Student loan scams on the rise as October repayment date approaches

Scammers are looking to take advantage of borrowers in need of financial assistance as student loan payments start back up

Student loans are back and scammers are taking advantage of borrowers.

The number of robocalls, scam emails and texts has shot up as the October deadline approaches.

Las Vegas – In addition to the pause on payments, student loan interest rates were halted during COVID, but that relief is nearing its end as interest rates kicked back in this month and payments begin again on Oct. 1.

While student loans are racking up interest again, scammers are taking advantage of borrowers. The number of robocalls, scam emails and texts has shot up as the October deadline approaches.

"If you click on this link, we’ll give you $5,000 for your student loan repayment, and you just have to fill out this application and all of this," said University of Texas at Austin graduate Kelsey Leffingwell, who was describing an email she received.

"I also have received text messages from people claiming to be random people that would offer me loan repayment of $5,000," she added.

STUDENT LOAN REPAYMENT MAY FORCE SOME TO TAKE ON MORE DEBT: SURVEY

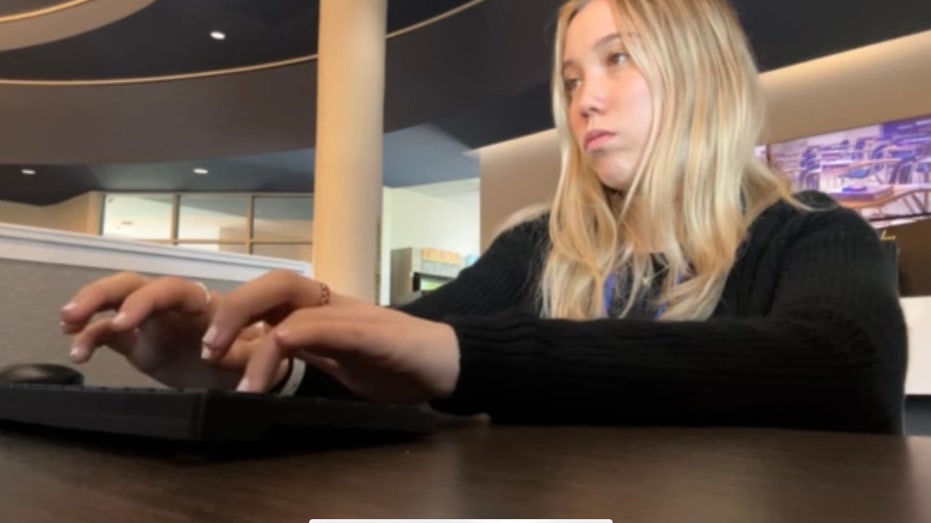

Recent graduate Kelsey Leffingwell will start making her first student loan payments next month when the COVID-related pause on payments ends. (Fox News / Fox News)

As a 2023 summer graduate, Leffingwell will start making her first-ever student loan payments beginning next month. She is not excited about her extra bills, but she is thankful she has a job to help her make those payments.

"I have a job and I have income. So for a lot of people, it’s easy to fall into those scams when you don’t have money coming in and you really need help," she said.

Student loan repayment scam calls are on the rise as the pause on payment deadline approaches, according to Transaction Network Services. (Fox News / Fox News)

According to the Federal Trade Commission, people reported losing around $21 million to phone fraud in 2022 – and that was before student loan interest rates were back in the picture.

OVER 4 MILLION STUDENT BORROWERS ENROLL IN BIDEN'S SAVE FOR FORGIVENESS PLAN

"We’ve seen that students have received nearly as many robocalls around student debt the first two weeks they’ve been back in school prior to the same three months before that," said Jim Tyrell, Transaction Network Services VP of product management.

More than 100,000 calls have been made weekly in efforts to scam borrowers recently, according to Tyrell.

Transaction Network Services found that scams become more common as students go back to school. (Fox News / Fox News)

PRIVATE STUDENT LOAN INTEREST RATES SPIKE FOR 5- AND 10- YEAR LOANS

"Are we catching all of them? Probably not, so if we were to multiply that by you know a little bit of a factor, I would say there’s several hundred thousand that are getting these types of calls every single week," he said.

Before you make payments via text, online or by phone, Tyrell said to always confirm directly with the organization you owe money to that the message did come from them.

CLICK HERE TO READ MORE ON FOX BUSINESS

Experts also recommend carefully monitoring bank transactions and flagging anything that doesn’t look right. If you have given out personal information by accident, contact the FTC and local police for the next steps.