City residents' 2021 receipts look a lot different than they did in 2020, 2019

Urban consumers continue to spend despite higher prices

Inflation being felt at 'all levels': McCartney

UBS Financial Services private wealth advisor Alli McCartney on the rise in prices due to inflation.

Inflation has driven up consumer prices across the board in major cities across the U.S., making receipts from 2019 and 2020 look a lot different than receipts in 2021.

U.S. consumer prices increased 0.5% in July, slowing from June’s 0.9% increase, according to the Labor Department. The food index rose 0.7% while the energy index rose 1.6%, buoyed by a 2.4% gain in gasoline prices.

The International Monetary Fund said last month that higher-than-expected inflation is expected to subside by 2022, although it acknowledged that "uncertainty remains high."

INFLATION CHECK: GAS, CAR, TRUCK PRICES RISING

Shang-Jin Wei, a business and economics professor at Columbia Business School, said the difference between price levels in big cities compared to other areas of the U.S. "are driven by differences in local wages, rent and costs of services" but added that he expects most inflation differences to be short-lived.

And while the pandemic drove rental prices down in large cities compared to other places, "the economic recovery might have given a bigger lift to the rent and service prices in large cities more than in the rest of the country," Wei explained.

"But I would expect the differences in inflation to be mostly temporary," he said.

In this May 21, 2020, file photo, people from a support organization for immigrant and working-class communities unfold banners, including one advocating rent cancelation, on a subway platform in the Queens borough of New York. (AP Photo/Bebeto Matth

Fed Chairman Jerome Powell has admitted that timing is uncertain.

"The Fed should consider this as yet more evidence of 'substantial' progress toward their goals, and surely a deep-dive discussion into tapering will be on the top of their agenda at the September FOMC meeting," said Seema Shah, chief strategist at Principal Global Investors.

Those disruptions are certainly appearing on consumers' bank statements in major metropolitan areas.

Miami

Jane Walker, a Miami resident, told FOX Business that her weekly grocery bill has shifted from $200 to $300 over the last two years.

"My husband went to purchase a rack of pork ribs. [I]t was $33. Meat and poultry is very high," she said, adding that "it’s getting expensive to eat."

INFLATION BEING FELT ‘AT ALL LEVELS’: WEALTH ADVISER

Food prices in the Miami-Fort Lauderdale area rose 1.9% in June compared to April, and 1.7% compared to June of 2020. Prices for home food purchases have increased 4.5 % year-over-year driven by an increase in meat, poultry, fish and eggs prices. Prices for food away from home increased by 3% compared to last year.

Food prices reflect the overall pricing in the area. In general, the cost of goods are up 1.6% in June compared to April and 5.1% year-over-year, according to a July 13 press release from the U.S. Bureau of Labor and Statistics. An August inflation report was not available at the time of publication.

A supermarket checkout cashier on May 27, 2020, at Publix in Miami Beach, Fla., during the coronavirus pandemic. (Photo by: Jeffrey Greenberg/Education Images/Universal Images Group via Getty Images)

Energy prices in the southeastern city jumped a staggering 26.7% in June compared to the same time period last year, led by a 47.6% hike in gas prices year-over-year. The energy index increased 2.7% in June compared to April.

The average cost of a Lyft ride in the Miami area increased nearly 72% between June of 2019 and June of 2021, according to data from Emburse, a company providing spend management tools to its clients. Uber rides in the city increased more than 34% between June of 2019 and June of 2021. Unlike in other cities where ride-hailing costs fell in 2020, Miami rates have steadily increased since 2019.

New York

In the New York City-Newark-Jersey City metropolitan area, the U.S. Bureau of Labor and Statistics' Consumer Price Index (CPI) for All Urban Consumers — an average measure of monthly changes in prices for goods and services purchased by urban consumers — edged down 0.1% in July over the last month after increasing 1% in June. Prices are up 3.5% year-over-year, according to an Aug. 11 press release.

