No emergency fund in coronavirus crisis? Here's what to do now

Now may seem like the perfect time to invest. Here’s why you probably shouldn't.

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

At a time when the stock market has declined significantly from its pre-pandemic highs, now may seem like the perfect time to invest. Here’s why you probably shouldn't.

As the saying goes, when markets get volatile, “cash is king.” That wisdom holds doubly true now, as the coronavirus pandemic has not just sent markets into a tizzy, but inflicted significant damage on virtually every sector of the economy.

TRUMP SAYS HE'LL SIGN CORONAVIRUS LIABILITY EXECUTIVE ORDER THAT HELPS MEAT PRODUCERS

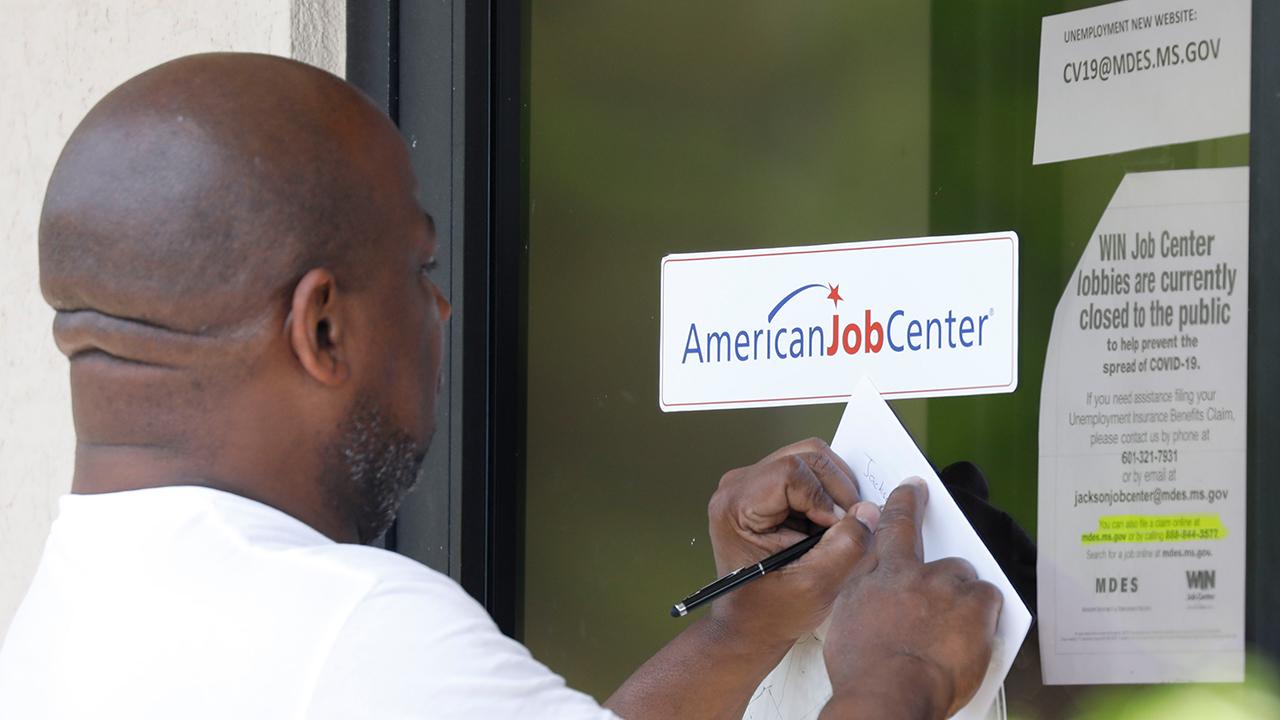

At a time of significant financial stress, American families who have a large emergency fund can sleep easier, knowing that they can rely on their cash cushion to help get them through this downturn. But some families don’t have a sizable emergency fund saved up—or don’t have one at all.

If you don’t have an emergency fund, you have several potential sources of revenue to start one.

For starters, the Internal Revenue Service will begin depositing stimulus payments to families this month. Individuals with incomes below $75,000 will receive payments of $1,200, and couples with incomes below $150,000 will receive payments of $2,400; individuals and couples will receive an additional $500 payment for every dependent under age 17.

Obviously, people who have lost their job or incurred some type of financial stress as a result of the pandemic and economic shutdown will use that money to help cover monthly expenses. But individuals whose job situation remains stable at present can put those dollars into an emergency fund, as a “Just-in-case” form of insurance to guard against a future job loss or other economic hardship.

DOORDASH REDUCES RESTAURANT FEES BY 50 PERCENT

Another potential source of emergency fund savings: Refunds from this year’s tax returns. The IRS postponed the Tax Day deadline, usually scheduled for this week, from April 15 to July 15 due to the pandemic. But if you’re like the nearly three in four (71.8 percent) American households who received a refund from the IRS last year, you should file as soon as you can to get your money back from the federal government.

Last year, filers who received refunds got a check from the IRS averaging $2,869—very close to the prior year average of $2,910. In many areas of the country, a sum this large would pay for one month or more of living expenses.

Unfortunately, however, some families spend rather than save their tax refunds. One survey last year found “making a major purchase” the second-most-popular use of tax refunds; vacations and “splurges” also ranked on the list of uses for tax refunds.

Given our current economic uncertainty, families who don’t have at least 3-6 months of expenses in an emergency fund should use their tax refunds to build up these reserves. Particularly this year, when government travel restrictions and quarantines make traditional summer vacations or home improvement projects less realistic, saving a tax refund makes far more sense than spending it on anything but necessities

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Finally, take the opportunity provided by the current virus-related shutdowns to reassess your spending. With restaurants in most areas of the country only open for takeout, many families are spending far less on dining out, even if spending more on groceries. Putting that net reduction in your food budget into an emergency fund will provide an immediate source of savings.

More importantly, taking the opportunity now to build savings, and reassess your financial priorities, will give you positive momentum to build on when the shutdowns recede, and the economy begins to return to normal. If you’re looking for things to keep you occupied while spending more time at home, going through your family’s spending, and finding things to trim—cutting back on cable, for instance—will help you well after the coronavirus threat has passed.

In the midst of a global pandemic, families have so many reasons to worry about their health, safety, and security. But by taking steps to build and maintain an emergency fund, you’ll have one big reason to sleep more secure at night.

Chris Burns is the CEO of Dynamic Money, and host of The Chris Burns Show on WSB Radio.

CLICK HERE TO READ MORE ON FOX BUSINESS