June inflation breakdown: Where are consumer prices rising the fastest?

Price increases in June were widespread with big increases in rent, energy

Inflation numbers hotter than expected

FOX Business' Cheryl Casone reports on June's Consumer Price Index released Wednesday, which revealed inflation now sits at a fresh 40-year high.

The hottest inflation in four decades is squeezing millions of Americans' budgets as rising consumer prices make it increasingly difficult for households afford everyday necessities

The Labor Department said Wednesday that the consumer price index, a broad measure of the price for everyday goods, including gasoline, groceries and rents, rose 9.1% in June from a year ago. Prices jumped 1.3% in the one-month period from May. Those figures were both far higher than the 8.8% headline figure and 1% monthly gain forecast by Refinitiv economists.

It marks the fastest pace of inflation since December 1981.

So-called core prices, which exclude more volatile measurements of food and energy, climbed 5.9% from the previous year. Core prices also rose 0.7% on a monthly basis — higher than in April and May — suggesting that underlying inflationary pressures remain strong and widespread.

"Clearly we’re not out of the inflation woods yet," said Mike Loewengart, managing director of investment strategy at E*Trade. "That it came in above an already very high estimate shows just how tricky the situation is — and our challenges spread far beyond oil, which is one of the few consumer goods to abate somewhat recently."

INFLATION TIMELINE: MAPPING THE BIDEN ADMIN'S RESPONSE TO RAPID PRICE GROWTH

Here's a breakdown of where Americans are seeing prices rise the fastest as they wrestle with sticker shock for the first time in a generation:

Energy

Energy prices rose 7.5% in June from the previous month, and are up 41.6% from last year.

Gasoline, on average, costs 59.9% more than it did one year ago and 11.2% more than it did in May, according to unadjusted Labor Department data. The average price for a gallon of gas was at $4.63 nationwide Wednesday according to AAA. While that's down from the record high of $5.01 set in mid-June, it's a big jump from just one year ago, when the average cost was around $3.14.

Until this year, prices had not topped $4 a gallon nationally since 2008.

The sharp rise in gas prices has become one of the most noticeable impacts of scorching hot inflation on Americans' daily lives, because so many people use cars to commute to work.

HOW THE FEDERAL RESERVE MISSED THE MARK ON SURGING INFLATION

In all, fuel oil prices actually fell 1.2% on a monthly basis in June. But over the course of the year, they are still up a stunning 98.5%. Natural gas prices, meanwhile, surged 8.2% in June, the largest monthly increase since October 2005. Electricity also increased in June, climbing about 1.7%, the Labor Department said.

Food

Food prices — another visceral reminder of red-hot inflation — have climbed 10.4% higher over the year and 1% over the month, a slight moderation from May, according to unadjusted figures.

Other prices jumping at the grocery store in the one-month period between May and June are dairy and related products (1.4%), cereal (2.5%), poultry (1.5%) and butter and margarine (3.7%). In a bit of good news, however, prices for items that have been climbing for months — namely beef, veal, pork chops and other meats — actually fell in June from the previous month (however, they remain far higher than where they were just one year ago).

