Zoom, Boston Beer, Nikola among Forbes 400's newest members

Many list newcomers are self-made billionaires worth at least $2.1 billion

This year's Forbes 400 has welcomed 18 new members, whose fortunes were built from industries ranging from videoconferencing to electric trucks to beer. Many of the newcomers are self-made billionaires who are worth at least $2.1 billion, the minimum requirement to make the list.

Below is a look at some of this year's most high profile newcomers:

BEZOS TOPS FORBES 400 LIST FOR THIRD STRAIGHT YEAR AS WEALTH JUMPS 57% FROM LAST YEAR

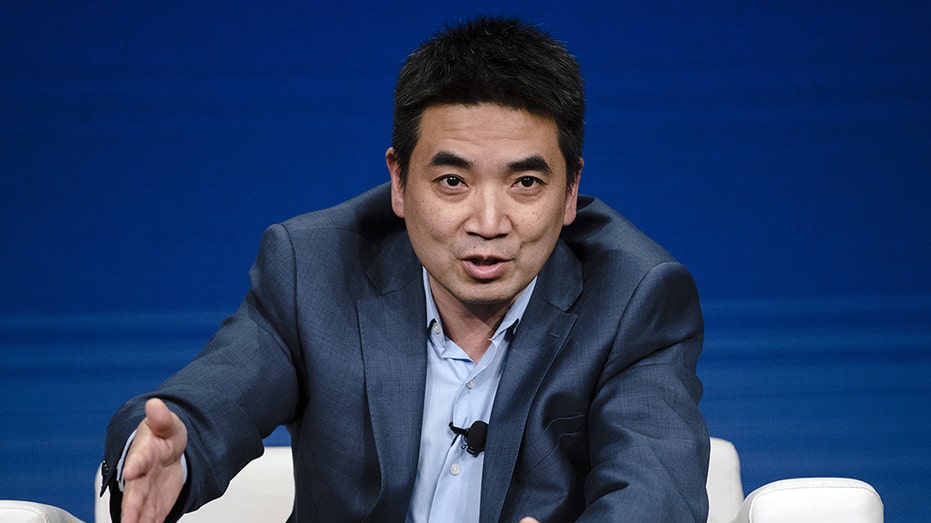

Eric Yuan

Eric Yuan, founder and chief executive officer of Zoom Video Communications Inc., speaks during the BoxWorks 2019 Conference at the Moscone Center in San Francisco, California, U.S., on Thursday, Oct. 3, 2019. BoxWorks brings together leaders across

Eric Yuan, the co-founder of the video-conferencing company Zoom, joins the Forbes 400 with a net worth of $11 billion, the highest ranking newcomer.

Yuan was previously a manager of WebEx at Cisco, which acquired Zoom in 2007. Yuan brought the company public in April 2019. According to Forbes, Yuan had a 22% stake in the company at its IPO, when Zoom was valued at just over $9 billion before trading began.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ZM | ZOOM COMMUNICATIONS INC. | 95.39 | +3.19 | +3.46% |

The service has gained wide popularity as Americans are working from home amid the coronavirus pandemic. For the second quarter of 2020, the company said revenue rose 355% to $663.5 million, and that it now has 370,200 institutional customers with more than 10 employees, up about 458% from the same quarter last year.

Yuan raised Zoom's annual revenue target for fiscal year 2021 to the range of $2.37 billion and $2.39 billion, from $1.78 billion to $1.80 billion earlier.

Trevor Milton

CEO and founder of U.S. Nikola, Trevor Milton speaks during presentation of its new full-electric and hydrogen fuel-cell battery trucks in partnership with CNH Industrial, at an event in Turin, Italy December 2, 2019. REUTERS/Massimo Pinca - RC2AND97

Trevor Milton, the founder of electric vehiclemaker Nikola Motor, joins the Forbes 400 with a net worth of $3.3 billion, the youngest newcomer at age 38.

Milton founded Nikola Motor in 2014, which specializes in building vehicles that run on pure electric or hydrogen-based power-trains. The company was renamed Nikola Corp. in June after merging with listed firm Vector IQ.

On Tuesday, General Motors announced it would manufacture Nikola Corp.'s Badger electric pickup truck for $2 billion in newly issued common stock, worth 11% of the company. Anheuser Busch also has taken an interest in the automaker, placing an order for up to 800 of the company's hydrogen-powered semi trucks.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NKLA | NO DATA AVAILABLE | - | - | - |

Shares of the stock closed up more than 40% Tuesday at $50.05.

WATCH: ELON MUSK TEST DRIVES ELECTRIC VOLKSWAGEN AND SAYS 'IT'S PRETTY GOOD'

Ken Xie

Ken Xie, president and chief executive officer of Fortinet Inc., speaks during an interview in San Francisco, California, U.S., on Wednesday, May 19, 2010. Fortinet Inc.'s initial public offering in November 2009 was Silicon Valley's first IPO in 21

Ken Xie, the co-founder and CEO of cybersecurity firm Fortinet, joins the Forbes 400 with a net worth of $3.3 billion.

