Inflation is still wiping out the average American's wage gains

American workers received a 3% pay cut in July thanks to inflation

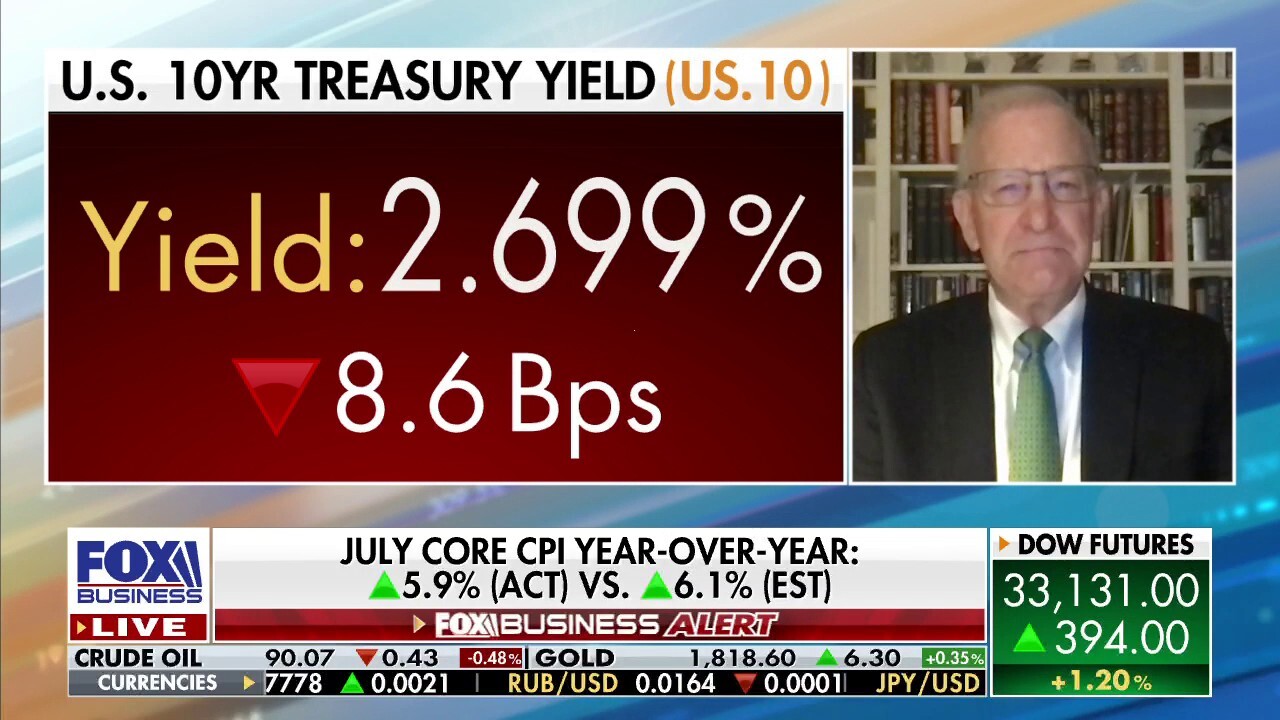

Inflation will be a 'major issue' for some time: Former Kansas City Fed president

Former Kansas City Federal Reserve President and CEO Thomas Hoenig forecasts what the Federal Reserve will do next following the latest inflation data.

The white-hot job market is fueling rapid wage growth for millions of Americans, but the worst inflation in nearly four decades quickly eroding those gains.

The Labor Department reported Wednesday that average hourly earnings for all employees actually declined 3% in July from the same month a year ago when factoring in the impact of rising consumer prices. On a monthly basis, average hourly earnings dropped 0.6% last month, when accounting for the inflation spike.

By that measure, the typical U.S. worker is actually worse off today than a year ago, even though nominal wages are rising at the fastest pace in years.

That's because consumers are confronting scorching-hot inflation, which has quickly diminished their purchasing power.

INFLATION REDUCTION ACT: WHAT TAX HIKES ARE IN THE BILL?

The government reported on Wednesday that the consumer price index, a broad measure of the price for everyday goods including gasoline, groceries and rents, rose 8.5% in July from a year ago, below the 9.1% year-over-year surge recorded in June. Prices were unchanged in the one-month period from June.

Those figures were both lower than the 8.7% headline figure and 0.2% monthly gain forecast by Refinitiv economists, likely a welcoming sign for the Federal Reserve as it seeks to cool price gains and tame consumer demand.

So-called core prices, which strip out the more volatile measurements of food and energy, climbed 5.9% from the previous year, below the 6.1% forecast from economists but matching the reading from July. Core prices also rose less than expected, rising 0.3% on a monthly basis — a smaller increase than in April, May and June, an encouraging sign that inflation is starting to loosen its stranglehold on the economy.

A man shops at a Safeway grocery store in Annapolis, Maryland, on May 16, 2022, as Americans brace for summer sticker shock as inflation continues to grow. (JIM WATSON/AFP via Getty Images / Getty Images)

Still, that may provide little comfort to Americans who are still grappling with prices for necessities like food and rent that are at a multi-decade high.

"While the boost to overall economic prospects is welcome, easing inflation will ring hollow with many down-market consumers whose wages are falling in real terms despite the decline in gasoline prices alone adding about $400 million dollars back to household balance sheets," said RSM chief economist Joe Brusuelas.

The combination of high inflation and rising wages has fueled concern about the possibility of a wage-price spiral, a 1970s-style phenomenon where high inflation leads to pay hikes that, in turn, lead to more spending and more expensive prices.

CLICK HERE TO READ MORE ON FOX BUSINESS

Inflation has created severe financial pressures for most U.S. households, which are forced to pay more for everyday necessities like food, gasoline and rent. The burden is disproportionately borne by low-income Americans, whose already-stretched paychecks are heavily impacted by price fluctuations.