Consumer confidence rosy, but COVID, inflation remain headwinds

Six-month plans for vacations and purchases of homes, cars, appliances all rose

Outlook for markets in 2022, GDP

Navellier & Associates chairman and founder Louis Navellier on his predictions for the markets in 2022 and how the political landscape impacts wall street.

U.S. consumers are feeling pretty good about the economy, even with the omicron variant, new threats of lockdowns and rising inflation, but these issues still remain wild cards for 2022.

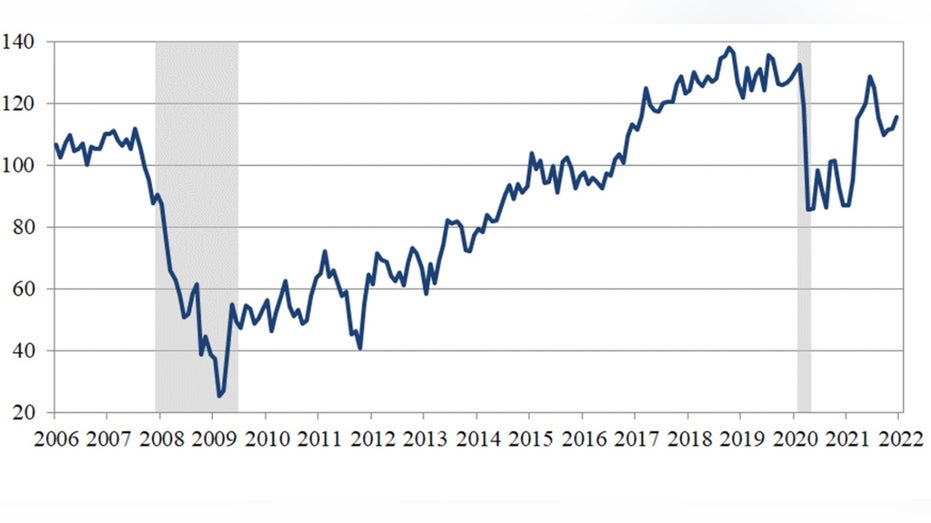

The Conference Board’s Consumer Confidence Index rose to 115.8, up from a revised higher 111.9 in November. The short-term future component, the Expectations Index, rose to 96.9 from 90.2

HERE'S WHERE SURGING PRICES ARE HITTING CONSUMERS THE MOST

THE CONFERENCE BOARD'S CONSUMER CONFIDENCE INDEX

December 2021 (The Conference Board )

"Expectations about short-term growth prospects improved, setting the stage for continued growth in early 2022. The proportion of consumers planning to purchase homes, automobiles, major appliances, and vacations over the next six months all increased," said Lynn Franco, senior director of economic indicators at The Conference Board.

LARRY SUMMERS: FED IS STILL BEHIND THE CURVE

While consumers’ concerns about inflation and COVID dipped, Franco notes both these factors will continue to present headwinds for consumer spending and overall confidence next year.

In November, consumer prices surged 6.8%, the highest since 1982, and producer prices by 9.6%, the most on record. The supply chain crisis that continues to plague the nation shows no signs of immediate improvement.

FED DOUBLES TAPER RATE, EYES THREE RATE HIKES IN 2022

Earlier, 3Q U.S. GDP rose a better-than-expected 2.3%, which was sharply lower than the second quarter’s 6.7% jump.

CLICK HERE TO READ MORE ON FOX BUSINESS

The Federal Reserve is forecasting the U.S. economy will grow 4% in 2022 after rising 5.5% this year.