PRODUCER PRICES RISE THE MOST ON RECORD IN JULY

Food prices increased 0.8% in July compared to June, and 3.4% compared to July of 2020. Prices for home food purchases rose 1.9% while prices away from home jumped 5.2% year-over-year.

Energy prices in this area jumped 17% in July, mostly because of an increase in gasoline prices. Additionally, ride-hailing services have become more expensive for myriad pandemic-related reasons. Some residents have signaled a shift back to taxis as a result, as The New York Times reported.

The average cost of a Lyft ride in the Miami area increased more than 14% between June of 2019 and June of 2021, according to data from wealth management company Emburse. Lyft rides took a slight dip in June of 2020, when the average price dropped to $27.63 compared to 2019's $39.88.

Comparatively, Uber rides in the city increased more than 11% between June of 2019 and June of 2021 after dipping slightly to $32.29 in June of 2020.

Hubert Horan, a transportation economics expert, told FOX Business that the 10-15% price increases since 2019 seen in Emburse's data seem "ridiculously low," meaning he thinks the price increases have been higher.

Users taking rides from John F. Kennedy International Airport to Manhattan and other areas of New York City have complained of prices over $50, with some reaching more than even $200 — more than the cost of a plane ticket during the pandemic, according to the Times.

The apps also temporarily ended shared-ride service amid COVID-19 in an effort to reduce customers' contact with strangers. Pre-pandemic, shared rides were typically less expensive than single rides.

Los Angeles

Prices are up 0.6% in July compared to June and 39.% year-over-year in the Los Angeles area, according to an Aug. 11 press release from the U.S. Bureau of Labor and Statistics.

Food prices in the city increased 0.6% in July compared to June, and 3.7% compared to July of 2020. Prices for food purchased away from home have risen 4.7% year-over-year while prices for home food purchased edged down 0.3%.

INFLATION HITS HOME APPLIANCE INDUSTRY, CONSUMERS PAY UP

Energy prices in the urban area jumped a staggering 26.7% over the past year, largely due to higher gas prices, which have increased 37.4% year-over-year.

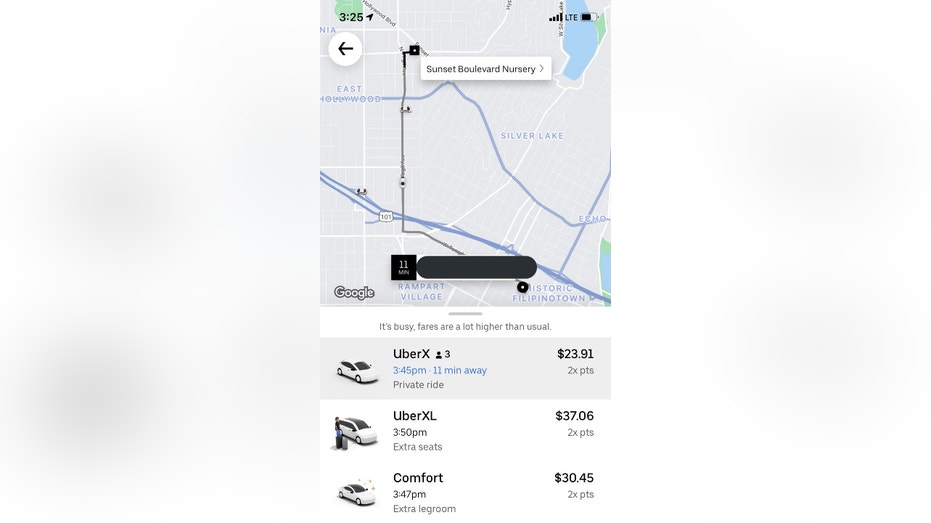

Caitlin Eckvahl, a new Los Angeles resident, told FOX Business that Uber rides that would have cost less than $10 before the pandemic are now more than $20.

Uber pricing in LA (Credit: Caitlin Eckvahl)

"I live in L.A. and tried to take an Uber trip 1 mile away and the price was estimated to be $33. Pre-COVID, I imagine this would have been like $6 tops," she said.

