Jim Chanos says 'pitchforks are undervalued' after report hedge funds received private coronavirus briefing

“It just gets to the whole idea that’s out there, both on the left and the right, that there’s two systems here,” Chanos said.

Famed investor Jim Chanos said Thursday that a New York Times report alleging White House officials held private briefings with hedge funds about the coronavirus pandemic’s severity while downplaying the risk in public exacerbating a narrative that business elites have an unfair advantage.

Chanos, known for his success as a short seller, said the report on the private briefings “crystallized” the notion among critics of the business sector and the public at large that the “game is rigged” against them.

TRUMP SAYS HE WOULD RAISE CORONAVIRUS STIMULUS DEAL OFFER TO ABOVE $1.8T

“It gets back to, would you rather be right and righteous or make money, but it also gets back to the tail risk, if you want to be a wise guy about it, in that torches and pitchforks are undervalued,” Chanos said during an interview with Hedgeye Risk Management. “You continue this type of political animus where the one percent and the elite are brought under the tent and everyone else is left to fend for themselves, history tells us that’s not a tenable position for a long, long period of time.”

Chanos spoke in response to a New York Times report that detailed White House briefings in late February, just days before the worsening pandemic triggered worldwide lockdown measures.

In a Feb. 24 meeting, top White House economic adviser Tomas Philipson told board members of the Hoover Institution, a conservative think tank that studies the economy, that he could not yet estimate the impact the novel coronavirus would have on the U.S. economy. That same day, President Trump tweeted the stock market was “starting to look very good to me.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

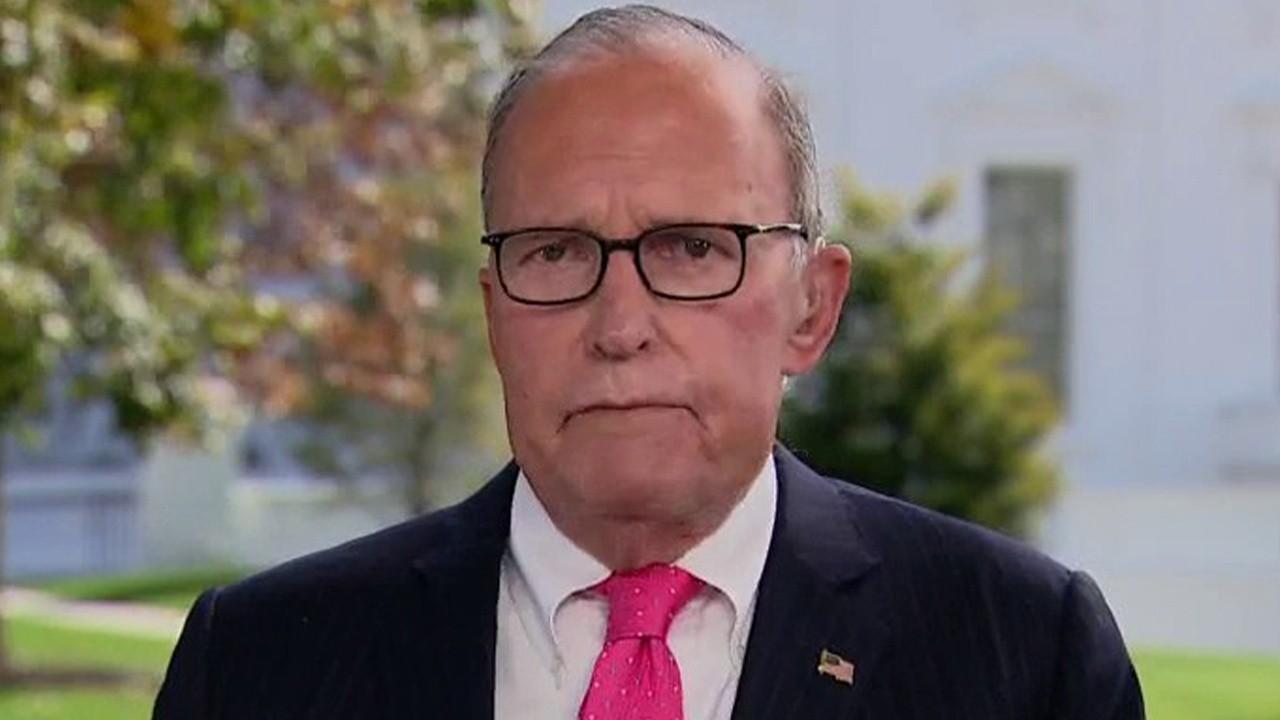

One day later, National Economic Council director Larry Kudlow told the board members the coronavirus “contained in the U.S., to date, but now we just don’t know,” hours after making a TV appearance asserting the virus containment was nearly “airtight,” according to the hedge fund consultant’s notes on the meetings obtained by the Times.

One investor told the newspaper that he took details from the meetings as a sign to “short everything.”

Kudlow said he felt his remarks during the briefings, which included comments downplaying the pandemic's impact, matched his remarks made on television in February. He told the Times that “There was never any intent on my part to misinform."

Treasury Secretary Steven Mnuchin dismissed the New York Times' report as "another exaggeration" during an appearance on CNBC.

Chanos said the report added to the notion that "there's two systems."

“There’s a system for the corporate class, the financial class, and then there’s the system for everybody else. COVID has just made that worse," Chanos said.

Chanos has been critical of Trump in the past. Speaking at a Democratic fundraising event in 2016, he said Trump's past business ventures were the "easiest short sales I’ve ever had in my life."