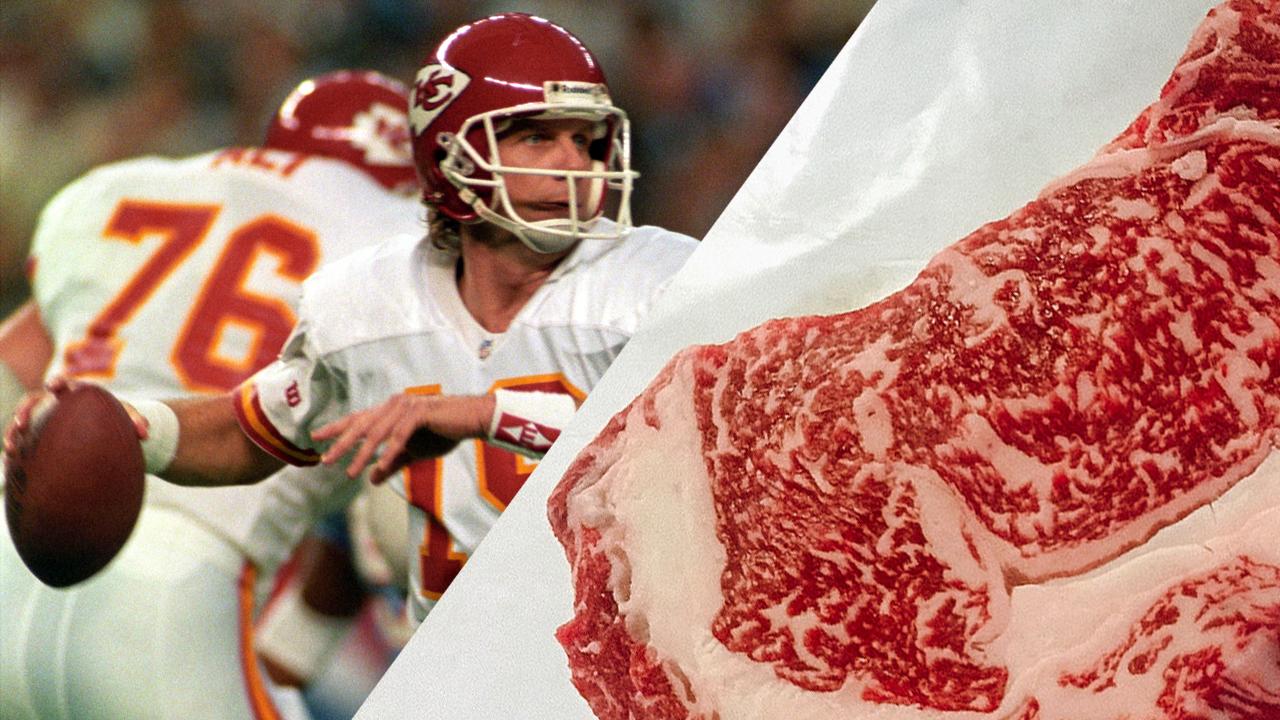

A look at Super Bowl legend Joe Montana's top investments

While NFL Hall of Famer Joe Montana’s football career ended more than 20 years ago, his investment game has been strong — and growing — since the late 1990s.

This week, the four-time Super Bowl champ made big news when his venture capital firm – Liquid 2 Ventures — announced its part of a $75 million investment in a marijuana startup called Caliva.

The former 49er's star said he’s investing in the industry because he believes it “can provide relief to many people and can make a serious impact on opioid use or addiction.”

Caliva now joins a long list of other startups under Montana’s umbrella.

In 2017, FOX Business spoke to the legend about his transition into the investment world, which he admits wasn’t always easy.

“The most difficult thing is to try to find people that you trust. You’re gonna get a lot of information from people who are going to want to tell you what to do and a lot of people who want to be your partner because most athletes who are looking to transition are going to have a large amount of capital that they are looking to do something with and you have to find the right people,” Montana said.

Montana added that he credits his investment success to teaming up with angel investor Ron Conway, who founded SV Angel, a San Francisco-based seed fund company.

In 2015, the pair later partnered with two other entrepreneurs to create Liquid 2 Ventures, an early stage venture capital firm.

Within the company’s first two years, it quickly established itself as an elite seed fund company, with investments including GitLab, Crowd Cow, Rappi, Captain401 and 90-plus other seed companies. Conway and Paul Graham — another venture capitalist and co-founder and partner at Y Combinator — both serve as board advisers.

“One of the things that we do is not just invest in companies, we actually go in and we offer to help in any way that we can,” Montana said.

CLICK HERE TO GET THE FOX BUSINESS APP

“We bring a lot of value to the table, not just capital, which when you invest some people think that the hard part is over but it’s just beginning in trying to make sure that companies are growing the right way and finding the right people to hire. It’s a big process and it is a lot more work than the fun side of things. I can tell you that,” he added.