Housing starts plunge in June to lowest level in 9 months

New home construction cooled more than expected in June

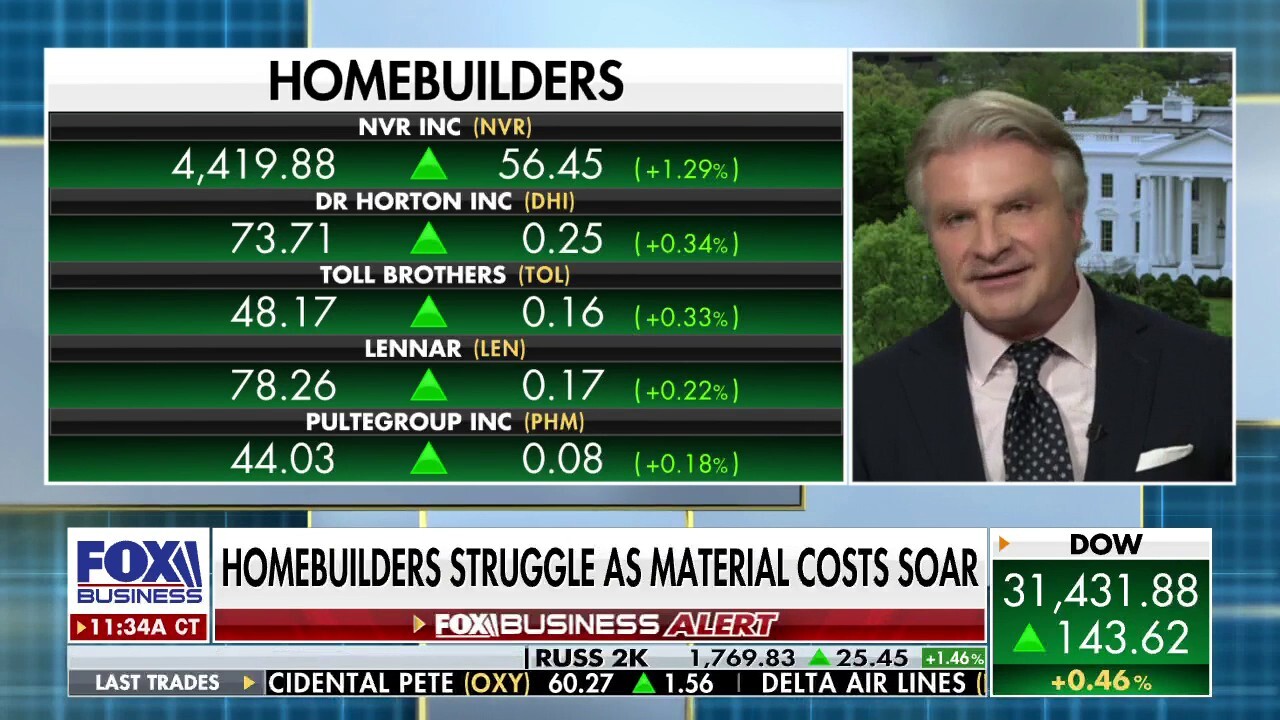

Real estate consultant on housing market: 'Everything costs more'

Tom Rood, SitusAMC Managing Director, discusses the increased costs of building a home and buying in the current real estate market

New U.S. home construction fell in June to the lowest rate since September, the latest sign that rising borrowing costs are starting to cool the red-hot housing market.

Housing starts dropped 2% last month to an annual rate of 1.559 million units, the lowest level since September 2021, according to new Commerce Department data released on Tuesday. That's below Refinitiv economists' forecast for a pace of 1.559 million units.

Applications to build – which measures future construction – slowed to an annual rate of 1.69 million units, which is also the lowest since September.

The data comes one day after the National Association of Home Builders/Wells Fargo Housing Market Index, which measures the pulse of the single-family housing market, fell for the seventh consecutive month to 55, the lowest level since May 2020. It is the second-biggest, one-month decline in the survey's 37-year history.

While any reading above 50 is still considered positive, the index has fallen considerably from just one year ago, when it stood at 80. It peaked at a 35-year high of 90 in November 2020, buoyed by record-low interest rates at the same time that American homebuyers – flush with cash and eager for more space during the pandemic – started flocking to the suburbs.

INFLATION TIMELINE: MAPPING THE BIDEN ADMIN'S RESPONSE TO RAPID PRICE GROWTH

Lumber at the site of a house under construction in the Cielo at Sand Creek by Century Communities housing development in Antioch, California, U.S., on Thursday, March 31, 2022. (Photographer: David Paul Morris/Bloomberg via Getty Images / Getty Images)

"Homebuilders pulled back in May and June in reaction to the surge in mortgage interest rates," said Bill Adams, chief economist for Comerica Bank. "The picture doesn’t look likely to improve near-term. The NAHB’s Homebuilder confidence index saw the second-largest drop ever in July, though the index’s level is still around its 30-year average."

The interest rate sensitive housing market has started to cool noticeably in recent months as the Federal Reserve moves to tighten policy at the fastest pace in three decades. Policymakers already approved a 75-basis point rate increase in June and are expected to approve another of that magnitude at the end of July.

Following the rate hikes, the average rate on a 30-year fixed mortgage – the most popular among new homeowners – climbed to nearly 6% in June, though they've since moderated. The average rate for a 30-year fixed rate mortgage hovered around 5.51% for the week ending July 14, according to recent data from mortgage lender Freddie Mac.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

That is significantly higher than just one year ago, when rates stood at 2.88%.