January inflation breakdown: Where are rising prices hitting Americans the hardest?

Take a look at what goods Americans are paying more for as inflation surges

U.S. inflation hits fresh 40-year high after surging 7.5% in January

U.S. inflation rose 7.5% in January, the highest since February 1982. FOX Business' Ed Lawrence with more.

American households are grappling with the steepest price increase in four decades, paying more for everything from cars to gasoline to food as uncomfortably hot inflation erodes most workers' wage gains.

The consumer price index rose 7.5% in January from a year ago, according to a new Labor Department report released Thursday, marking the fastest increase since February 1982, when inflation hit 7.6%. The CPI, which measures a bevy of goods ranging from gasoline and health care to groceries and rents, jumped 0.6% in the one-month period from December.

MOST SMALL BUSINESSES SINCE 1974 ARE HIKING PRICES TO OFFSET INFLATION

So-called core prices, which exclude more volatile measurements of food and energy, climbed 6% in January from the previous year, a sharp increase from December, when it rose 5.5%. It was the steepest 12-month increase since August 1982.

"U.S. annual CPI is the highest since 1982, and what’s worse is that this likely isn’t the peak," said Seema Shah, chief strategist at Principal Global Investors. "Higher-than-expected monthly gains in core CPI indicate continued underlying heat and will do nothing to relieve pressure on the Fed to tighten sharply and urgently."

The inflation spike has been bad news for President Biden, who has seen his approval rating tumble as consumer prices rise. The White House has blamed the price spike on supply-chain bottlenecks and other pandemic-induced disruptions in the economy, while Republicans have pinned it on the president's massive spending agenda and his energy policies targeting the oil and gas industries.

Here's a breakdown of where Americans are seeing prices rise the fastest as they wrestle with sticker shock for the first time in a generation.

Energy

Energy prices, which have been a major driver of inflation for most of the year, rose 0.9% in January from the previous month, with an increase in electricity offsetting monthly decreases in gasoline and natural gas.

Although gasoline prices actually declined 0.8% on a monthly basis, Americans are still paying more at the pump. Gasoline prices have soared over the past year, largely due to lopsided supply and demand. Consumers are traveling more, but the supply side has not kept up with the demand.

The Labor Department reported that gasoline prices have skyrocketed 40% over the past year, while natural gas has surged 22.6% and electricity is up 10.7%. A gallon of gas, on average, cost $3.47 nationwide Thursday, according to AAA, up from $2.47 a year ago. In California, gas prices are well over $4 per gallon.

In all, energy prices have climbed more than 27% over the course of the past 12 months.

"The primary drivers of inflation continue to be energy, transportation and industrial goods," said Joe Brusuelas, RSM chief economist. "While transportation costs will fade as supply chains normalize, the sustained increase in the cost of shelter and owner’s equivalent rent imply that inflation is not going to return to the Fed’s inflation target of 2% this year or next."

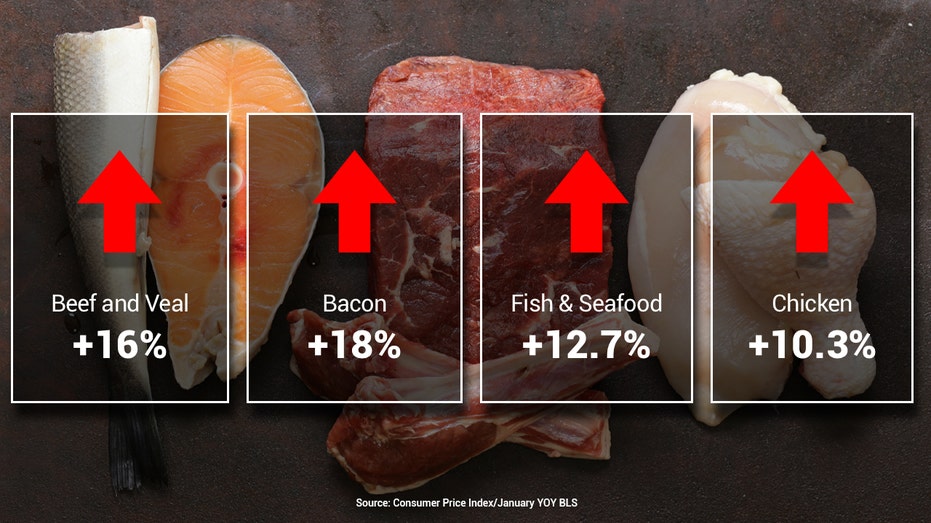

Food

Food prices rose 0.9% in January, surging after smaller increases in December and November.

Americans are increasingly likely to see far more expensive grocery bills. In all, food prices jumped 7% in January from the previous year, with the annual increases most pronounced for different types of meats, including beef and veal (16%), pork (14.1%), chicken (10.3%), ham (10%) and fish and seafood (12.7%).

