Fed plans coronavirus support to small businesses via ramp-up in lending

More than $40B worth of PPP loans to small businesses had been processed as of Monday afternoon

Get all the latest news on coronavirus and https://bitly.com/more delivered daily to your inbox. Sign up here.

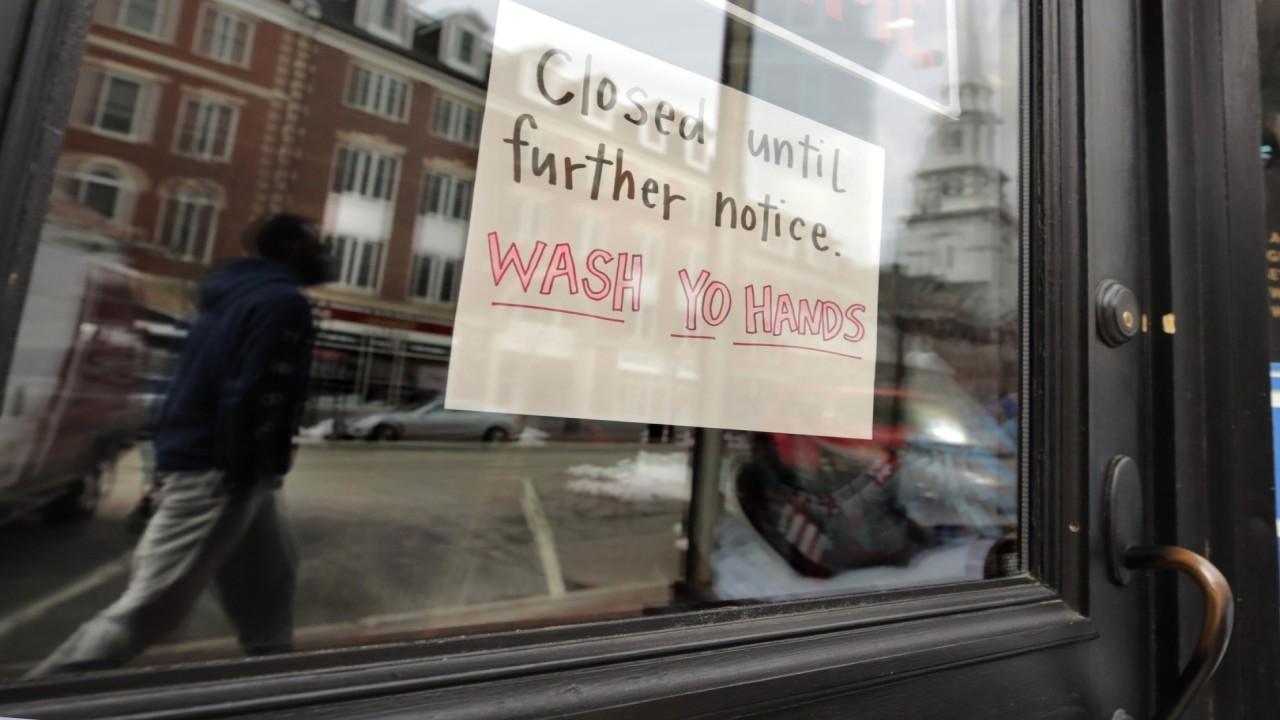

The Federal Reserve on Monday announced it would take new action to support America’s small businesses as coronavirus-related prevention measures have led to mass closures all around the country.

The central bank will pump up lending to small businesses by encouraging banks to make more loans through the newly implemented Paycheck Protection Program (PPP). It said in a statement Monday that it will set up a facility to provide term financing backed by PPP loans, which would potentially free up room on lenders' balance sheets so they could make more loans.

CORONAVIRUS LEADS TARGET TO SUPPLY ALL EMPLOYEES WITH MASKS, GLOVES FOR WORK

Additional details on how exactly the process would work were not immediately made available but were expected to be announced later this week.

CORONAVIRUS PROMPTS TRUCKERS TO ASK TRUMP FOR HELP AS CHALLENGES MOUNT, DEMAND CLIMBS

The Small Business Administration launched the Paycheck Protection Program on Friday – a measure implemented as part of Congress' multitrillion-dollar stimulus package. The program provides forgivable loans of up to $10 million to small businesses, so long as they keep their staffing levels and salaries constant.

According to the administration, more than $40 billion worth of loans to small businesses had been processed as of Monday afternoon. That equates to more than 130,000 loans.

CLICK HERE TO READ MORE ON FOX BUSINESS

There are concerns that the $350 billion set aside for the program would not be enough. President Trump said on Twitter over the weekend that he would request additional funds for the program from Congress if the initial round is depleted.