The Best 3D Printing Stock of 2017 -- and How It Gained 101%

With the 2017 trading year now in the record books, we can officially give out the crown for the best-performing 3D printing stock of the year. And the winner is ... drumroll, please ... Proto Labs (NYSE: PRLB), which gained a whopping 100.6%.

While not a pure play like industry bigwigs Stratasys (NASDAQ: SSYS) and 3D Systems (NYSE: DDD), the digitally enabled, quick-turn contract manufacturer of plastic and metal prototypes and low-volume production parts has a 3D printing business that has been growing nicely. In the most recent quarter, it accounted for nearly 13% of its total revenue, and over time has the potential to comprise a larger chunk of the overall business.

Here's what you should know about Proto Labs' winning 2017.

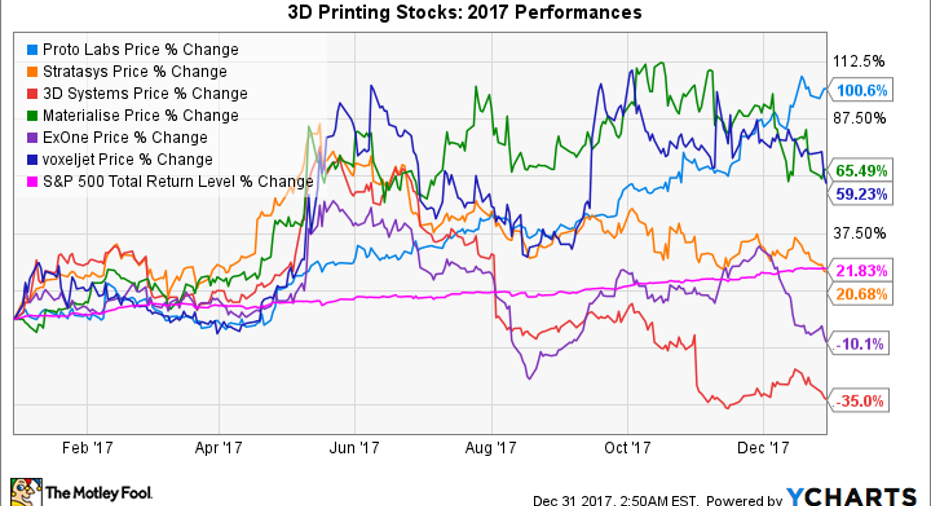

How the 3D printing players stacked up in 2017

The following chart shows how the 3D printing stocks listed on a major U.S. stock exchange performed in 2017. HP Inc. isn't included because its 3D printing business -- it entered the space in May 2016 when it launched two speedy polymer 3D printers for the enterprise market -- probably accounts for just a tiny portion of its overall business.

Earlier this year, I called Proto Labs "the best 3D printing stock to buy in 2017" -- and it really came through. Its year-to-date performance at that time was second to last of the six 3D printing stocks, and well behind the three leaders, Stratasys, Materialise, and 3D Systems.

The lesson here is to keep in mind that a company's business performance and future potential can be quite out of sync with its stock performance over the short term. While I couldn't be sure when the market would recognize that it was underestimating Proto Labs and getting ahead of itself (again) with respect to 3D Systems, in particular, I was confident it would eventually happen. As it turns out, it did happen in 2017, with Proto Labs surging from fifth place to the top of the heap in eight months, while 3D Systems sunk to last place after it posted a subpar second-quarter earnings report followed by a poor third-quarter report.

Luck was on my side that Proto Labs beat out Materialise, which had a huge lead when I made my call. Belgium-based Materialise -- which makes 3D printing software and provides 3D printing services -- is worth watching.

While we're focusing on 2017, it's helpful to know the bigger picture. The following chart shows how the 3D printing stocks have performed over the three-year period: Proto Labs is the only one that has beaten the broader market. (Only Proto Labs, Stratasys, and 3D Systems stocks have been publicly traded for at least five years, which is why a longer-term chart isn't shown.) The 3D printing stocks soared in 2012 and 2013, and then got hammered in 2014 and 2015 when the heady growth many investors expected didn't materialize. Since 2016, the performances of the group's stocks have diverged quite a lot.

Why did Proto Labs stock gain 101% in 2017?

Proto Labs' business performance improved considerably from 2016 to 2017, which has driven the stock's rise. The primary reason the company's business struggled in 2016 appears to have more to do with the overall economic climate than the company's execution.

In Q1, Proto Labs' revenue increased 10.5%, and adjusted earnings per share (EPS) jumped 16% from the year-ago period. The metal CNC (computer numerical control) machining business' 16% revenue growth led segment results, while plastic injection molding and 3D printing both grew about 11%. Second-quarter revenue and adjusted EPS grew 9.4% and 8.9%, respectively. CNC machining's revenue soared 22%, 3D printing's revenue climbed 20%, and injection molding's revenue rose 5%. In Q3, revenue and adjusted EPS rose 12.7% and 9.8%, respectively. CNC machining once again led results, with revenue surging 25%, while the 3D printing and injection molding businesses grew 13% and 7%, respectively.

Revenue growth throughout the year was stronger than the numbers suggest, as the company discontinued some services and its results were negatively affected by foreign exchange. Profitability is being held back by the company's European 3D-printing acquisition made two years ago. Operating margin in this business lags that of the 3D printing business in the U.S., which management is taking steps to address.

Looking ahead

Proto Labs has an attractive business model: It provides high-quality, fast-turnaround contract manufacturing through a user-friendly digital interface. Moreover, the company generates considerable free cash flow and has no debt. You'll have to pay up for these qualities, however, as the stock is trading at 58.9 times trailing-12-month earnings and 41 times projected forward earnings. It's getting a bit richly valued even for a high-quality company. So some investors might want to wait a quarter or two to see if its growth continues to improve before making an investment decision.

10 stocks we like better than Proto LabsWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Proto Labs wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of December 4, 2017

Beth McKenna has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Proto Labs. The Motley Fool recommends 3D Systems and Stratasys. The Motley Fool has a disclosure policy.