Bill Gates: NFTs '100% based on greater fool theory'

The Microsoft co-founder prefers other asset classes over cryptos

Bitcoin investor: Cryptocurrency still a ‘long-term investment’

Bitcoin investor Nikki Beesetti says the crypto crash makes her ‘nervous,’ but forecasts the market will ‘recover’ in the long term.

Bill Gates has reiterated his skepticism for digital assets, such as cryptocurrencies and non-fungible tokens.

At a climate change event hosted by TechCrunch on Tuesday, Gates said NFTs are "100% based on greater fool theory that someone is going pay more for it than I do" and that they have "this sort of anonymity that you avoid taxation or any sort of government rules."

"Obviously, expensive digital images of monkeys are going to improve the world immensely," he joked, referring to the NFT project Bored Ape Yacht Club.

The billionaire and Microsoft co-founder said he prefers asset classes "like a farm, where they have output, or a company, where they make products." He added that he is not "long or short" on any digital assets. Gates is one of the largest landowners in America.

BITCOIN PRICE TRADES AROUND $21,000 AS CRYPTO FIRMS ANNOUNCE LAYOFFS

In a February 2021 interview with Bloomberg, Gates warned that crypto is a risky investment for the average retail investor.

"I do think people get bought into these manias who may not have as much money to spare. So I’m not bullish on Bitcoin," he said at the time. "My general thought would be that if you have less money than Elon [Musk], you should probably watch out."

Bill Gates speaks during the Global Investment Summit on Oct. 19, 2021, in London. (Leon Neal - WPA Pool / Getty Images)

Gates also told the New York Times in March that Bitcoin mining is "not a great climate thing" because it "uses more electricity per transaction than any other method known to mankind."

"If it’s green electricity and it’s not crowding out other uses, eventually, you know, maybe that’s OK," he added.

CLICK HERE TO READ MORE ON FOX BUSINESS

Cryptocurrencies have fallen in sympathy with the broader market as the Federal Reserve has started hiking interest rates to tame scorching-hot inflation. On Wednesday, the Fed will offer an update on its outlook for the economy following the conclusion of its policy-setting meeting.

The world's largest cryptocurrency has taken a nosedive from its all-time of $68,990.90 per coin hit in 2021, falling to around $21,000 per coin as of the time of publication. Meanwhile, Ethereum and Dogecoin are trading around $1,100 and 5 cents per coin, respectively.

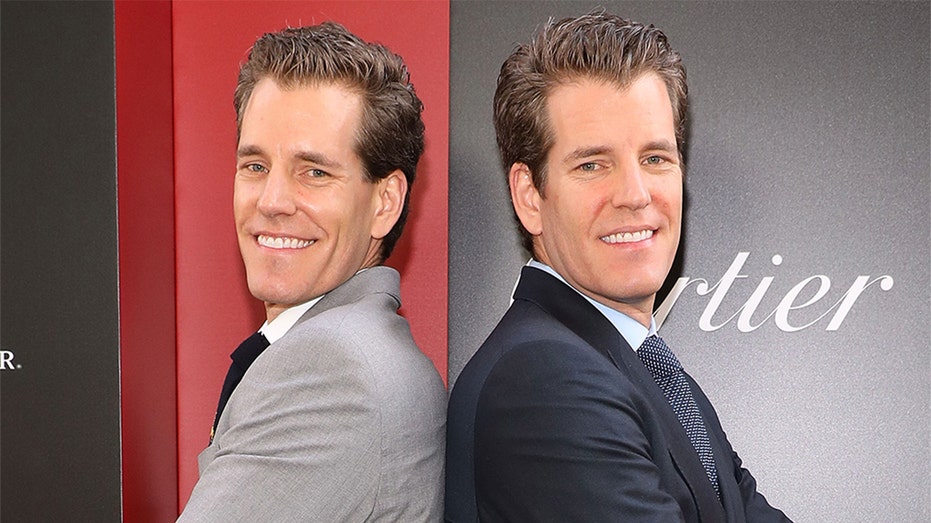

Cameron Winklevoss and Tyler Winklevoss (Taylor Hill/Getty Images)

In response to the volatility, Coinbase and Gemini, led by the Winklevoss twins, have started laying off employees and have warned of a potential recession and "crypto winter." Crypto lending firm Celsius also said it would pause all withdrawals, swaps and transfers between accounts due to "extreme market conditions."