Chevron CEO says Houthi attacks in Red Sea pose 'very real' risks to oil flows and prices

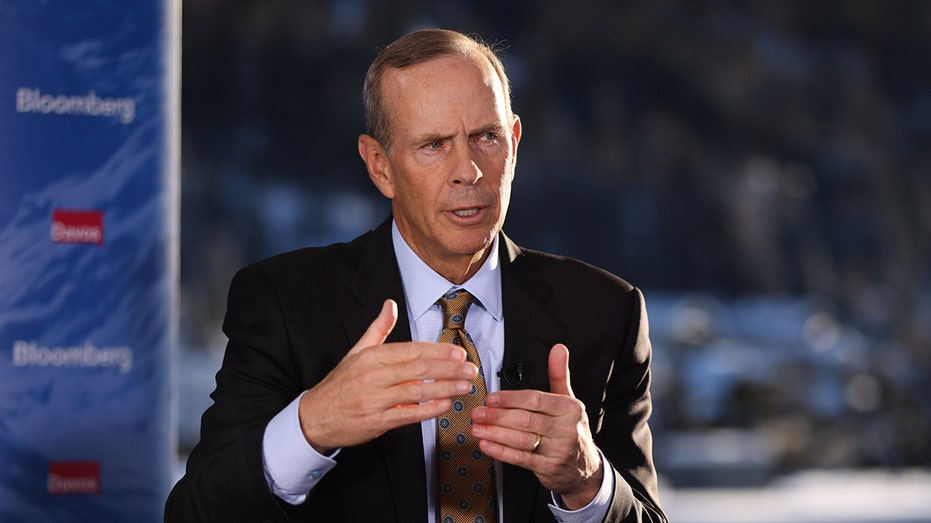

Chevron CEO Michael Wirth said Houthi attacks on oil shipping in the Red Sea 'seems to be getting worse'

Sen. Markwayne Mullin: The Houthis are not listed as a terrorist organization because of Joe Biden

Sen. Markwayne Mullin, R-Okla., reacts to the U.S.-U.K. militaries launching strikes against Houthis in Yemen and weighs in on the Iowa caucuses on 'The Bottom Line.'

Chevron CEO Michael Wirth said Tuesday the ongoing attacks by Houthi rebels on shipping vessels in the Red Sea poses "very real" risks to oil flows and prices.

"It's a very serious situation and seems to be getting worse," Wirth told CNBC in an interview at the World Economic Forum in Davos, Switzerland.

He noted that Chevron, a giant in the industry, has ships that transport oil through the Arabian Gulf and the Red Sea regularly. The company has been following the Houthi attacks "very closely" to monitor the safety of Chevron's employees, he said.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CVX | CHEVRON CORP. | 182.55 | +1.81 | +1.00% |

| SHEL | SHELL PLC | 77.80 | +2.51 | +3.33% |

| BP | BP PLC | 39.22 | +0.21 | +0.54% |

"We coordinate every vessel movement with U.S. and other military authorities that are in the region, but it’s a very serious situation. It seems to be getting worse," Wirth added.

SHELL SUSPENDS ALL RED SEA SHIPMENTS INDEFINITELY AMID HOUTHI ATTACKS FROM YEMEN: REPORT

The annual Davos gathering of political leaders, top executives and celebrities runs from January 15 to 19. (Hollie Adams/Bloomberg via Getty Images / Getty Images)

Asked about U.S. oil prices, Wirth said he was surprised to see crude oil trading below $73 a barrel because the "risks are very real."

"So much of the world’s oil flows through that region that were it to be cut off, I think you could see things change very rapidly," he told CNBC.

The Chevron logo is being displayed on a smartphone in this photo illustration in Brussels, Belgium, on January 13, 2024. (Jonathan Raa/NurPhoto via Getty Images / Getty Images)

Chevron competitor Shell has suspended all shipments through the Red Sea indefinitely amid the ongoing Houthi attacks from Yemen, the Wall Street Journal reported Tuesday. BP paused shipments through the Red Sea last week, and Qatar Energy followed suit this week with its shipments of liquefied-natural-gas-exports.

Speaking to Reuters at the World Economic Forum in Davos, Switzerland, an executive from the port and freight operator DP World predicted that the prices of consumer goods will be "significantly higher" as a result of the Houthi attacks, specifically impacting Europeans’ pocketbooks.

YEMENI LEADER CLAIMS US IGNORED WARNINGS ABOUT RISING HOUTHI THREAT

Houthi followers burn the Israeli and American flags during a tribal gathering on January 14, 2024, on the outskirts of Sana'a, Yemen. Houthi followers gathered to protest against the U.S.-U.K. airstrikes on positions in areas under their control. (Mohammed Hamoud/Getty Images / Getty Images)

Since November, Iranian-backed Houthi rebels in Yemen have launched dozens of missiles and drones at commercial vessels around the Red Sea. They are claiming to avenge the Israel counter-operation in Gaza against Hamas terrorists, though the Houthi attacks have grown increasingly indiscriminate and have even imperiled tankers and container ships moving sanctioned Russian oil.

Houthis targeted a tanker by Shell on its way to carry Indian jet fuel through the Red Sea last month.

CLICK HERE TO READ MORE ON FOX BUSINESS

The Houthi attacks provoked a U.S. military response, with President Biden ordering airstrikes on military targets in Yemen. The Biden administration is currently considering whether to reverse a 2021 decision to remove the foreign terrorist organization (FTO) label imposed on the Houthis by the Trump administration.

"Nothing to update yet on the FTO designation," White House National Security Council spokesman John Kirby told reporters on Tuesday. "We're still in the process of reviewing it."

Fox Business' Danielle Wallace contributed to this report.