FirstEnergy reaches deal to give Carl Icahn two board seats: WSJ

Move comes as utility looks to put a bribery scandal behind it

FirstEnergy Corp. reached a deal with Carl Icahn that will give him two seats on the Ohio utility’s board and avert a potential proxy fight as the company looks to put a bribery scandal behind it.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| FE | FIRSTENERGY CORP. | 49.57 | +0.63 | +1.29% |

| IEP | ICAHN ENTERPRISES LP | 7.95 | -0.08 | -1.00% |

Two employees of the billionaire activist’s firm, Jesse Lynn and Andrew Teno, will join FirstEnergy’s board and serve on committees focused on helping the company improve its compliance and settle litigation, the company said Tuesday. The agreement, which was reported earlier Tuesday by The Wall Street Journal, would expand the board to 14 directors.

Icahn, who hasn’t disclosed his stake size, controls well over 3% of the company’s shares, according to people familiar with the matter. That makes him one of its top five holders with a stake worth over $600 million.

TIMING KEY IN CONSULTING DEAL BETWEEN FIRSTENERGY, REGULATOR

FirstEnergy, based in Akron, Ohio, provides electricity to about six million customers in a handful of states including Ohio, Pennsylvania and West Virginia. It has a market value of more than $19 billion. Last year, the company’s stock sank and it fired several high-ranking executives following an internal review related to government investigations of its potential role in an alleged state-bribery scandal.

Icahn took a stake in FirstEnergy with an eye toward pushing it to quickly settle litigation related to the scandal, the people said. A settlement would suggest at least some agreement between the two sides on next steps in that process and allow them to avoid the costly distraction of a proxy fight this spring. The window for shareholders to officially nominate directors opens later this week.

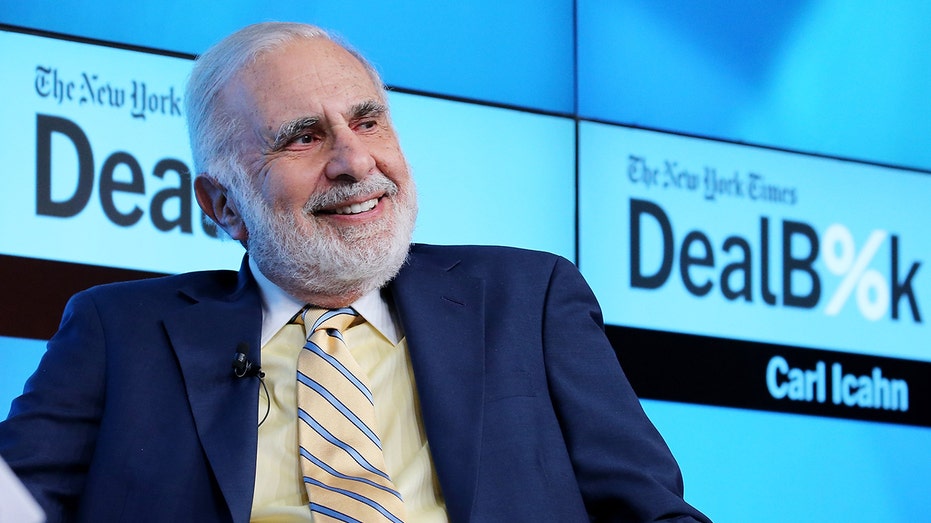

FirstEnergy Corp. reached a deal with Carl Icahn that will give him two seats on the Ohio utility’s board and avert a potential proxy fight as the company looks to put a bribery scandal behind it. (Getty Images)

Lynn, general counsel of Icahn Enterprises LP, has experience helping other companies move past litigation as a director of Conduent Inc. and former director of nutritional-supplement maker Herbalife Nutrition Ltd. Teno joined Icahn Enterprises as a portfolio manager when Mr. Icahn’s son Brett rejoined the firm and formed a new investment team last year.

The two men wouldn’t be able to cast votes on the board until regulators sign off.

FirstEnergy’s shares had been starting to recover from the market downturn in the early days of the coronavirus pandemic when the bribery allegations surfaced and sent them tumbling again. Even after rallying since Icahn’s involvement surfaced, they have underperformed shares of other utilities, indicating lingering investor concerns about fallout from the scandal.

CLICK HERE TO READ MORE ON FOX BUSINESS

In July 2020, Ohio House Speaker Larry Householder and several associates were arrested and charged with racketeering as part of an alleged $60 million bribery scheme in which state politicians championed legislation to bail out troubled nuclear plants including ones then owned by FirstEnergy. Prosecutors have called it the largest bribery scheme in the state’s history.

Householder has pleaded not guilty.

The U.S. Attorney for the Southern District of Ohio alleged that the company paid Mr. Householder and other state political operatives, in exchange for his support of a state bailout package that collected $1.5 billion from the utility’s customers.

FirstEnergy fired its former chief executive officer and other executives about three months later. Steven E. Strah, the company’s president, has since been named CEO.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

While the arm that owned the nuclear plants was spun off from FirstEnergy after filing for bankruptcy protection in 2018 and is now known as Energy Harbor, there could be remaining financial ramifications for its former parent. The Midwestern electricity market is also getting increasingly competitive.

Strah said on the company’s most recent earnings call that it is taking decisive actions to rebuild its reputation, including being more transparent with investors and customers, and it is cooperating with government investigations.