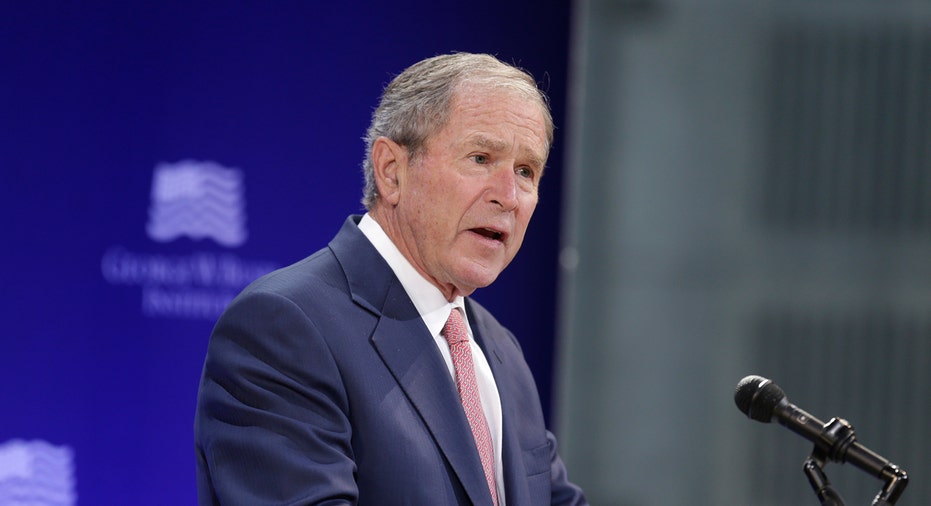

George W. Bush avoids the fray amid Trump's tax bill win, despite his own tax reform success

Despite sharing an affinity for tax cuts, President Donald Trump and former President George W. Bush, the 43rd president, continue their frosty relationship with Bush choosing not to support or condemn the Republican tax reform bill, FOX Business has learned.

Bush’s spokesman, Freddy Ford, tells FOX Business that the former Commander in Chief will not be “weighing in” because “he’s not a pundit, he’s a former President, and prefers not to bloviate and opine.”

This is not the first time the former president has avoided backing the Trump agenda as both have had a contentious relationship since the 2016 presidential election.

The most recent example came in October during a policy seminar in New York when Bush went after Trump without mentioning him by name.

“We have seen our discourse degraded by casual cruelty,” Bush said at the time. “We’ve seen nationalism distorted into nativism. Forgotten the dynamism that immigration has always brought to America.”

Trump, for his part, hasn’t avoided stoking the flames. On the campaign trail, he constantly barraged the Bush administration for starting the Iraq war and attacked Jeb Bush, George Bush’s brother and then nominee for president, labeling him “low energy Jeb.”

A spokeswoman for the White House did not return calls for comment at the time of publication.

Bush’s lack of endorsement for the Republican tax plan, the Tax Cuts and Jobs Act, may seem surprising to some, due to his efforts when he was in office to make significant changes to the tax code. In what became known as the Bush tax cuts, the former president was the architect of one of the most expansive tax reform efforts in the history of the United States with the first of two bills being named the Economic Growth and Tax Relief Reconciliation Act of 2001.

The bill at the time was considered revolutionary as it cut each individual tax bracket and limited the capital gains tax. The second bill of the Bush tax cuts was the Jobs and Growth Tax Relief Reconciliation Act of 2003, which increased the exemption amount for the Alternative Minimum Tax as well as a continued lowering of individual income taxes.

The catch with the Bush tax cuts was that they phased out in 2010. They were eventually renewed for two years under President Obama, and only the individual tax cuts for those earning less than $400,000 and couples making less than $450,000 per year remained permanent.

Trump scored a victory on Tuesday, as the House passed its own bill on Tuesday by a vote of 227 to 203. The bill lowers the corporate rate from 35% to 21% and drastically changes the rates for individuals. It’s expected to pass in the Senate as almost every Republican has guaranteed their support, except for Sen. Jeff Flake (R-AZ), who has yet to commit to voting in favor of the bill.