Buy now, pay later is convenient but there are pitfalls

Americans are sitting on a record $1.08T in credit card debt

Inflation is not transitory, it's ‘permanent’: Jim Grant

Grant's Interest Rate Observer founder and editor Jim Grant reveals the ‘political significance’ of the Federal Reserve's interest rate decision on 'Mornings with Maria.'

As consumers head into the final days of the holiday shopping season, many already dealing with double-digit interest credit card debt, using "Buy Now Pay Later" (BNPL) options can ease spending anxiety amid high inflation.

While the strategy is gaining steam, buyers need to be aware of the pros and cons as you wind down your 2023 gift giving.

How does BNPL work?

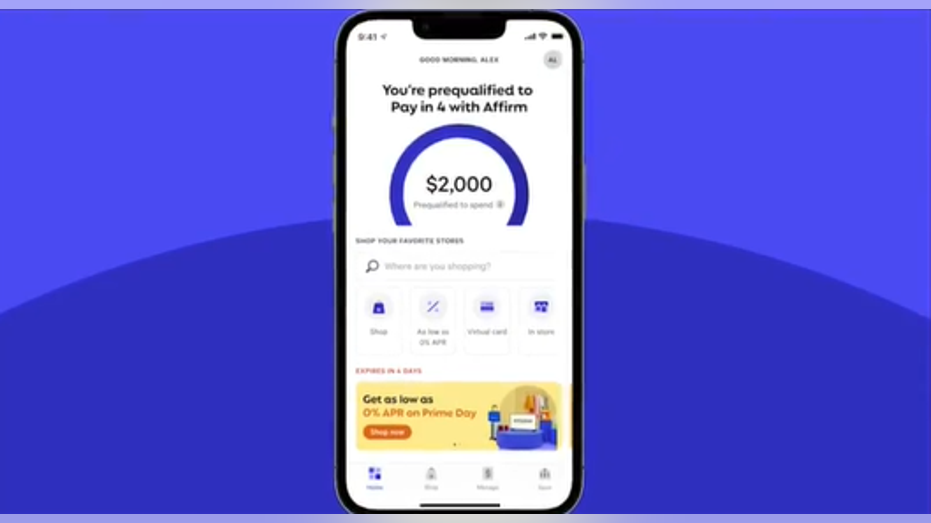

Buy now, pay later is a form of installment lending. "Companies such as Affirm, Afterpay and Klarna offer the ability to split purchases into smaller chunks," Ted Rossman, senior industry analyst with Bankrate.com explained. "It’s sometimes called reverse layaway because you obtain the item now and pay for it over time."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AFRM | AFFIRM HOLDINGS INC. | 57.03 | -2.39 | -4.02% |

He noted that four interest-free payments over six weeks is a common structure. "Sometimes these plans last longer (up to a few years) and they can charge interest (sometimes up to about 30% APR), so it’s important to consider your specific terms," Rossman warned.

Affirm App ( )

However, there are certain times a BNPL option may be a good pick. "My favorite use case for BNPL is when you partition a large purchase away from the rest of your finances," he says. "Like if you buy a $1,000 couch or TV and you get a low or no-interest offer to pay it off in monthly installments. Especially if the interest rate is low or nonexistent, this could free up cash flow and be more desirable than paying 20%+ on a credit card."

A customer has a new television delivered to his vehicle at a Best Buy store on March 23, 2020,, in Melrose Park, Illinois. ( (Photo by Scott Olson/Getty Images))

When credit checks come in

There’s usually a soft credit check, so it doesn’t affect your credit score, Rossman cited, as it would when you apply for something like a credit card and a hard inquiry is placed on your credit reports. "Buy now, pay later underwriting usually isn’t overly strict, but lenders do consider your credit history and they might ask for your income as well," Rossman added.

Why in a sense is it too good to be true?

According to Rossman, BNPL is still debt, even if it may feel kinder and gentler than a credit card. "The average credit card charges a record-high 20.72% (APR) and if you only make minimum payments, you could be in debt for decades. But buy now, pay later isn’t a handout. You still need to pay these lenders back," he clarified.

How do BNPL loans potentially lead to a risk of overspending?

