Will President Trump's Tax Reform Help Retailers? The Devil Is in the Details

Earlier this month, top department store chains Macy's (NYSE: M) and Kohl's (NYSE: KSS) reported that their weak sales trends continued during the critical holiday season. Other department store chains also reported poor results. For the past two years or so, among apparel and home-focused retailers, only off-price merchants such as TJX Companies (NYSE: TJX) have consistently performed well.

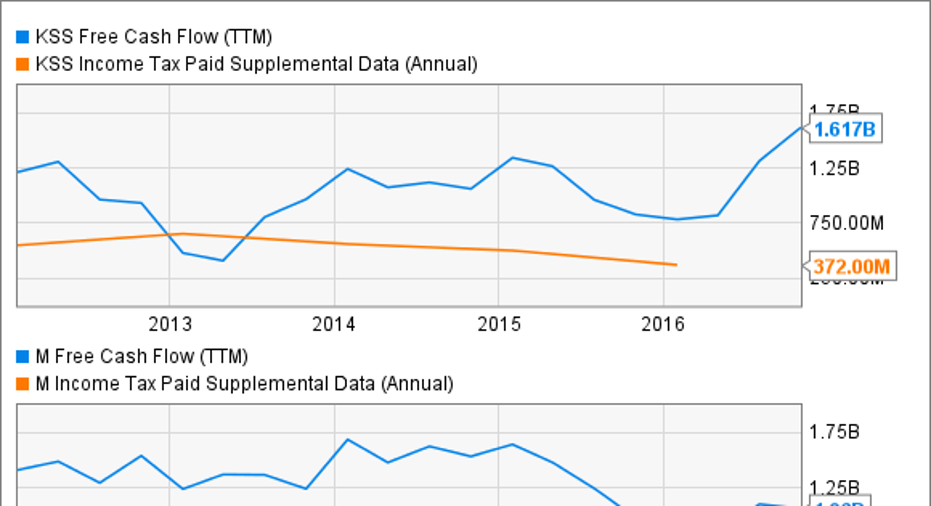

One of the few potential bright spots for retailers such as Macy's and Kohl's is corporate tax reform. Both companies still produce plenty of free cash flow but face high taxes. A reduction in the corporate tax rate could boost their cash flow, allowing them to return more cash to shareholders.

Corporate tax reform could provide a nice windfall for Kohl's. Image source: The Motley Fool.

That said, some tax reform proposals have included a "border adjustment," which could send retailers' tax bills skyward. President Donald Trump's tax reform agenda is a major opportunity for Macy's and Kohl's -- and TJX, for that matter -- but also a potential source of risk.

What's the tax plan?

During the presidential campaign, Trump supported cutting the corporate tax rate significantly as part of his overall plan to boost the economy. Trump has suggested lowering the federal corporate tax rate to as little as 15% from 35% today.

However, congressional Republicans have presented an alternative plan calling for a "border-adjusted" tax. This would pay for the reduction in the corporate tax rate by making imports non-deductible. That would be terrible for companies such as Macy's, Kohl's, and TJX, as a very large proportion of the items they sell are imported.

Further complicating matters, Trump's nominee for Treasury Secretary -- Steven Mnuchin -- has stated repeatedly that any tax reform shouldn't add to the federal deficit. It may be possible to fudge the numbers a bit using "dynamic scoring" that incorporates an optimistic forecast of GDP growth, but a revenue-neutral tax reform plan is likely to have winners and losers.

On Monday, President Trump told business leaders that he wanted to cut the corporate tax rate to somewhere in the 15%-25% range. "All you have to do is stay," he told them. "Don't leave. Don't fire your people in the United States," according to The Washington Post.

Obviously, retailers can't move many jobs to other countries if their stores are here. Meanwhile, their suppliers have been overseas for many years. If corporate tax reform only penalizes companies that move jobs offshore in the future, then retailers such as Macy's, Kohl's, and TJX would be big beneficiaries, because they all have effective tax rates of 35%-40% today. However, nothing's settled until Congress passes a tax reform bill and Trump signs it.

The details matter a lot

A reduction in the federal corporate tax rate without a border tax would have a huge positive impact on cash flow at Macy's and Kohl's. Both companies continue to generate strong free cash flow, despite their recent sales woes -- especially Kohl's. But they both also routinely face big tax bills.

Kohl's and Macy's Free Cash Flow and Income Tax Paid, data by YCharts.

If the statutory corporate tax rate declined from 35% to 15% or 20%, Macy's and Kohl's would probably see their cash tax burdens cut in half (roughly speaking), boosting their free cash flow. Since both companies return most of their free cash flow to shareholders, this extra cash would probably be used for further dividend increases or share buybacks.

Unlike Macy's and Kohl's, TJX has significant overseas operations. Even so, it generates the vast majority of its income in the U.S. and paid a whopping $1.3 billion in corporate taxes last year. That represented a little more than 35% of the company's net income. Thus, a lower tax bill could drive free cash flow higher at TJX, too.

On the other hand, since Macy's, Kohl's, and TJX spend more than half of their revenue on buying inventory and most of those goods are imported, a border-adjusted tax could drive their tax bills dramatically higher. If a large proportion of their costs become non-tax deductible, their tax bills could easily double or triple, even with a 15%-20% corporate tax rate.

A border-adjusted tax would dramatically increase Macy's tax bill. Image source: The Motley Fool.

To make matters worse, it wouldn't be feasible to switch to American suppliers for things such as apparel, handbags, and bedding. Thus retailers would have to raise prices to offset the border tax, which would probably drive further sales declines.

Who stands to win (or lose) the most?

A corporate tax cut with no border-adjustment impact would benefit Kohl's and Macy's more than TJX. Shares of both department stores have fallen dramatically since early December. If their share prices stay depressed, Kohl's and Macy's could use the extra free cash flow from their tax savings to buy back a ton of stock.

By contrast, Kohl's faces the most downside in a border-adjusted tax environment. TJX would be protected somewhat by its higher profit margin and international operations, while Macy's could fall back on its underlying real estate value if a border tax undermined its profitability.

Corporate tax reform could be a big catalyst for retailers later this year. But whether it will be a positive or negative catalyst still remains to be seen.

10 stocks we like better than Macy's When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Macy's wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of January 4, 2017

Adam Levine-Weinberg owns shares of Macy's and is long January 2018 $60 calls on The TJX Companies and short January 2018 $90 calls on The TJX Companies. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.