The average price of a Lyft ride in the L.A. area increased more than 60% between June of 2019 and June of 2021, according to Emburse. Comparatively, the average price of Uber rides in the city increased more than 90% from $28.57 in June of 2019 to $54.61 in 2021.

Uber allows drivers in the state to set their own fares in an effort to give drivers more flexibility and control, though the company was reportedly considering rescinding the policy in April, as FOX Business previously reported.

Uber and Lyft have not publicly disclosed nationwide pricing data to compare how fares have shifted in recent months, and neither company responded to FOX Business' inquiries.

Experts weigh in on demand

Urban consumers' active spending on goods and services since a drastic slowdown in 2020 has helped drive up some prices due to supply-and-demand fluctuations, but they are continuing to open their wallets. Demand for restaurants and transportation has steadily increased since the spring of 2021. There is still fear, however, that consumer activity could falter again due to delta variant concerns.

BIDEN SEES INFLATION EASING, DESPITE PRICES STILL ON THE RISE

Andrew Moger, founder and CEO of BCD, a New York City-based real estate and brokerage firm with a focus on restaurants, told FOX Business that while inflation has caused menu prices "across the board" to increase, it has not slowed consumer spend in the city.

Still, restaurants in Midtown Manhattan and the Financial District are still suffering a "considerable lack of density" due to a switch to remote work due to COVID-19, and many others are still struggling to find workers amid a labor shortage.

"I think at this point right now…where there was thinking that after Labor Day there would be a meaningful return to the workplace — not the same numbers as prior to COVID but still meaningful — the variant has clearly muddied the waters there," Moger said.

Transportation industry experts continue to be skeptical of Uber's and Lyft's fares post-COVID as demand returns.

A restaurant employee wearing a mask pours an alcoholic drink into a plastic cup on May 31, 2020, in New York City. (Photo by Alexi Rosenfeld/Getty Images)

Reports suggest a number of factors have contributed to more expensive rides, including a rebounding driver shortage led by a desire for higher wages and fears of catching COVID-19 amid an increased demand for ride-hailing services as people return to the office.

Uber and Lyft have offered cash incentives to get more drivers on board to meet demand, but the companies are still struggling to recruit.

Leonard Sherman, a business professor at Columbia Business School, published an extensive analysis of Uber's and Lyft's pricing and demand trends on Monday and reported that the two ride-hailing services "aggressively raised U.S. rideshare prices at double-digit rates in 2018 and 2019, which, not surprisingly depressed their trip demand growth."

CLICK HERE TO READ MORE ON FOX BUSINESS

He criticized the companies for an "abhorrent lack of transparency" in regard to publicly available pricing data.

"Until and unless Uber is willing or forced to provide full disclosure on the distribution of their fares, we will be left in the dark," he said. "They will enjoy an asymmetric information advantage, drivers will get shortchanged and consumers will be playing fare Russian roulette on every trip."

Horan, the transportation expert, believes there are two basic reasons driving price surges for ride-hailing companies, focusing specifically on Uber.

A departing passenger speaks with a taxi driver at LAX in Los Angeles, Calif., on Oct. 18, 2020. (Francine Orr/ Los Angeles Times via Getty Images)

First, Uber has faced "massive losses" in recent years and "can no longer afford the multibillion-dollar annual subsidies that covered their losses," he said. Second, because its pricing algorithm "imposes big price surges whenever the demand for cars exceeds the number of drivers looking for riders," there has been an "imbalance over the past few months," and "drivers are only getting a small share of these big surged increases."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

All of these factors combined have bumped up the price tag for city dwellers across the country, but some experts believe they will fall again.

Professor Wei, for example, believes the imbalance between supply and demand in recent months that has led to price increases will eventually end once the economy fully recovers from the pandemic.

"While the pandemic has reduced production in many sectors in many countries, the generous stimulus programs [in the U.S.] have sustained household demand," he said. "The mismatch between demand and supply leads to price increases. … This effect will presumably go away once the economy fully returns to normal."

Fox News' Brooke Singman and Jonathan Garber contributed to this report.