How Big Is the Opportunity for Marijuana Stocks in Florida?

Florida is undeniably behind the curve when it comes to passing pro-pot legislation, but the Sunshine State did make up some ground in November, when voters legalized medical marijuana in the state. How big could the medical marijuana market be in Florida for marijuana stocks? Read on to find out.

Image source: Getty Images.

Getting on board

While Florida's been dragging its feet in passing medical marijuana laws, Americans' attitudes toward marijuana have been steadily improving.

According to Gallup polls, more Americans support marijuana legalization than ever before, and Americans' view of medical marijuana is even more favorable. Because of improving attitudes, 25 states had passed medical marijuana laws before 2016, and three more states, including Florida, passed medical marijuana laws in November.

Pro-pot advocates victory in Florida significantly expands the use of medical marijuana beyond earlier efforts in 2014 that legalized low THCproducts for compassionate use.

Small steps, right direction

While Florida will allow greater use of medical marijuana following November's vote, the list of approved indications falls shy of what's been approved in many other states. For instance, Florida doesn't allow the use of medical marijuana for chronic pain, but Arizona does.

As a result, medical marijuana sales in Florida may trail other states with smaller populations and more inclusive laws.

Nevertheless, medical marijuana market in Florida could still be big. Following November's vote,the Florida Department of Health is drafting guidelines that will establish a medical marijuana market by mid-2017. After those guidelines are complete, licenses will be issued, and sales will begin, likely in 2018.

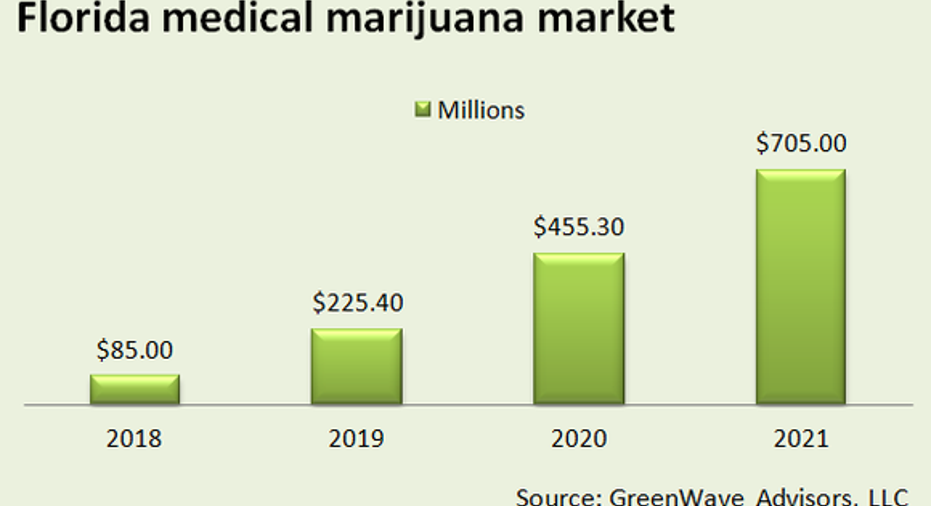

Although sales will initially be small, they could grow significantly over the next few years, according to Matt Karnes, founder of GreenWave Advisors, LLC.

Karnes expects that Florida's medical marijuana market will be worth $85 million in 2018, and that it could grow to $705 million in 2021.

Data source: GreenWave Advisors, LLC. Author's chart.

Investing in marijuana stocks

The potential to profit from Florida's medical marijuana market could be big, but investors have few investment options that they can buy right now.

Most marijuana stocks that can benefit from ramping demand in Florida are small companies that are trading on over the counter markets, which are risky, unregulated exchanges that are prone to fraud. For that reason, the majority of marijuana stocks are best left untouched.

Instead, investors interested in buying marijuana stocks might want to consider backdoor marijuana stocks that won't benefit directly from sales in Florida, but will benefit from improving attitudes toward cannabis.

Among the most intriguing of these companies are Canadian medical marijuana stocks Canopy Growth (TSX: CGC)(NASDAQOTH: TWMJF) and Aphria, Inc. Canada's approved the use of medical marijuana nationally, and market demand in Canada is leading to millions of dollars in medical marijuana sales for these companies.

For instance,Canopy Growth's brands include Tweed and a partnership with cultural icon Snoop Dog on his Leafs by Snoop.

So far, Canopy's sales are small, but they're growing quickly. In Q3, unaudited revenue was $8.4 million Canadian, up from $2.5 million Canadian the year before, and profit was $0.05 Canadian. The company's robust expansion plans, however, could mean that its profit swings wildly, or that profits turn to losses. Given its market cap is already north of $900 million, investors may already be pricing in a lot of its potential growth.

Instead, investors might want to consider bio-pharmaceutical companies that are working on marijuana medicine, such asGW Pharmaceuticals (NASDAQ: GWPH), a U.K. drugmaker.

GW Pharmaceuticals is developing Epidiolex,a purified CBD that in scientifically controlled clinical trials has reduced seizures by about 40% in rare forms of childhood epilepsy.

Industry watchers believe that if Epidiolex wins FDA approval, it could have nine-figure sales potential. GW Pharmaceuticals hopes to file for approval soon, and if so, then a FDA decision could come later this year, or early next year.

According to management, roughly one-third of the470,000 children who suffer from epilepsy receive inadequate relief from existing medications, and therefore, there's a big opportunity to fill this big unmet need. That being said, GW Pharmaceuticals' shares aren't cheap, and the company's got very little revenue coming in, so it's losing money every quarter.

With a market cap of $3 billion, investors are already pretty optimistic about GW Pharmaceuticals, but there's no guarantee Epidiolex nets a FDA approval, or that if approved, it becomes a top seller. Because of that, investors should approach this company cautiously, despite Epidiolex's potential.

10 stocks we like better than GW Pharmaceuticals When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and GW Pharmaceuticals wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of January 4, 2017

Todd Campbell has no position in any stocks mentioned.His clients may have positions in the companies mentioned.The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.