Berkshire Hathaway's Greg Abel: 5 fast facts

Warren Buffett has tapped Greg Abel as his likely successor

Berkshire Hathaway CEO Warren Buffett has indicated Greg Abel will be his likely successor.

"The directors are in agreement that if something were to happen to me tonight, it would be Greg who’d take over tomorrow morning," Buffett told CNBC.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BRK.A | BERKSHIRE HATHAWAY INC. | 747,320.00 | -15,249.63 | -2.00% |

| BRK.B | BERKSHIRE HATHAWAY INC. | 508.09 | +4.20 | +0.83% |

In 2018, FOX Business reported that Abel was the leading candidate to succeed Buffett, based on insight from "Buffettologists" who have studied and scrutinized all things Berkshire.

WARREN BUFFETT'S SUCCESSOR WILL BE GREG ABEL: REPORT

During Berkshire Hathaway's annual shareholder meeting on Saturday, Vice Chairman Charlie Munger signaled, "Greg will keep the culture," according to reports.

Here is a FOX Business roundup of five important things to know about the man who will be handed the keys to Buffett's empire.

Who is Greg Abel?

Abel, described as affable, hails from Alberta, Canada, and is a University of Alberta-trained accountant with a bachelor of commerce degree who lives and breathes all forms of energy.

Greg Abel in an undated file photo. (AP Photo/Nati Harnik)

He trained as a chartered accountant with PricewaterhouseCoopers in San Francisco's office, before joining geothermal electricity producer CalEnergy in 1992. In 1999, CalEnergy acquired MidAmerican Energy, adopting its name, and Berkshire Hathaway acquired a controlling interest later that year. Abel became CEO of MidAmerican in 2008, and the company was renamed Berkshire Hathaway Energy in 2014.

In 2018, Abel joined Berkshire Hathaway's board of directors as vice chairman of non-insurance operations. He currently serves as Berkshire Hathaway Energy's chairman, where he oversees more than 90 subsidiary businesses including BNSF railroad, AltaLink, L.P., BHE Pipeline Group, BHE Renewables, BHE U.S. Transmission, HomeServices of America, Inc., MidAmerican Energy Company, Northern Powergrid Holdings Company, NV Energy, Inc. and PacifiCorp.

WARREN BUFFETT SAYS TRADING PLATFORMS LIKE ROBINHOOD ENCOURAGE A ‘GAMBILING IMPULSE’

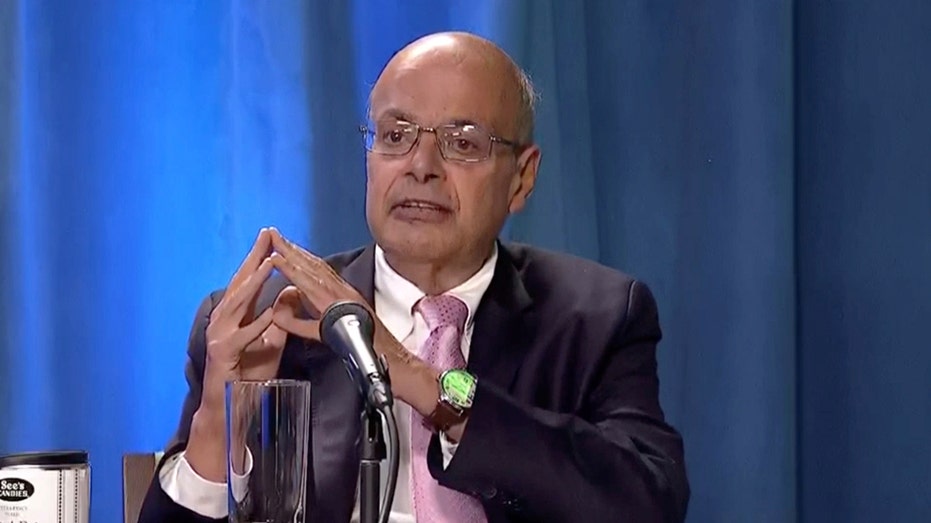

Who takes over if Abel can't serve as CEO?

While Abel came out on top, both he and the CEO of Berkshire Hathway's insurance businesses, Ajit Jain, have been the primary contenders for the role.

"If, heaven forbid, anything happened to Greg tonight then it would be Ajit," Buffett said, adding that age is a determining factor for the board. "They’re both wonderful guys. The likelihood of someone having a 20-year runway though makes a real difference."

Berkshire Hathaway's Vice Chairman Ajit Jain speaks at Berkshire's annual meeting, held virtually for a second year, in Los Angeles, California, May 1, 2021. (Yahoo Finance/ Handout via REUTERS)

Abel is 10 years younger than Jain at 59 years old. Meanwhile, Mr. Buffett’s son, Howard Buffett, is expected to succeed his father as non-executive chairman.

REUTERS/Carlo Allegri

Meanwhile, investment managers Todd Combs and Ted Weschler are in line to become chief investment officers.

Todd Combs and Ted Weschler. (Getty Images/Reuters)

What Abel told FOX Business in 2019

Abel praised Buffett during 2019's shareholder meeting, telling FOX Business' Liz Claman that he's a "great man."

"I couldn’t be more proud of Berkshire and obviously Warren and Charlie," Abel added while keeping a low profile at the meeting.

