How Biden's corporate tax rate increase would affect Americans

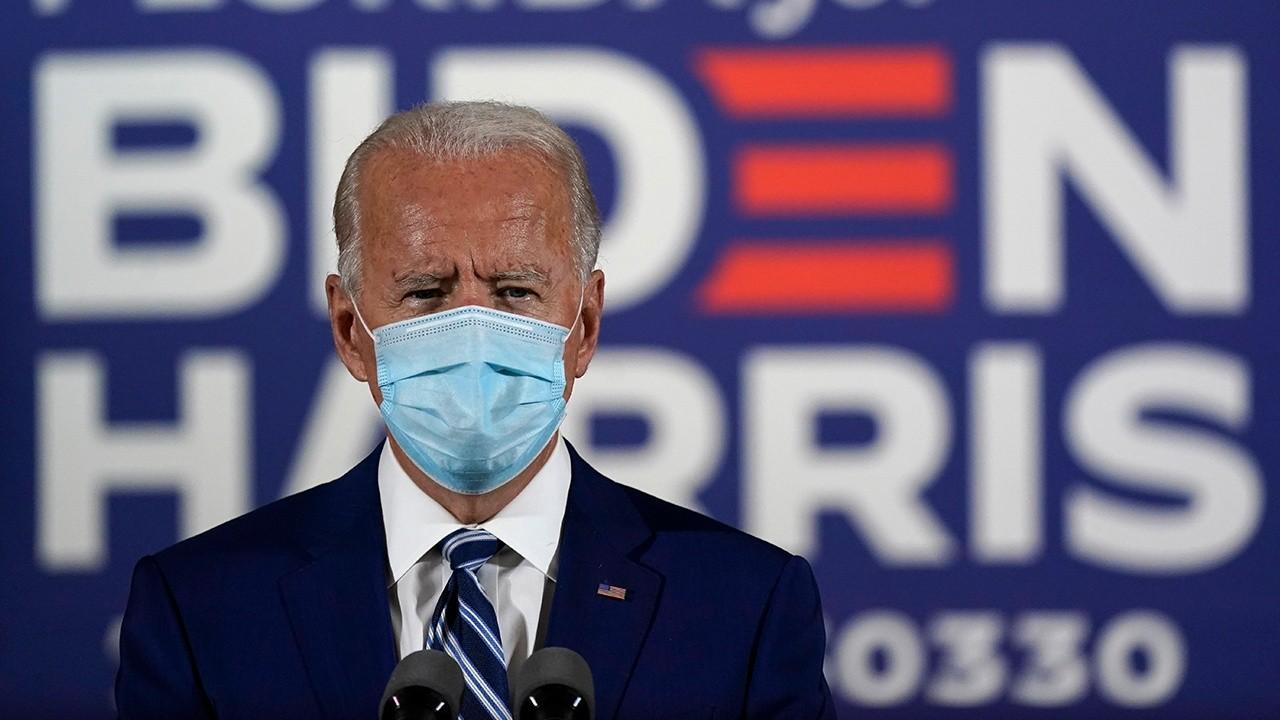

Democratic presidential candidate Joe Biden has promised not to raise taxes on anyone making less than $400,000 a year, but his proposal to raise the corporate tax rate from 21% to 28% would result in increases for all Americans in the long run, according to a new analysis.

The former vice president's corporate tax increase is by far the largest hike of a bevy of taxes Biden has proposed on the campaign trail. The American Enterprise Institute, a conservative think tank, found that his tax plan would raise $2.8 trillion over the next decade, $1.9 trillion of which would come from the corporate tax hike and broadening of the business tax base.

Another $616.8 billion would be raised through income and payroll tax increases, while the final $276.4 billion would be raised through estate and gift tax increases.

BIDEN PLEDGES TO ROLL BACK TRUMP'S TAX CUTS: 'A LOT OF YOU MAY NOT LIKE THAT'

His plan would reverse the 2017 GOP income tax cut only for people who make more than $400,000, increasing their tax rate from 37% to 39.6%. He would also apply the 12.4% Social Security payroll tax to earnings over $400,000.

As a result of these taxes, the top 1% would see a reduction in after-tax income of 14.2%, taxpayers between the 95th and 99th percentile would see a small reduction in after-tax income, and everyone else would see an increase in after-tax income ranging from .5% to 11.3%.

This combination of Sept. 29, photos shows President Trump, left, and former Vice President Joe Biden during the first presidential debate at Case Western University and Cleveland Clinic, in Cleveland. (AP Photo/Patrick Semansky)

"In 2021, Biden’s tax proposals would increase the tax burden on the top 5 percent of households and reduce the tax burden on the bottom 95 percent of households," Kyle Pomerleau and Grant Seiter of AEI wrote.

When it comes to income taxes, Biden is right about only raising taxes on the wealthiest Americans, but over time, his corporate tax hike would trickle down to the rest of Americans, decreasing their wages as businesses deal with the increased taxes.

BIDEN'S TAX PLAN COULD COST BIGGEST US BANKS $7B PER YEAR

By 2030, the wealthiest Americans would continue to see their tax burden grow, but the bottom 99% would also see "modest" tax hikes at this time.

"Tax filers in the bottom 99 percent would see a reduction in after-tax income of between 0.1 percent and 2.1 percent," Pomerleau and Seiter wrote. "The average size of the tax increase ranges from $23 for the bottom decile (0 percent to 10 percent) to $6,270 for taxpayers between the 95th and 99th percentile."

Biden is right that income taxes will not be raised on Americans earning less than $400,000, but that doesn't mean most Americans won't be affected by the increased tax burden on corporations.

The Biden campaign did not respond to a request for comment Wednesday.

It's unclear when Biden aims to implement this. He told CNN last month that he would do it on "day one" of his presidency, but Jared Bernstein, an informal campaign adviser to Biden, said Wednesday he wasn't "going to litigate the timing of that set of policies."

WALL STREET ROLLS THE DICE ON JOE BIDEN-KAMALA HARRIS TICKET

Regardless, business owners already are starting to worry about the consequences of a potential tax hike.

A recent Goldman Sachs analysis predicted that Biden's plan would reduce 2021 S&P 500 earnings by about 12% per share, from $170 to $150.

A PricewaterhouseCoopers survey of C-suite executives last week found that an increase in corporate taxes is the top concern for business leaders of a Biden administration. 62% of executives said corporate tax policy under Biden is their top concern, while 39% said the same thing about continuity under a Trump administration.

Johnson & Johnson CFO and Executive Vice President Joe Wolk said that the current corporate tax rate, which Republicans lowered to 21% from 35% with their 2017 tax bill, needs to stay the same.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"I will say that having a lower corporate tax rate, which we currently enjoy -- and again, it's still above 37 developed countries in the OECD -- that's an important factor," Wolk told FOX Business's Maria Bartiromo on Tuesday.

"We were facing into, in the US, about a 15 to 20 point headwind that had to be overcome in the analysis. That's no longer the case and we go right to where the talent, the work ethic, the ingenuity is. That's a tremendous advantage and that's one of the things that we think needs to be preserved."