Jack Welch’s one regret is General Electric’s demise

The Jack Welch that I knew and reported on wouldn’t have allowed this once-great American corporate icon to slip into disarray as it has

Jack Welch should have had no regrets, but at the end of his life he had one big one, and that involved General Electric and his role in its current sorry state of affairs.

As someone who has covered GE for years, known and admittedly liked Jack, maybe I’m biased for saying this. But the Jack Welch that I knew and reported on wouldn’t have allowed this once-great American corporate icon to slip into disarray as it has.

People forget how long Jack was CEO of GE and how he adapted the company to fit the times. In the early 1980s, when Welch took over as CEO, GE was a staid conglomerate offering a dividend to investors. He blew the place up, earning the name “Neutron Jack” for eliminating layers of management bloat and installing a management standard that was second to none.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GE | GE AEROSPACE | 321.00 | +14.63 | +4.78% |

Before just about anyone in corporate America he saw the rise of two distinct trends in global business: Growth in Asia and high finance as the key to GE’s success, and retrofitted the company to thrive during this evolution.

Yes, lots of people got fired by Jack Welch because of his standards, but these weren’t just mass purges as some have suggested. Under Welch, you got the ax but you knew it was coming, people who were there tell me. With rare exceptions, it was almost never a surprise. If you performed, you thrived in the Welch corporate culture.

As a result, GE didn’t just flourish during these times; it became among the world’s most profitable corporations. Welch’s GE, as it jettisoned underperforming units, bought scores of others that met his growth models as the company continued to grow and innovate for two decades. Wall Street demanded growth and Jack gave it. A little context: When you throw in dividends, GE’s stock price exploded about 5,000 percent during the Welch era as CEO, far surpassing the bull-market S&P during that time – a metric I can’t imagine any CEO ever accomplishing.

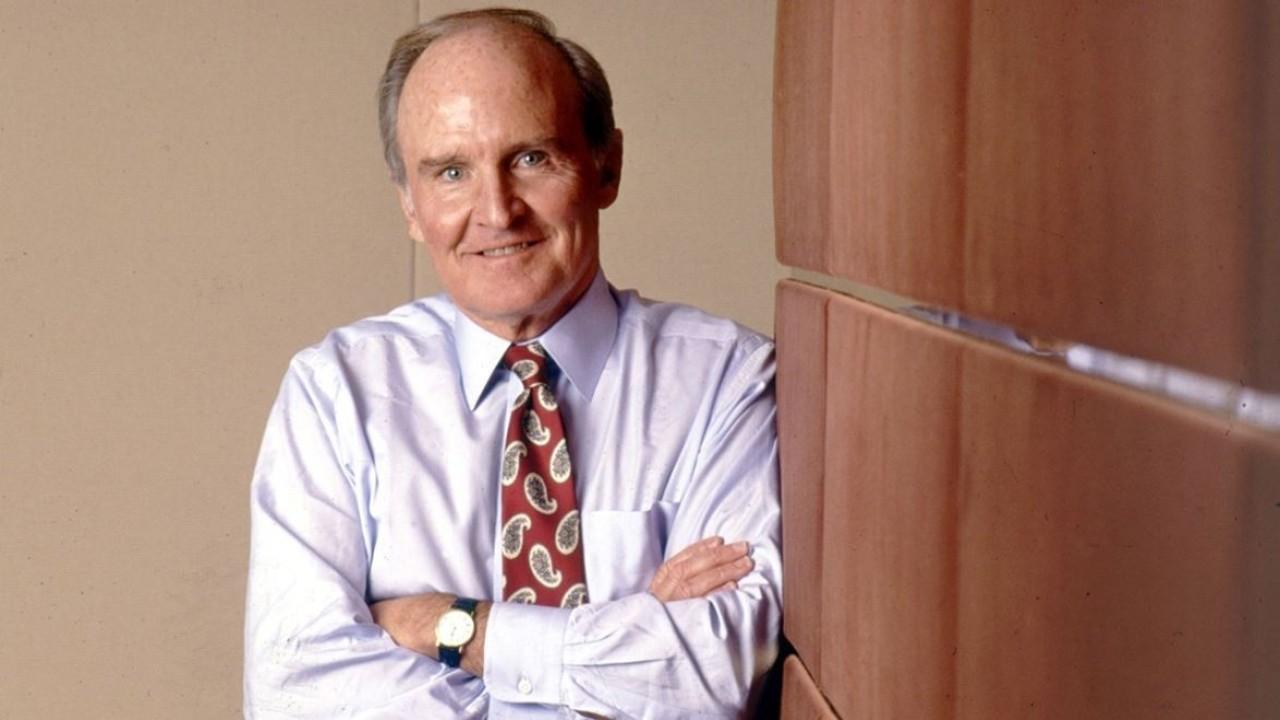

PHOTOS: JACK WELCH WITH WORLD LEADERS, WALL STREET TITANS OVER THE YEARS

There is no one reason for GE’s success under Welch. Certainly the stock market boom that began in the mid-1980s and lasted through the bursting of the dot-com bubble in 2000 was a significant factor. But rising stock prices can’t shield managerial incompetence, which there was very little of at GE under Welch.

