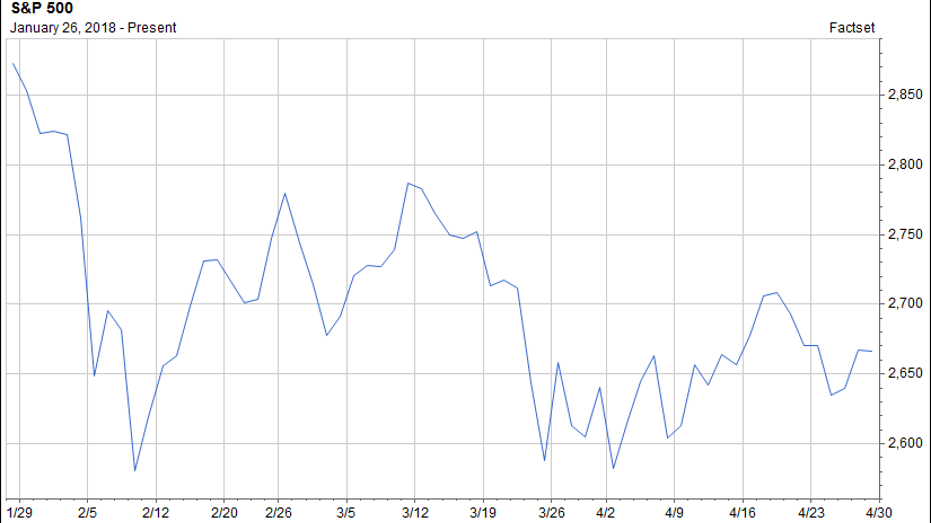

Stocks stuck in correction mode for longest stretch in 10-years

If you feel as if Wall Street’s stock trading patterns mirror the movie “Ground Hog Day” – when actor Bill Murray relives the day over and over – you’re right: triple digit swings have become commonplace.

The S&P 500, the broadest measure of large company stocks, has been hovering in correction mode [yet to recoup the 10% drop from the high reached in January 2018] for the longest stretch since 2008, as tracked by our partners at WSJ Market Data Group.

S&P 500 Off 7% Since Hitting High of 2872.87 On January 26, 2018

“It’s a new age of volatility” Mark Newton, chief technical analyst at Newton Advisors, tells FOX Business. “The momentum won’t reach the levels of last year so investors need to be more selective” when it comes to sectors and stocks, says Newton.

The VIX Index, a key measure of future stock volatility, is seeing its own repeats, racking up its 23rd move of 10% through April, the most on record.

Despite a strong first quarter earnings season in which companies including Amazon, Caterpillar and Boeing blasted past expectations and a growing U.S. economy with the latest GDP read rising 2.3%, the chances of the stock market busting out of this rut are getting slimmer.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMZN | AMAZON.COM INC. | 208.72 | -1.60 | -0.76% |

| CAT | CATERPILLAR INC. | 742.12 | +15.92 | +2.19% |

| BA | THE BOEING CO. | 244.74 | +1.76 | +0.72% |

The seasonal summer slowdown is approaching along with the oft used Wall Street phrase, “Sell in May and go away.” And there is an additional layer of worry, notes Jeffrey Hirsch, editor of the Stock Trader’s Almanac & Almanac Investor: Midterm elections. “We are obligated to remind you that the “Worst Six Months” are now upon us, and as we pointed out last month this bearish seasonal stretch has been more pronounced in midterm years” he writes.

Creating more uncertainty: rising bond yields. This week the 10-year yield hovered around 3%, a level not seen since 2014 and viewed as a precursor of higher borrowing costs.

Next week will bring a host of potential market-moving events. Earnings continue with biggies, including McDonald’s on Monday and Apple on Tuesday. Midweek the Federal Reserve is expected to leave interest rates unchanged, but a fresh assessment on the economy from policymakers will hold clues about the future pace of rate hikes.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MCD | MCDONALD'S CORP. | 325.60 | -1.56 | -0.48% |

| AAPL | APPLE INC. | 274.62 | -3.24 | -1.17% |

Finally, the monthly jobs report for April, due on Friday, is expected to deliver a so-so read on hiring with the addition of 193,000 jobs after 103,000 the prior month, well below the 200,000 level economists like to see during an economic expansion.

Suzanne O’Halloran is Managing Editor of FOXBusiness.com and a graduate of Boston College. Follow her on @suzohalloran