling into less than 17% of its TAM. Given that it's the leading player in highly fragmented machine-vision marketplace -- Japanese rival Keyence is a company nearly eight times larger but sells less into this particular market -- Cognex clearly has plenty of growth potential.

While its share of TAM in 2D vision is above 20% and in the mid-teens in ID factory automation, Cognex is still growing strongly. For example, Morin outlined that factory automation is growing by more than 20%. Meanwhile, logistics (a market that contributes around 10% of Cognex's current sales), life sciences, and 3D are all markets where Cognex has a TAM share in the single digits. Cognex has negligible revenue in mobile terminals and airport baggage handling.

Data source: Cognex Corporation. Chart by author.

In short, Cognex has plenty of growth potential and logistics is key opportunity. For example, FedEx and UPSboth are under pressure to expand their networks and invest in productivity-enhancing solutions to deal with e-commerce growth. This is a trend likely to be relevant across the entire logistics industry, and if so Cognex could be a key beneficiary.

CGNX EV to EBITDA (Forward) data by YCharts

Looking ahead

All told, Cognex has plenty of growth drivers, and despite being on a hefty valuation--see chart above--- it could still have a great year in 2017. All it will take is one or two large deals to be signed and analyst estimates will be revised higher, and for growth orientated investors Cognex might well be a very attractive stock.

10 stocks we like better than Cognex When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Cognex wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of January 4, 2017

Lee Samaha has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Apple and Cognex. The Motley Fool has the following options: long January 2018 $90 calls on Apple and short January 2018 $95 calls on Apple. The Motley Fool recommends FedEx and United Parcel Service. The Motley Fool has a disclosure policy.