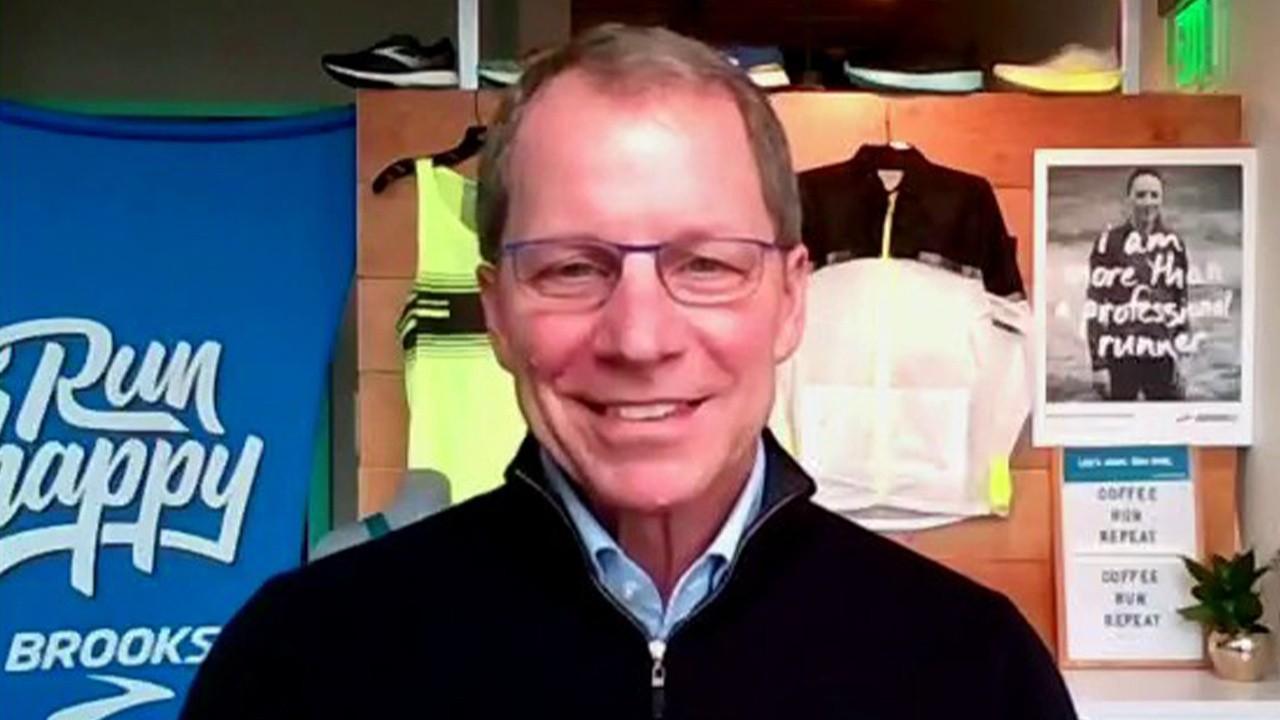

Brooks Running Company CEO on Abel

Jim Weber, CEO of Berkshire’s Brooks Running company, said Abel has routinely visits the Seattle company to review its strategy and operations. Plus, Abel is available whenever needed, which Weber took advantage of last year when the coronavirus pandemic shut down all the retail stores that sell Brooks’ shoes, the Associated Press reported.

In an interview with FOX Business last week, Weber noted how the company's brands gel. "We are all working for our shareholders [Berkshire Hathaway's]" he said, while also explaining Brooks' climate priorities which Abel is expected to prioritize like other corporate leaders.

"It was very easy for us to set goals that set on us a journey to be carbon neutral and to be inclusive as a running brand to invite everyone in from DEI (diversity, equity & inclusion) to sustainabilities"

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Brooks Running CEO: We’ve gained ‘more market share than ever’ this year

Jim Weber on Brooks Running’s success amid pandemic

"I wanted to get his insight into what he was seeing in the economy and at the other businesses. He’s seeing a large part of the economy just like Warren always has," Weber said. Abel encouraged Weber to focus on Brooks’ customers during the pandemic, which helped lead the company to shift to online sales and set sales records because people kept running even with the coronavirus restrictions.

How much is Abel currently making at Berkshire?

According to a filing with the Securities and Exchange Commission, Abel's total compensation for 2020 came in at just over $19 million. As vice chairman of non-insurance operations, Abel makes an annual base salary of $16 million, as well as an additional bonus of $3 million which is authorized by Buffett. In addition, Abel made $14,250 in "other compensation".

Since 2018, it has been the responsibility of Abel to set the compensation for the CEOs of Berkshire's non-insurance businesses, while Jain sets the compensation for the CEOs of Berkshire’s insurance businesses.

CLICK HERE TO READ MORE ON FOX BUSINESS

"Mr. Jain and Mr. Abel use the same general criteria as had been used by Mr. Buffet. Many different incentive arrangements are utilized, with their terms dependent on such elements as the economic potential or capital intensity of the business," the filing adds.

"The incentives can be large and are always tied to the operating results for which the CEO has authority and are related to measures over which the CEO has control."

Fox Business' Liz Claman and the Associated Press contributed to this report.