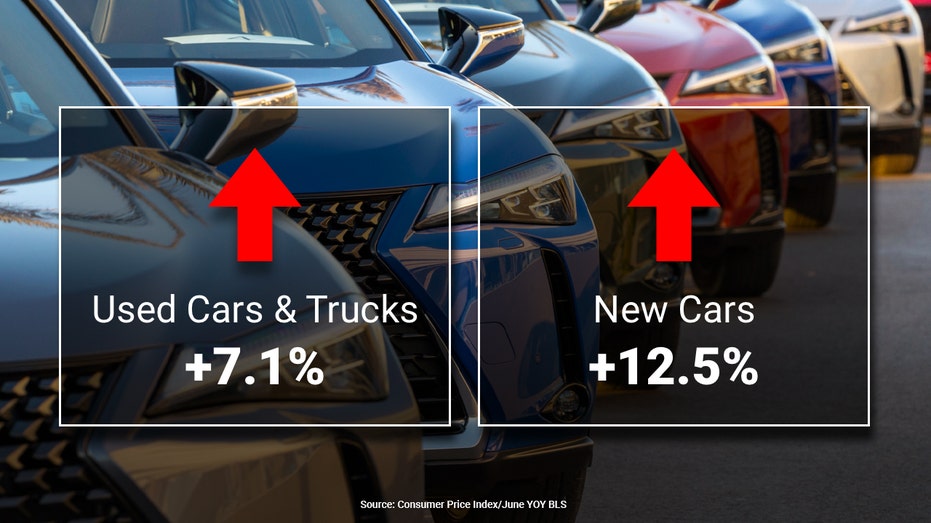

Cars

Unfortunately for Americans who needed to buy a car in June, the price of both new and used vehicles continued to soar.

Used car and truck prices, which have been a major component of the inflation increase, are still up 7.1% from the previous year. In more bad news, prices — after briefly declining in April and moderating in May — surged in June, jumping 2.2% on a monthly basis.

The cost of new vehicles, meanwhile, is up 11.4% from the prior year, largely because semiconductor shortages continue to delay car manufacturing. On a monthly basis, the price of new vehicles jumped 0.6%, according to the unadjusted Labor Department data.

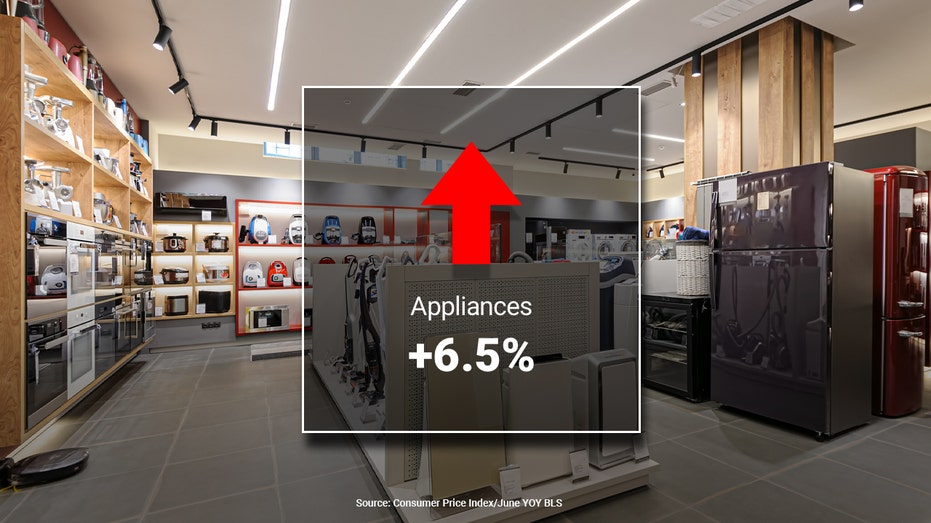

Rent, appliances and households goods

In another worrisome sign, shelter costs — which account for roughly one-third of the CPI — sped up again in June, climbing 0.6%, matching an 18-year-high set in May. On an annual basis, shelter costs have climbed 5.6%, the fastest since February 1991.

Rent costs also surged in June, jumping 0.8% over the month, the largest monthly increase since April 1986. Rising rents are a concerning development because higher housing costs most directly and acutely affect household budgets.

Another data point that measures how much homeowners would pay in equivalent rent if they had not bought their home, also jumped 0.7% in June from the previous month.

"Perhaps, more troubling than the top line increases, inflation inside the housing sector has resulted in situation where costs in that sector are now up 7.3%, well above the 5.9% core inflation rate," said Joe Brusuelas, RSM chief economist. He suggested that rising shelter costs could force the Federal Reserve to move interest rates into restrictive territory, "and keep it there longer than anyone will be comfortable."

"These increases have created the conditions whereby it is increasingly difficult to make the case that the economy will achieve anything resembling a soft landing given the rate increases that have taken place and those to come," he added.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Travel and transportation

Nearly everything got more expensive in June, with just a few exceptions. One of those exceptions is airline fares, which fell by just 0.2% in June from the previous month. Still, airfare costs are up 34.1% over the past year, according to unadjusted data — in part because airlines are passing along the cost of more expensive fuel to consumers.