According to Forbes, Xie became interested in entrepreneurship while at Stanford, founding SIS, a software firewall business, in 1993. Three years later, he started another cybersecurity firm, Net Sceen, before founding Fortinet in 2000.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| FTNT | FORTINET INC. | 85.93 | +3.17 | +3.83% |

Fortinet, which went public on the Nasdaq in 2009, earned $2.2 billion in revenue in 2019.

BUDWEISER LOOKS FOR NEW KING OF BEERS AS AB INBEV BEGINS CEO SEARCH

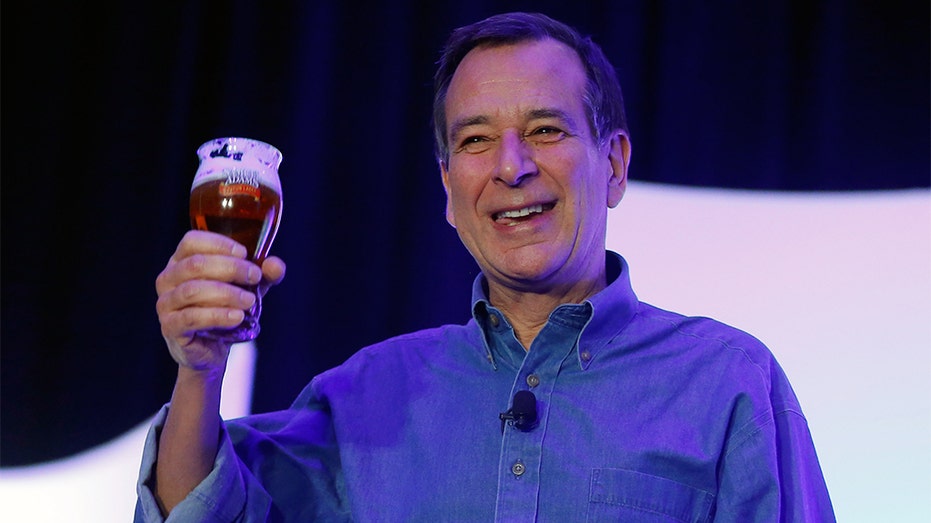

Jim Koch

LAS VEGAS, NV - MARCH 19: Founder and Chairman of the Boston Beer Co. Jim Koch delivers a keynote address at the 28th annual Nightclub & Bar Convention and Trade Show at the Las Vegas Convention Center on March 19, 2013 in Las Vegas, Nevada. (Pho

Jim Koch, the co-founder and chairman of Boston Beer Company,joins the Forbes 400 with a net worth of $2.6 billion. Koch is considered one of the founding fathers of the American craft brewery movement after creating Samuel Adams in 1984. He took his company public in 1995 and owns a 26% stake, according to Forbes.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SAM | BOSTON BEER CO. INC. | 246.71 | -0.05 | -0.02% |

In 2019, the company sold more than $1 billion of over 60 types of beer and acquired popular craft brewery Dogfish Head for $300 million.

Boston Beer Company reported a net income of $60.1 million for the second quarter, or $4.88 a share, compared with $27.9 million, or $2.36 a share, a year ago while net revenue rose to $452.1 million from $318.4 million a year ago. Boston Beer Company has seen its products, such as Truly Hard Seltzer, soar in popularity during the pandemic.

Rodney Sacks

WASHINGTON, DC - JULY 31: Rodney Sacks, chairman and CEO of the Monster Beverage Corporation, testifies during a hearing before the Senate Commerce, Science and Transportation Committee July 31, 2013 on Capitol Hill in Washington, DC. The hearing was

Rodney Sacks, CEO of energy drink maker Monster Beverage Corporation, joins the Forbes 400 with a net worth of $2.5 billion.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MNST | MONSTER BEVERAGE CORP. | 80.90 | -1.64 | -1.99% |

Sacks bought the drink company, originally named Hansen Natural in 1992. Hansen's Natural launched Monster brand energy drink in 2002, and the company changed its name to Monster Beverage in 2012.

Coca-Cola opened up its global distribution to Monster after buying a 16.7% stake for $2.15 billion in cash in June 2015. Monster later went into arbitration with the company in 2018 after Coca-Cola decided to develop two energy drinks, with Coca-Cola ultimately winning.

Like Boston Beer Company, Monster has seen a surge in demand amid the coronavirus pandemic, reporting second-quarter net income of $311.4 million, or 59 cents a share, compared with $292.5 million, or 53 cents a share, in the year-ago period. Revenue, meanwhile, declined to $1.09 billion from $1.1 billion the previous year.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Jim McKelvey

SQUAWK ALLEY -- Pictured: Jim McKelvey, co-founder of Square, in an interview during the eMerge Conference on May 5, 2015 -- (Photo by: David A. Grogan/CNBC/NBCU Photo Bank/NBCUniversal via Getty Images)

Jim McKelvey, a co-founder of payment firm Square, joins the Forbes 400 with a net worth of $2.2 billion

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SQ | NO DATA AVAILABLE | - | - | - |

McKelvey founded the company with Twitter CEO Jack Dorsey in 2009 and continues to serve as one of the company's board members. He owns nearly 5% of the company and has netted at least $270 million from selling Square shares, according to Forbes.

McKelvey also sits on the board of the Federal Reserve Bank of St. Louis and started a nonprofit, LaunchCode, to teach people how to program.

CLICK HERE TO READ MORE ON FOX BUSINESS