Americans dealing with lower income due to coronavirus outbreak

30% have seen their household income decrease

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

The coronavirus has impacted the way of life for millions of people.

There's not only the human and emotional toll, but ithere is also a financial toll.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

There's more than 30 million people out of work, forced to file for unemployment benefits.

The impact on American's financials is the focus of a new Bankrate report released on Wednesday.

“The pandemic is deepening the financial hardship for millions of Americans, with nearly one-third of households reporting lower income since the start,” said Bankrate.com chief financial analyst Greg McBride, CFA. “The financial legacy of this pandemic will be elevated unemployment, reduced household incomes, more debt and even less savings.”

PUBLIC PENSION-FUND LOSSES SET RECORD IN FIRST QUARTER

Thirty percent of U.S. adults have seen their household income decrease as a direct result of the coronavirus outbreak.

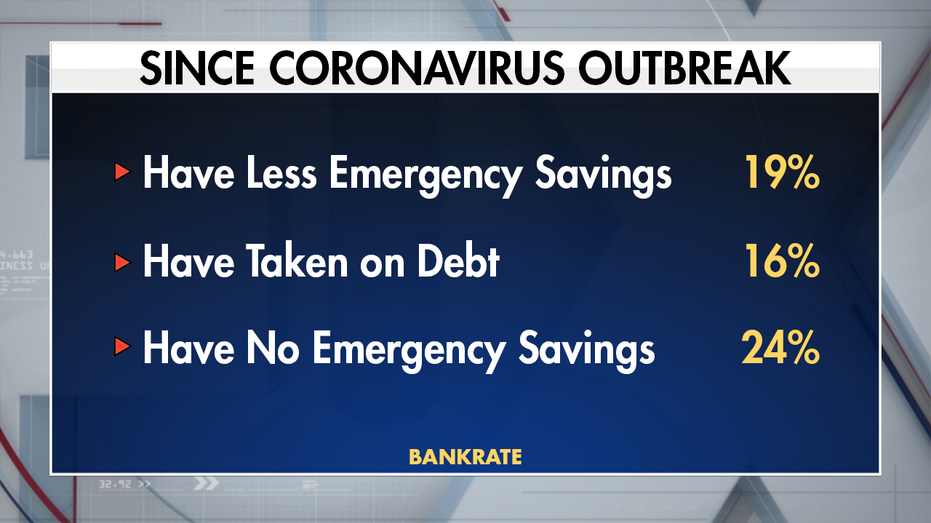

Additionally, nearly 1 in 5 have less emergency savings now than before the pandemic, while others have taken on more debt.

An additional 24 percent had no emergency savings heading into the pandemic and have not made progress since.

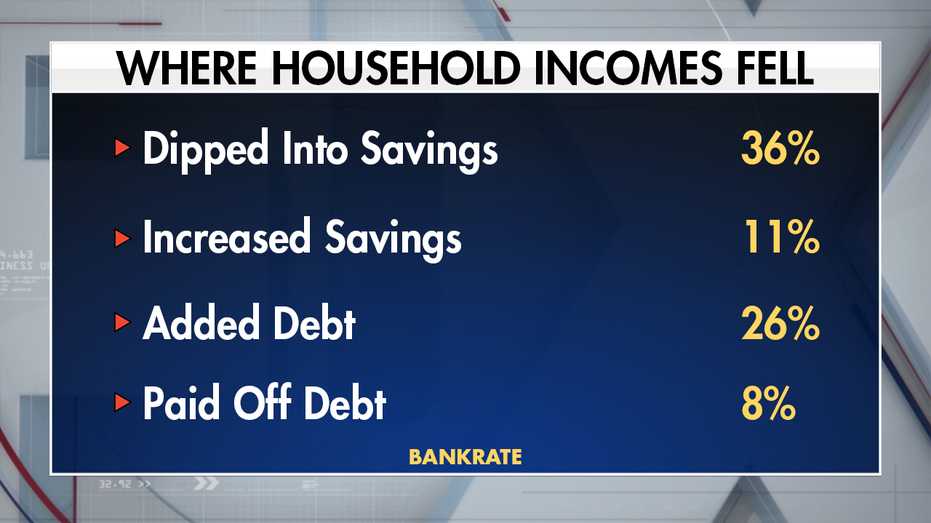

Where household incomes have decreased, 36 percent have dipped into emergency savings, more than three times as many as those whose income has increased or stayed the same. Only 9 percent whose household income decreased have added to their emergency savings, but thre are those who added to their debt. Some have even been able to cut existing debt during this time.

AMAZON, GOOGLE HELP STATES AS CORONAVIRUS BOOSTS UNEMPLOYMENT CLAIMS

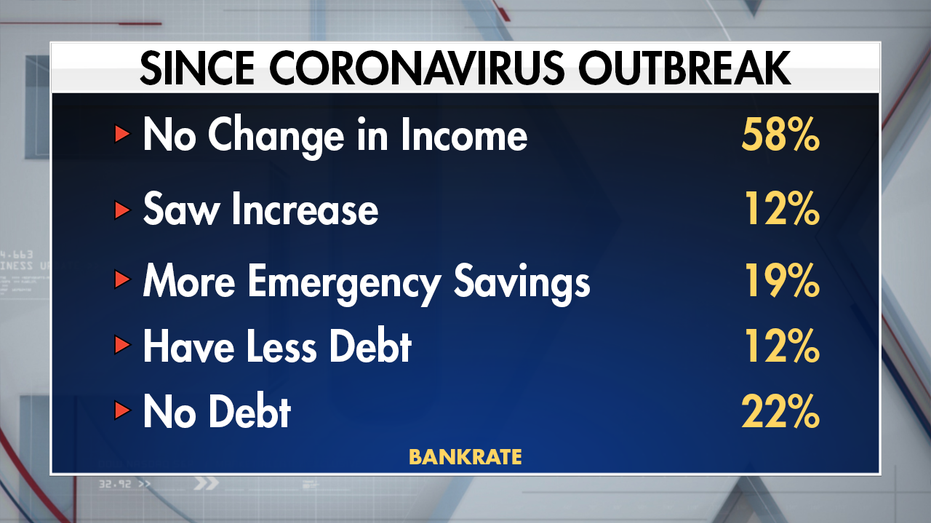

Among the positives during this time, 58 percent have not seen any change in their household income, and 12 percent even saw it increase.

Meanwhile, they've been able to add to emergency savings, cut personal debt and some even entered the pandemic without debt before and still have none now.

CORONAVIRUS PANDEMIC FORCES RETIREMENT SAVINGS TO TAKE BACKSEAT, STUDY SHOWS

Despite positive income gains, under half (48 percent) of households with increased income levels have added to their emergency savings. 12 percent percent have less, and 15 percent still have no savings at all. Furthermore, just 14 percent who have seen an income increase have less debt now, and 32 percent have more debt.

While every generation was more likely to report a decrease in income rather than an increase, millennials are more than twice as likely as those who are older to report an income increase.

CLICK HERE TO READ MORE ON FOX BUSINESS

Among millennials, 24 percent percent have more savings now, versus 19 percent of Gen Xers and 14 percent of baby boomers.

Millennials are, however, more likely to have added to their debt (21 percent) than Gen Xers (19 percent) and baby boomers (12 percent).