Unlike previous months, however, meats, poultry and eggs – which actually fell 0.3% from December – were not the driving force behind food inflation. Things like flour products (up 6.5% for the month) and fresh fruits (up 2.3%) were instead contributing to the price in food costs last month.

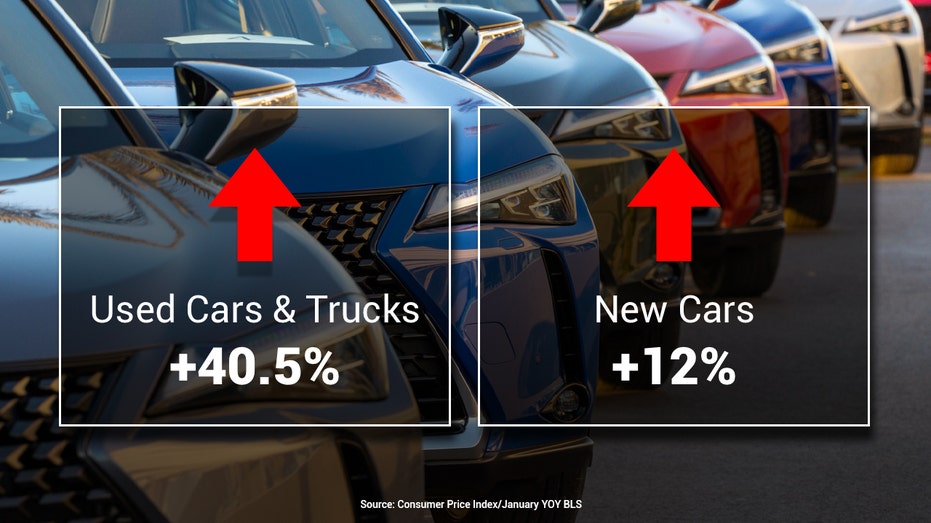

Cars

Unfortunately for Americans who needed to buy a car in December, the price of both new and used vehicles continued to soar.

Used car prices, a key component of the months-long inflation surge, increased again last month, jumping 1.5% from the previous month and 40.5% year over year. Rental cars, meanwhile, shot up a stunning 29.3% from last January, although they actually declined 10.9% in January compared to December.

The cost of new cars, meanwhile, rose 0.6% in December from the previous month and 12.2% from the prior year, largely because semiconductor shortages continue to delay car manufacturing. Experts think this will be a problem that continues for the foreseeable future.

The Senate in June passed a $250 billion bipartisan bill that includes funding for scientific research and subsidies for chipmakers and robot makers.

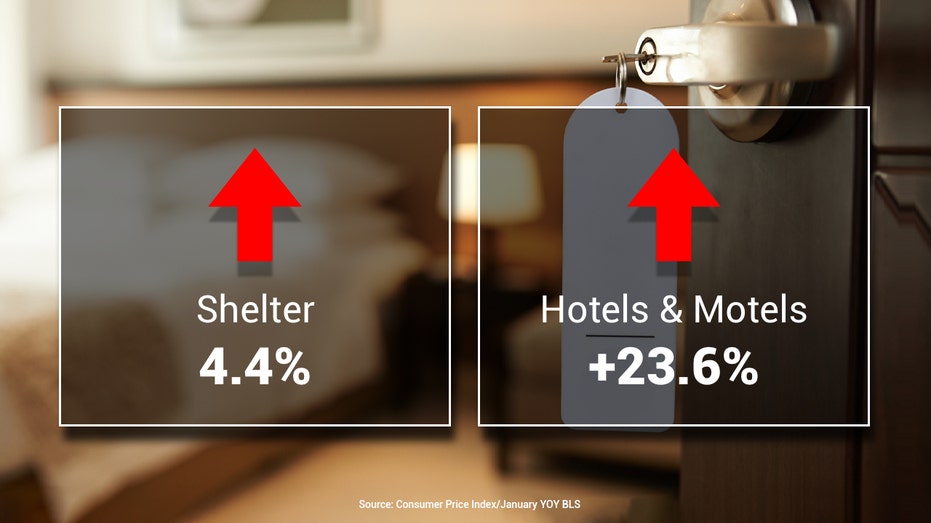

Rent, appliances and household goods

The price of everyday goods that Americans have in their homes is also on the rise.

CLICK HERE TO READ MORE ON FOX BUSINESS

Rent costs swelled 0.4% in January and 4.4% over the past 12 months, a concerning development because higher housing costs most directly and acutely affect household budgets. Another data point that measures how much homeowners would pay in equivalent rent if they hadn't bought their home, also jumped 4.1% over the past year.

The Labor Department also reported that prices for furniture (17%), laundry equipment (7.9%), clothing (5.3%), tools and other outdoor equipment (10.7%) all jumped in January from the previous year.