New York state lawmakers weigh tax increase on wealthy

Senate leader considers imposing new levies on residents reporting $2M or more in annual income

New York state lawmakers may act this month to raise taxes on high-income people, a top legislator said, as the state confronts a budget deficit exacerbated by the coronavirus crisis.

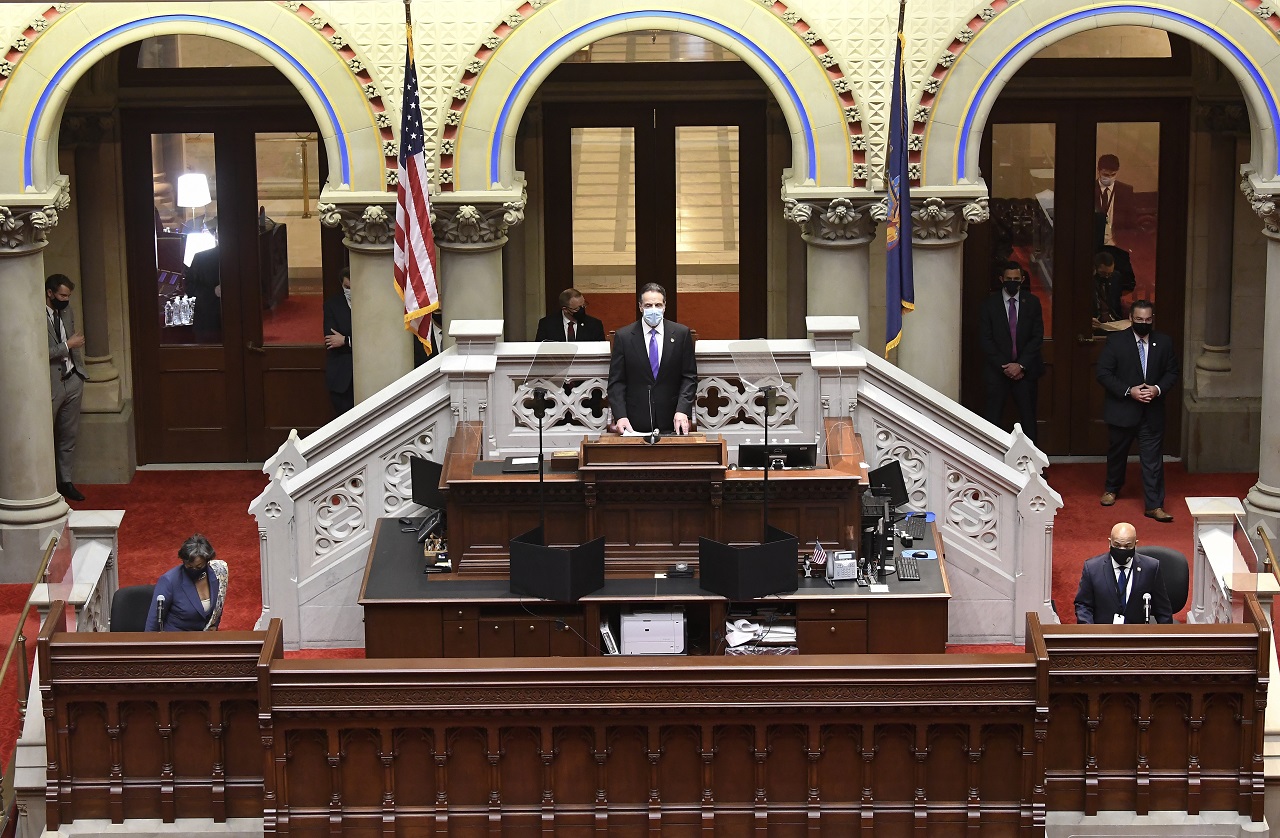

Assembly Speaker Carl Heastie, a Democrat from the Bronx, told reporters Monday he wants to increase rates during a December session so they can take effect starting in 2021. He is in talks about the matter with Gov. Andrew Cuomo and Senate Majority Leader Andrea Stewart-Cousins, who are also Democrats.

CUOMO SAYS NEW YORK TAX HIKES LIKELY ON THE WAY, EVEN IF CONGRESS APPROVES AID

A state official familiar with the negotiations said senators are pushing to make higher rates retroactive to some earlier point in 2020. This would raise revenue to avoid up to $8 billion in unspecified cuts to education and social-service funding that state lawmakers authorized in April as a placeholder in the current $178 billion budget. That spending plan was contingent on additional federal funding that hasn't materialized.

