Lawmakers fight back against state and local deduction elimination

The states that have the most to lose from a key provision in the Republican tax plan are joining forces to make their case.

Congressional leadership met at least two dozen Republican lawmakers from New York, New Jersey and California on Thursday to discuss the possible elimination of the state and local tax deduction, also known as SALT, as part of the final tax reform bill, FOX Business has learned.

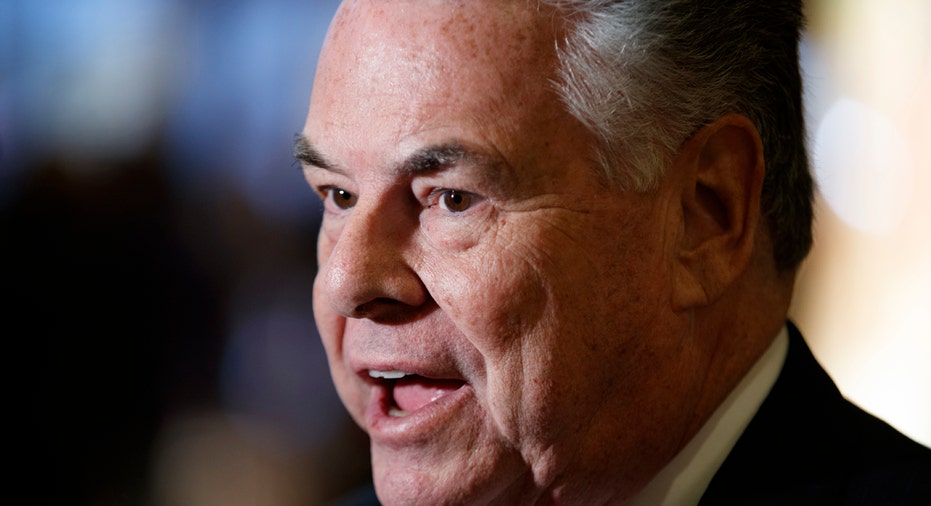

The meeting was called after members from these states started voicing their concerns to senior lawmakers about the impact the eradication of the loophole could have on their districts, Rep. Peter King (R-N.Y.) tells FOX Business.

“We had a meeting with Reps. Scalise (R-La.), Kevin McCarthy (R-Calif.) and Kevin Brady (R-Texas) and made some pretty forceful arguments. They are certainly open to compromise. The question is how far the compromise goes,” King said.

King argued the negative impact the loopholes elimination could have on his district, New York’s 2nd Congressional District, and how there needs to be a compromise if Republicans want to pass comprehensive tax reform.

“To have a chance of passing, it has to be negotiated and it has to be negotiated on good terms. That’s not a threat, it’s a reality. My district won’t survive if this goes away," King said.

He added that if they excluded SALT from the tax code it could be political sabotage for the Republican Party.

“This is the equivalent of going into some of the most red states and talking about gun control,” King said.

King indicated at Thursday’s meeting that he’s willing to compromise on keeping the elimination of SALT in the final tax blueprint, but only if it’s eradicated for those in the upper income bracket.

“I suggested that if it is going to be in there at all it should only apply to those who make over $400,000. Because otherwise you are looking at a tax increase for everyone else and maybe at best they break even,” King said.

A spokesman for Scalise, the House Majority Whip, confirmed the meeting with the lawmakers yesterday and called it “productive” in a statement to FOX Business.

“It was a productive discussion, one of many important conversations the Whip office will hold with members as House Republicans work to pass pro-growth tax reform that creates jobs and benefits middle class families,” the statement said.

New York,along with New Jersey and California, are considered high-tax states that give taxpayers a break with the deduction. About one-third of the value of the tax break, which in total is estimated to be $1.3 trillion in savings, is used by filers in these states according to a study by the nonpartisan Center for a Responsible Federal Budget.

While Republican lawmakers try to negotiate a deal on the deduction, White House officials have been indicating that President Trump is not willing to discuss an alternative to paying for his tax plan.

“The president’s been clear about his position, and we’re moving forward with the framework that we’ve laid out,” White House press secretary Sarah Sanders said on Thursday when asked whether the administration was open to making a deal on the tax break.

At a press conference on Thursday, Brady gave a slightly different perspective, acknowledging that leadership is willing to listen to those who represent the states who would be most impacted by the loss of the loophole.

“At this point there’s been no change to the framework the way it was laid out, but we’re again listening very carefully to ideas and how we can make sure we can deliver tax relief to those families,” Brady said.

A spokesman for McCarthy did not return emails for comment at the time of publication.