Stanley Druckenmiller sees high chance of recession in 2023: 'We are in deep trouble'

Legendary investor sees 'high probability' the stock market will be 'flat' for a decade

Peter Andersen is worried the Fed has 'a blindfold on' running rate hike 'regime'

Andersen Capital Management CIO Peter Andersen argues the Federal Reserve isn't making decisions based on 'real-time' data.

Legendary investor Stanley Druckenmiller sees the Federal Reserve triggering a recession with its inflation fighting policy and warns that financial markets could stagnate for a decade as a result.

"I will be stunned if we don’t have recession in ’23," Druckenmiller said Wednesday at CNBC’s Delivering Alpha Investor Summit in New York. "I don’t know the timing but certainly by the end of ’23. I don’t rule out something really bad."

Druckenmiller, who runs Duquense Family Office, a wealth manager with more than $1.3 billion of assets under management, pointed to the extraordinary quantitative easing and zero interest rates over the past decade as the driving forces behind the looming recession.

"All those factors that cause a bull market, they’re not only stopping, they’re reversing every one of them," he said. "We are in deep trouble."

THE FED'S WAR ON INFLATION COULD COST 1M JOBS

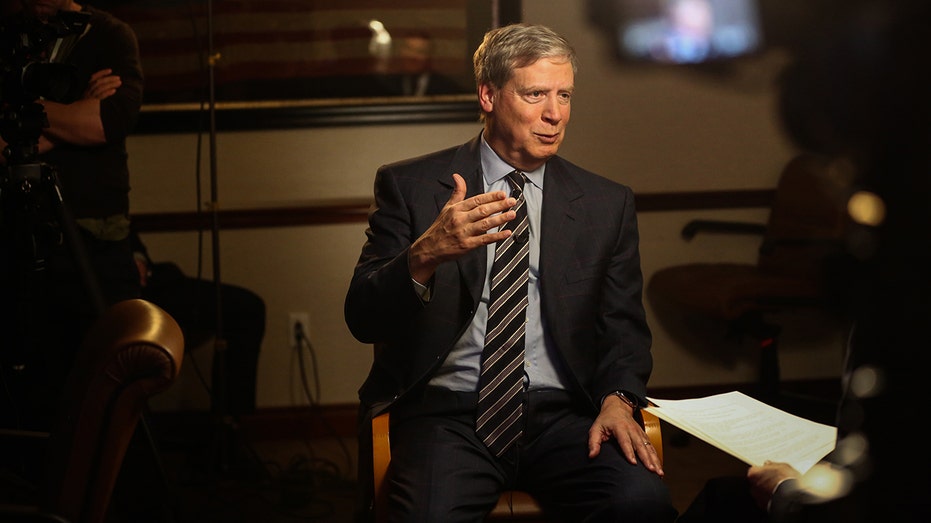

Stanley Druckenmiller, chief executive officer of Duquesne Family Office, speaks during a Bloomberg Television interview in New York, Mon., Dec. 17, 2018. (Photographer: Christopher Goodney/Bloomberg via Getty Images / Getty Images)

The Fed is raising interest rates at the fastest pace in decades as it tries to crush stubbornly high inflation. Policymakers last week approved their fifth consecutive interest rate hike and laid out an aggressive path for future increases that will put the federal funds rate range well into restrictive territory.

"The chances of a soft landing are likely to diminish to the extent that policy needs to be more restrictive, or restrictive for longer," Federal Reserve Chair Jerome Powell told reporters in Washington. "Nonetheless, we’re committed to getting inflation back down to 2%. We think a failure to restore price stability would mean far greater pain."

But the efforts to combat inflation, which rose 8.3% in August, carry a potential risk of recession, with a growing number of economists and Wall Street firms forecasting an economic downturn this year or next.

Jerome Powell, Federal Reserve chair, arrives to speak during a news conference following a Federal Open Market Committee (FOMC) meeting in Washington, D.C., Sept 21, 2022. (Photographer: Sarah Silbiger/Bloomberg via Getty Images / Getty Images)

Hiking interest rates tends to create higher rates on consumer and business loans, which slows the economy by forcing employers to cut back on spending. Mortgage rates have nearly doubled from one year ago to more than 6.0%, while some credit card issuers have ratcheted up their rates to 20% or more.

The increasingly hawkish stance from Powell and other Fed policymakers has triggered a massive market sell-off, with the S&P 500 notching a new bear market low.

CLICK HERE TO READ MORE ON FOX BUSINESS

So far this year, the benchmark index has tumbled more than 22%, while the blue chip Dow Jones Industrial Average is down 19% and the technology heavy Nasdaq Composite has plunged about 30%.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50135.87 | +20.20 | +0.04% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23238.66991 | +207.46 | +0.90% |

| SP500 | S&P 500 | 6964.82 | +32.52 | +0.47% |

Druckenmiller sees low odds of an imminent market recovery, and has warned that stocks could remain stagnant for a decade.

"There's a high probability in my mind that the market, at best, is going to be kind of flat for 10 years, sort of like this '66 to '82 time period," he said last week during a separate interview with Alex Karp, the CEO of data company Palantir.