Eli Lilly cuts cost of certain Zepbound doses by at least 50%

Single-dose vials will cost at least 50% less than rival GLP-1 drugs, Eli Lilly says

Eli Lilly has a great global portfolio and is catching our eyes: Brandon Pizzurro

GuideStone Funds President Brandon Pizzurro says the company has 'great prospects' on 'The Claman Countdown.'

Eli Lilly is expanding the supply of its weight-loss drug and selling it for half the price of other drugs in the highly lucrative market.

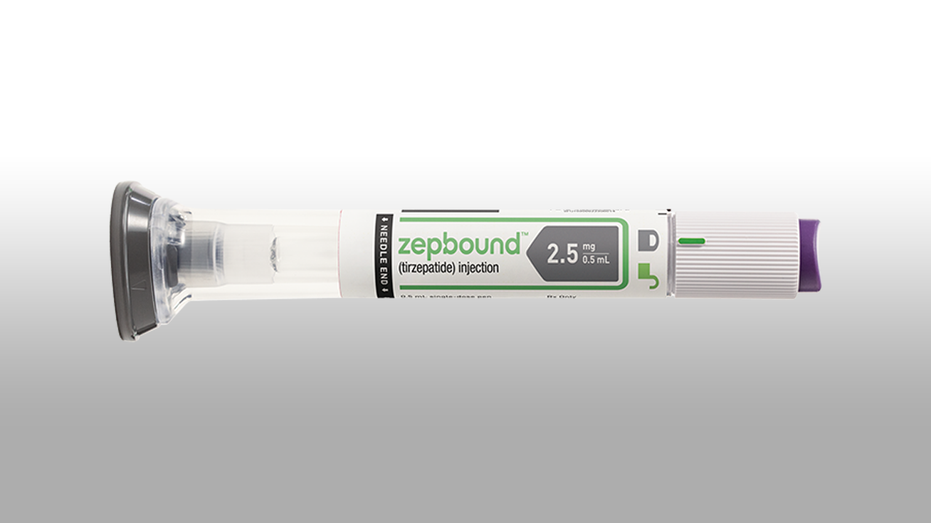

Eli Lilly announced on Tuesday that it is now offering 2.5 mg and 5 mg single-dose vials of tirzepatide, sold under the brand name Zepbound, in response to growing demand. In its last fiscal quarter, the company's earnings surpassed Wall Street expectations due in large part because of the performance of Mounjaro and Zepbound, which have the same active ingredient but have different FDA-approved uses.

The new single doses are also "priced at a 50% or greater discount compared to the list price of all other incretin (GLP-1) medicines for obesity," Eli Lilly said.

GLP-1 agonists are a class of Type 2 diabetes drugs that improve blood sugar control but may also lead to weight loss. Semaglutide, which is the active ingredient in Novo Nordisk's Wegovy and Ozempic, as well as tirzepatide, are considered GLP-1 drugs.

ELI LILLY'S ZEPBOUND REDUCES TYPE 2 DIABETES RISK, STUDY SHOWS

Eli Lilly said that the additional supply will help "millions of adults with obesity access the medicine they need." That includes those not eligible for the Zepbound savings card program, those without employer coverage and those who are paying outside of insurance, the pharmaceutical giant said.

A shot of Eli Lilly's Zepbound weight loss drug. (Eli Lilly)

"These new vials not only help us meet the high demand for our obesity medicine, but also broaden access for patients seeking a safe and effective treatment option," Patrik Jonsson, Lilly's president of cardiometabolic health, said.

WEIGHT-LOSS MEDICATION SHORTAGE CREATES MARKET FOR BOGUS DRUGS

Jonsson referenced a clinical study in which the 5 mg maintenance dose helped patients achieve an average of 15% weight loss after 72 weeks of treatment.

A recent trial also showed that weekly shots of tirzepatide injections significantly reduced the risk of progression to Type 2 diabetes by 94% among adults with pre-diabetes and obesity compared to the placebo, according to Eli Lilly.

A pharmacist displays a box of Mounjaro, a tirzepatide injection drug used for treating Type 2 diabetes and made by Eli Lilly, at Rock Canyon Pharmacy in Provo, Utah, on May 29, 2023. (REUTERS/George Frey / Reuters Photos)

Pharmaceutical companies have been racing to gain a better foothold in the market by launching new products, expanding their current supply and undercutting competitors as the popularity of weight-loss related drugs continues to surge.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In May, the health platform Hims & Hers Health Inc. announced that it was rolling out injectable weight-loss drugs that cost a fraction of the price of Novo Nordisk's Wegovy and Ozempic.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LLY | ELI LILLY & CO. | 1,057.80 | +38.66 | +3.79% |

In 2023, one in 60 adults were prescribed a GLP-1 medication, according to the American Pharmacists Association.

By 2030, the number of GLP-1 users in the U.S. could reach 30 million, or around 9% of the overall population, according to JPMorgan. The market is projected to exceed $100 billion by that same year, "driven equally by diabetes and obesity usage," the firm noted.