Ms. Stewart-Cousins' team is willing to impose new levies on New Yorkers reporting $2 million or more in annual income, the state official said. Another official familiar with the talks said Assembly negotiators are willing to increase taxes on people reporting annual income of at least $1 million.

Just over half of the roughly $50 billion New York collects each year of personal income taxes is paid by 188,000 tax filers -- the highest-earning 2% of the state's tax base, according to the state budget office.

New York state now taxes personal income over $1,077,550 at a rate of 8.82%, and New York City levies an additional tax. Assembly Democrats have for several years proposed enacting new brackets at $5 million, $10 million and $100 million of income, which the labor-backed Fiscal Policy Institute estimated in May would generate an additional $2 billion of revenue each fiscal year.

NYC MAYORAL CANDIDATE HINTS AT SUPPORTING HIGHER TAXES ON STATE'S WEALTHY

If income over $1 million were taxed at 10.75%, the rate just adopted by New Jersey lawmakers, the state could generate an additional $5.28 billion a year, FPI estimated in the same report.

Mr. Heastie said talks were fluid, and he said he was worried that a retroactive increase would be subject to a legal challenge. In a statement, Ms. Stewart-Cousins said she was working with the Assembly "to make sure whatever action we take helps to address the severity of the crisis at hand."

The state Assembly and Senate would need to reach agreement on legislation by Wednesday to vote on it and possibly override a gubernatorial veto before the new year, Mr. Heastie said. If legislators and the governor reach a three-way agreement, they could act as late as Dec. 31.

Last week, the governor said the state would need to increase taxes regardless of congressional action. However, Mr. Cuomo said at a Monday news conference that any changes to income taxes should be made in the full context of adjusting this year's state budget and shouldn't occur until the state knows if it will receive additional assistance from Congress.

Republican legislators said they are concerned about raising taxes because New York already has some of the highest levies in the country. Business groups warn that increasing income taxes will prompt New York's wealthiest taxpayers to relocate to other states.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Advocates of tax increases said the number of New York taxpayers reporting more than $1 million of income increased after state lawmakers raised income taxes in 2009 and said concerns about migration aren't justified. The number of these filers in New York, however, grew by a smaller percentage than for the nation as a whole between 2010 and 2018, according to IRS data.

Kathryn Wylde, chief executive of the business group Partnership for New York City, said displacement caused by the coronavirus pandemic as well as new limits on the amount of state and local taxes that can be deducted from a taxpayer's federal income mean wealthy people are more likely to move.

"There is a real danger that a large number of New York high earners who are working remotely will not come back to the city if their tax rate is going to increase substantially," she said. "New York is not as sticky as it was even three years ago."

But as the immediate prospects of additional state and local aid from Washington dim, unions and progressive groups are intensifying their campaign for Albany lawmakers to adopt new revenue streams. In addition to raising income taxes, they are advocating for taxes on financial transactions and, for individuals with net worth of $1 billion or more, a tax on unrealized capital gains.

CLICK HERE TO READ MORE ON FOX BUSINESS

State officials said an income-tax increase has the most immediate chance of passage but acknowledged that additional actions are possible as part of the budget for New York state's next fiscal year, which begins April 1.

"We're in the discussion stage of knowing that there's huge amounts of needs," Mr. Heastie said.

Mr. Cuomo's budget office is projecting an $8.7 billion deficit for the coming fiscal year, but if no recurring savings are found to address the $8 billion gap in the current fiscal year, next year's deficit could be more than $16 billion. The financial burdens are greater if you add on deficits of local governments and entities like the Metropolitan Transportation Authority, which operates New York City's subway system.

"Doing it without the Washington funding is going to be really, really difficult," Mr. Cuomo said. "You want to raise half of it in taxes? You want to do half of it in cuts? Who are you going to cut?"

On Tuesday, 10 labor groups called on lawmakers to raise taxes on the wealthy to generate between $7 billion and $9 billion of annual revenue.

Hae-Lin Choi, the New York state political and legislative director for the Communications Workers of America, said the unions didn't have a strong preference for the type of taxes raised but recognized much of the revenue would come from a personal-income-tax increase.

"In this historic budget crisis that we're facing, cuts are not the answer," Dr. Choi said. "Raising taxes on the wealthy is not only immensely popular, but economists say it not only won't hurt the state economy, but it's better than budget cuts."