Because it is relatively easy for anyone to qualify for BNPL financing, the risk of over-borrowing which leads to overspending is ever present, Bruce McClary, spokesperson with the National Foundation for Credit Counseling told FOX Business. "It is conceivable that a person could be approved for multiple BNPL financing requests within an hour, placing the consumer at greater risk of taking on more debt than they could afford to repay," McClary added.

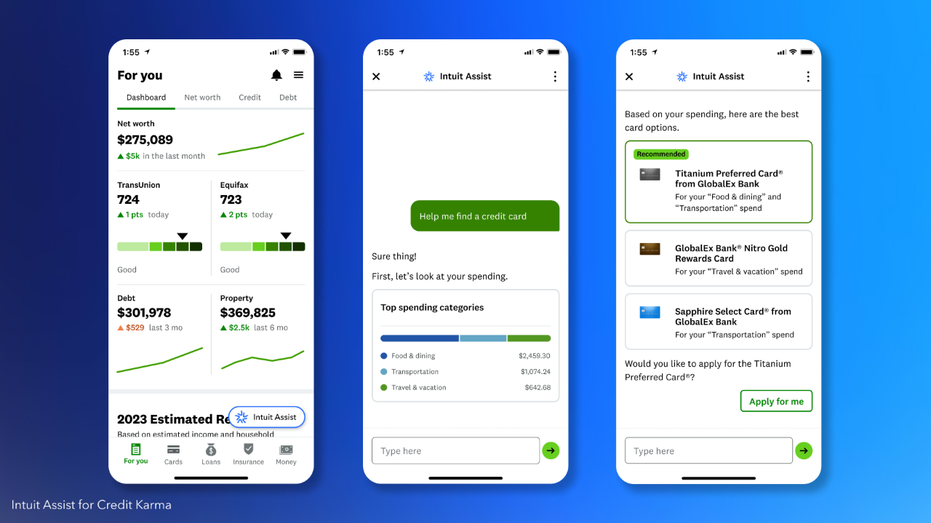

Product images of the AI-powered Intuit Assist financial assistant for Credit Karma. (Courtesy of Intuit Credit Karma / Fox News)

Also, he said because these accounts don’t usually report to the credit bureaus, there isn’t much chance that banks and credit card issuers can see how far in debt someone may be when they apply for a credit card or mortgage loan. "With an incomplete picture of a borrower’s financial obligations, there is an increased risk that they could be approving a loan for someone who has limited capacity to repay according to the terms," McClary added.

Bankrate.com's Rossman agrees. "Sometimes I hear of people getting into trouble with BNPL plans because they trick themselves into thinking they’re spending less than they really are" he said.

Read BNPL fineprint

It’s so important to know terms such as the length of the loan and the interest rate you’ll be charged, Rossman cautioned. "Terms vary widely from provider to provider and merchant to merchant. Know what you’re getting into before you commit."

What happens if you miss a payment?

Because, in most cases, a consumer will face higher interest rates and additional late fees adding significantly to the cost of the purchased item, McClary said. "It’s also important to point out that your BNPL account could start reporting to the credit bureau if the account becomes delinquent, and especially if the account is sent into collections," he added. "You may not derive any credit score benefit from making your payments on time, but you could be penalized by making late payments and allowing the account to enter into default."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| FICO | FAIR ISAAC CORP. | 1,390.89 | +33.84 | +2.49% |

When a credit card may make more sense

According to Rossman, credit cards are the gold standard in terms of fraud protection and buyer protections: returns, refunds, disputes and extended warranties.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| V | VISA INC. | 331.61 | +2.58 | +0.79% |

| MC | MOELIS & CO. | 73.20 | +1.49 | +2.08% |

| DFS | NO DATA AVAILABLE | - | - | - |

While more regulation is coming to BNPL, for now, it’s still lightly regulated. "That means fewer protections if you’re not satisfied with a purchase," Rossman pointed out. And returns are a common pain point. "Sometimes I hear of people having trouble getting a refund because of snags between the retailer and the BNPL provider, which acts as a middleman of sorts," he continued. "Sometimes the BNPL provider still wants its cut even after you returned the item, so it takes additional back and forth to sort everything out."