“When you brought a deal to Jack you better bring your A-game because Jack would tear your presentations apart,” said John Myers, the former president of GE Asset Management. “He loved it when you pushed back and engaged with him in what he called ‘candid, constructive conflict.’ I don’t know if he made all these sayings up, but he certainly told us to embrace change and don’t fight it. He was clearly one of the most iconic business leaders of our time.”

Those days are long gone, of course, and the company’s slide began not long after he left in 2001, aided and abetted at times by factors outside management’s control such as the 9-11 terrorist attacks and later the 2008 financial crisis. GE is now a company known for announcing big losses and downsizing and fighting to remain in some semblance of its former self.

FORMER GE CEO JACK WELCH IS AMERICA’S BEST BUSINESSMAN: KEN LANGONE

Many blame Jack's last-stage CEO ambitions for the company's current problems. He built GE Capital – an in-house Wall Street firm – from a sleepy backwater into a juggernaut in the capital markets. The financial profits were good until they weren’t, particularly during the 2008 banking meltdown where losses from this unit nearly tanked the company (Disclosure: I was an employee as CNBC, then a unit of GE, at the time).

Yes, Welch also went on a buying spree, including an ill-fated attempt to purchase Honeywell International just before his retirement in 2001. Some say this underscored his management excesses that he left to his successor, Jeffrey Immelt, a difficult and maybe impossible job to sort out.

But to his critics, I would ask them to consider the following: If Jack stayed at GE would he have allowed it to meander through changes in the business environment without changing GE’s structure? Would Welch have allowed the bloat that consumed the company in recent years from strangling it?

If you know Jack, you know the answer is a resounding “no.” He would have figured out a way to adapt.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Of course, Immelt, a classy man and a decent manager, doesn’t deserve all the blame for GE’s sorry state, even if Jack has blamed him for mismanaging GE for years. Immelt himself issued a statement Monday that tried to downplay the friction between the two men that if you know either Welch or Immelt weakly papers over the truth of their contretemps. “From the first day I joined GE, I felt like I worked for Jack Welch, and that was all right by me," Immelt said. "He was a brilliant, aspirational leader. Jack was always direct, but his frankness was appealing and effective. His informality and accessibility made GE a team – we all loved working for him because he wanted the people around him to succeed. Jack was the best boss I have ever seen. God bless him and his family."

Immelt was bounced by the company’s board in 2017 (as was the guy who succeeded him) when it was clear that after brushes with near death (the financial crisis), lack of profitability and a depressed stock price, whatever he was doing wasn’t working. Welch, I am told, believed the board waited far too long to end what he considered his “biggest mistake” as CEO, signaling the board that it should name Immelt his successor over other viable candidates such as Bob Nardelli and James McNerney.

In Welch’s mind, Immelt wasted time on extraneous projects (windmills and solar power comes to mind) and cozying up to the Obama White House just after the 2008 banking debacle. He allowed an institution that needed to change to exist without change. He didn’t listen to opposing voices, and thus he failed.

CLICK HERE TO READ MORE ON FOX BUSINESS

All possibly true. But Immelt also took over a company at the height of the market that was defined by a legend, and it would have been hard to reverse all of that maybe ever. Could Immelt have really jettisoned GE Capital in 2005 or 2006 before the financial crisis? I doubt it.

But if you know Welch, you also know he would have surrounded himself with people to see the storm coming sooner and taken the appropriate steps to remake GE in the way the markets demanded. If Jack Welch had somehow succeeded Jack Welch he would have cared less about legacy.

One more thing I should add: Jack was, in my opinion, not just an excellent CEO but a great guy (I know we will be debating the former, though not the latter in the coming days, and I’m ready). He gave me great career advice along the way, for which I’ll always be thankful. Condolences to Suzy Welch and his family.

Again, I’m biased, but I’ve also been around a lot of CEOs during my years covering American business, and if you know one thing about Jack Welch it’s that he knew how to adapt to the times better than anyone I’ve have seen running a major American company (with some rare exceptions like J.P. Morgan Chase’s Jamie Dimon). The reason: He didn’t run away from an argument over corporate strategy; he embraced it and would change that strategy when necessary. Corporate America, please take note.