Allstate raises auto rates due to inflation

Pricing actions will continue to be implemented throughout 2022 as needed

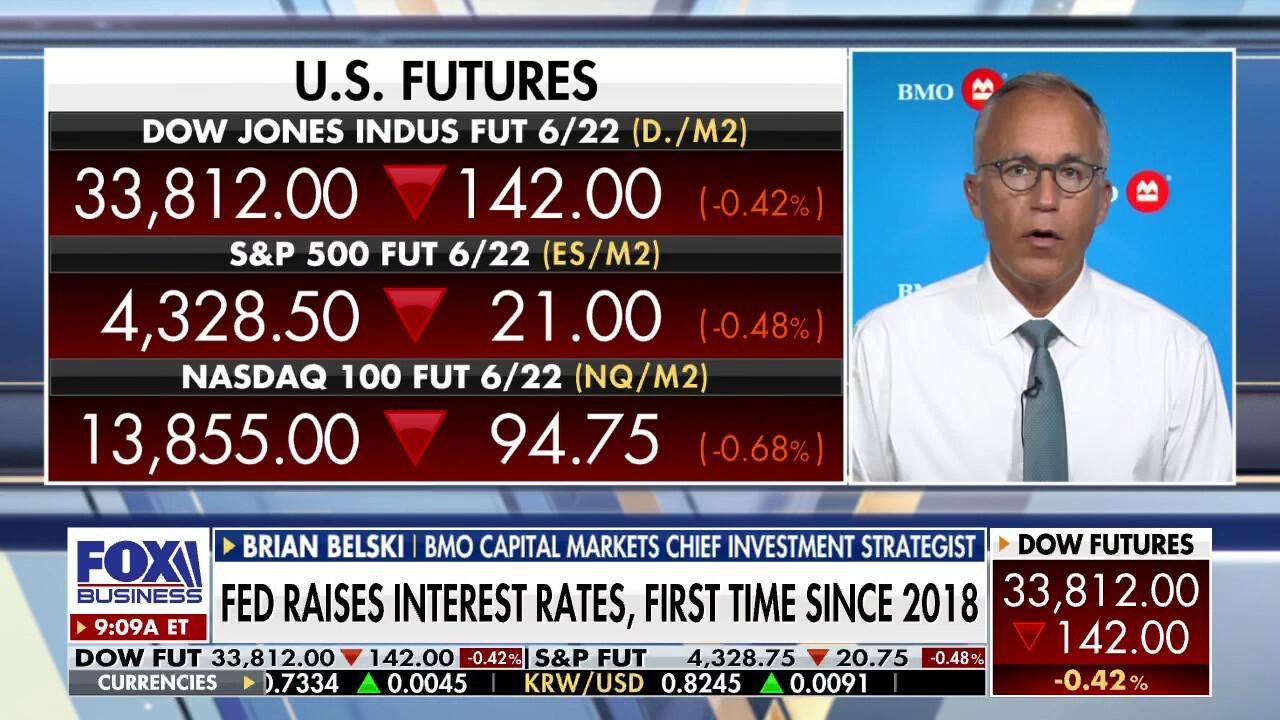

Market 'fixated on inflation': Strategist

BMO Capital Markets strategist Brian Belski joins 'Varney & Co.' to discuss interest rate hikes and the Ukrainian conflict's impact on the market.

Allstate is raising its auto insurance rates in an effort to address loss costs being driven higher by inflation. The move equates to an approximately 5.1% increase for the brand's total auto insurance written premiums.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ALL | THE ALLSTATE CORP. | 207.60 | -7.54 | -3.50% |

Since the fourth quarter of 2021, the Allstate brand has implemented 41 rate increases averaging approximately 7.8% across 34 locations, translating to an annualized impact of approximately $1.2 billion in gross premiums.

"The increase to Allstate brand total auto insurance written premiums of approximately 5.1% implemented over this five-month period will be earned throughout the year," Allstate chief financial officer Mario Rizzo said in a statement.

The company added that pricing actions will continue to be implemented throughout 2022 as needed.

ELON MUSK WORKING ON TESLA MASTER PLAN PART 3

Allstate emphasized in a presentation to investors that its auto insurance loss costs over the past five years are made up of approximately 60% in physical damage claims and 40% in casualty claims.

Allstate is raising its auto insurance rates in an effort to address loss costs being driven higher by inflation. (Bruce Bennett/Getty Images)

Used car values, which have increased 68% since the end of 2018, have accounted for 60% of the increase in physical damage claim severity, while higher impact accidents and parts, labor, and repair costs each accounted for approximately 20% of the increase. Meanwhile, the rise in casualty claim severity is being driven by more severe injuries, medical inflation and greater attorney representation.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In addition to rate increases, Allstate is focusing on reducing its expenses. The company has achieved approximately half of its savings to date in its commitment to reduce its adjusted expense ratio by around 6 points from 2018 to 2024.

Allstate is planning future cost reductions from operating, claims and distribution expenses and will accurately and efficiently resolve claims by leveraging on-staff experts, predictive modeling, strategic partnerships and parts procurement.