Disney to acquire 21st Century Fox assets for $52.4B in stock

Disney (DIS) has reached a deal to acquire certain assets of 21st Century Fox (FOXA), the parent company of FOX Business, for approximately $52.4 billion in stock.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DIS | THE WALT DISNEY CO. | 107.13 | -1.57 | -1.44% |

| FOXA | FOX CORP. | 62.85 | -1.93 | -2.98% |

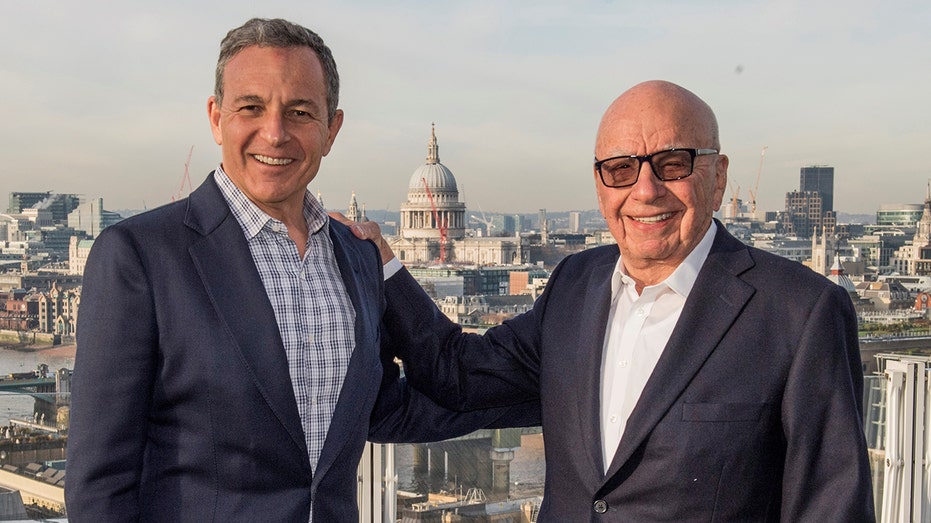

The transaction has a total value of $66.1 billion, including 21st Century Fox’s debt. Assets included in the deal are Twentieth Century Fox Film and Television studios, along with cable and international TV businesses. Disney Chairman and CEO Robert Iger will extend his tenure through 2021.

“I’m convinced that this combination, under Bob Iger’s leadership, will be one of the greatest companies in the world,” Rupert Murdoch, executive chairman of 21st Century Fox said in a statement.

Rosecliff CEO Mike Murphy told FOX Business’ Maria Bartiromo on “Mornings with Maria” that this is “Disney’s largest acquisition to date, it is actually larger than all of its previous acquisitions combined.” He noted that Disney’s competitors “should be concerned.”

Commenting on the transaction, Iger said, “The deal will also substantially expand our international reach, allowing us to offer world-class storytelling and innovative distribution platforms to more consumers in key markets around the world.”

Immediately prior to the acquisition, 21st Century Fox will separate the Fox Broadcasting network and stations, Fox News Channel, Fox Business Network, FS1, FS2 and Big Ten Network into a newly listed company that will be spun off to its shareholders.