At 91, Warren Buffett still sprints circles around Wall Street

Over the past twelve months, Berkshire shares have returned 30% vs. the S&P’s 8%.

After a two-year pandemic-induced haitus, the only shareholder meeting of its kind on the planet is back and could break its own stunning record.

What began in a small cafeteria decades ago today has gotten so huge it sells out the very arena where Taylor Swift and Paul McCartney perform. This weekend, tens of thousands from around the world will descend on Omaha, Nebraska--the birthplace of the "Oracle of Omaha," a.k.a. Warren Buffett.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The price of admission? A single share of Berkshire Hathaway, the conglomerate he’s run for 57 years.

Not only is Buffett alive and kicking at age 91, the chairman and CEO of the $307 billion conglomerate--a behemoth with 80+ businesses under its corporate umbrella--will burst onto the stage Saturday with the power to declare that Berkshire’s stock performance has trounced the market… again.

Berkshire Hathaway CEO Warren Buffett (Fox Business Network)

Buffett himself is predicting a record-breaking crowd of more than 40,000, although Berkshire later put out a statement downplaying that number. But for a man who regularly deals in odds thanks to his massive insurance business, he’s never been one to casually throw out predictions involving numbers.

He could believe that with so many Americans eager to travel post COVID-19 lockdowns, why not come to the capitalist circus whose #1 attraction is an oddity more fascinating than any three-headed snake: two elderly self-made billionaires--Buffett and his 98-year-old best friend and Berkshire Vice Chairman Charlie Munger--who, decade after decade, have crushed stock market benchmarks and the performances of the world’s top fund managers. They’ve done it simply by adhering to disciplined, plain vanilla investing rules they readily share, and yet few if any manage to mimic.

Warren Buffett (L), CEO of Berkshire Hathaway, and vice chairman Charlie Munger attend the 2019 annual shareholders meeting in Omaha, Nebraska, May 3, 2019. (JOHANNES EISELE/AFP via Getty Images / Getty Images)

The two sit alone on stage and for hours take questions from the crowd. This year, Buffett and Munger will share the spotlight with Buffett’s eventual successor, Vice Chairman Greg Abel, along with Vice Chairman Ajit Jain, who runs Berkshire’s vast insurance business.

WARREN BUFFETT'S CHARITY LUNCH RETURNS, BUT FOR THE LAST TIME

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BRK.A | BERKSHIRE HATHAWAY INC. | 762,569.63 | +5,626.63 | +0.74% |

All four will come armed with a stock performance shareholders are sure to cheer: over the past twelve months, Berkshire shares have returned 30% vs. the S&P’s 8%.

HOW HAS BUFFETT DONE IT?

With a net worth of $120 billion today, Buffett is the sixth richest person in the world but when he started his investment company back in 1965, he was just the Nebraska neighbor next door, so shy he forced himself to take the Dale Carnegie course ‘How to Win Friends and Influence People’ so he could face potential investors. He went door-to-door asking friends and family to take a chance on the kid from Omaha who said he could grow their hard-earned money by investing in and outright buying cash-producing companies that churned out unique, quality products that were best in class: think Geico Insurance, American Express, Coca-Cola, See’s Candies. In fact, See’s made so much money that after he bought the entire company, he used its cash flow to fund the purchase of other businesses, including an entire railroad.

Berkshire Hathaway Chairman and CEO Warren Buffett (AP Photo/Nati Harnik)

He also deftly collects huge blocks of stock in companies that fit his requirements. Berkshire’s $340 billion stock portfolio is a green whale--chock full of Apple, Bank of America, Kroger, and more recently, HP Inc. and Occidental Petroleum.

BUFFETT'S BERKSHIRE HATHAWAY ADDS STAKE IN HP; SHARES JUMP

Buffett’s shareholders won’t arrive entirely happy, though. He’s sitting on a cash pile of $144 billion, most of it parked in low-yielding Treasuries. The chintzy returns haven’t thrilled investors who have already asked why he hasn’t put the money to work. Yes, he’s done share buybacks, $27 billion last year alone, but that’s barely made a dent. Buffett refuses to pay a dividend, preferring instead to reinvest earnings in new businesses, and yet, he also complains that there isn’t much out there that checks his boxes *and* isn’t overvalued.

THE 800-LB. BULL IN THE ROOM

Perhaps the number one question for the crowd: will this be the last in-person meeting featuring the Warren & Charlie show? Both have failing physical faculties. Buffett is hard of hearing, and at 98, Munger’s mind is as sharp as ever (his new hobby is architecture) but he’s mostly wheelchair-bound with limited eyesight. (At the 2017 meeting, the two came out on stage and Buffett joked, "That’s Charlie and I’m Warren. You can tell us apart because he can hear and I can see.")

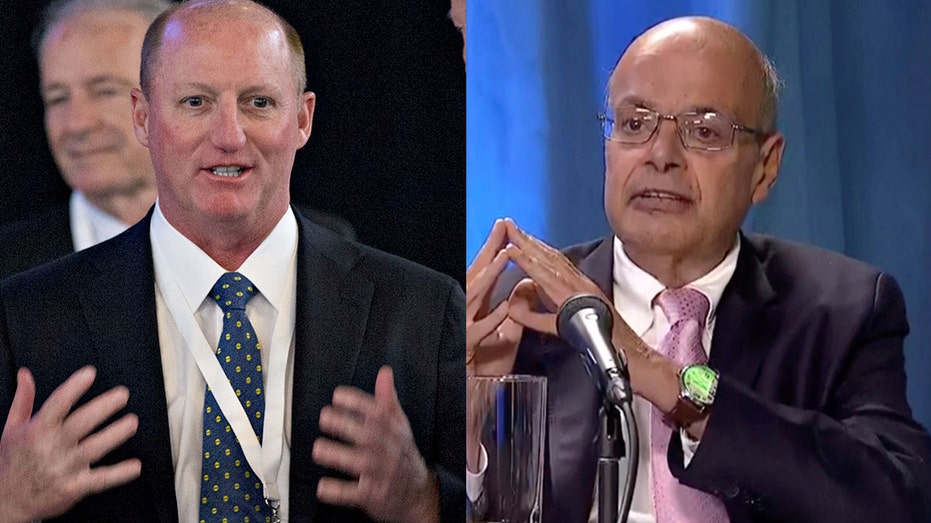

Greg Abel and Ajit Jain (Getty Images/Reuters)

While he’s named his Abel and Jain his successors, he said in a recent interview that Abel, who will run all non-insurance operations, "hasn’t started warming up yet," perhaps an indication that Buffett is far from loosening his grip on the Berkshire scepter, let alone handing it over to Abel.

CLICK HERE TO READ MORE ON FOX BUSINESS

Could that be because Buffett worries Berkshire stock will sell off if he does? He’s often said that Jain and Abel, along with his stock investment chiefs Ted Wechsler and Todd Combs, are smarter than he is, but don’t believe it. While each is brilliant in his field, the mere fact that Buffett has positioned four people to do the job he single-handedly did for years speaks volumes. No wonder shareholders come from as far away as China and Australia to hang on his every word.

Liz Claman will be reporting live from the Berkshire Hathaway Shareholder weekend beginning Friday.