STOCK MARKET NEWS: S&P wraps worst first half since 1970, Nasdaq worst ever

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SP500 | $3,785.50 | -33.33 | -0.87% |

It was a rough first half of the year for U.S. equities as inflation skyrocketed dialing up the chances of a recession. The S&P 500 lost 20.6%, the worst performance since 1970, the Nasdaq fell 29.5% the worst ever, while the Dow Jones Industrial Average lost a lesser 15.3%, the worst since 1962 as tracked by Dow Jones Market Data Group.

Wheels Up founder and CEO Kenny Dichter discusses the boom in the private jet industry on 'The Claman Countdown.'

Hundreds of off-duty Delta Air Lines pilots have joined picket lines at airports across the country Thursday to fight for better pay, retirement, job protections and better schedules.

The fight – though – comes amid a time when the entire industry is already grappling with staffing shortages, including pilots, as well as weather and air traffic control constraints, which is leading to an onslaught of cancelations and delays.

National Association of Convenience Stores Jeff Lenard argues higher prices also hurt the retailer through organized gas theft operations.

Chief White House budget office economist under Trump Vance Ginn details key economic implications that are contributing to struggling markets on ‘Cavuto: Coast to Coast.’

FOX Business correspondent Lydia Hu analyzes how rising costs are impacting construction projects across America on ‘Varney & Co.’

Delta pilots protest across the country amid staffing shortages and flight cancellations. FOX Business' Lydia Hu with updates.

Democrats and environmental groups quickly condemned the Supreme Court decision Thursday for curbing federal regulatory powers related to climate issues.

The high court ruled that the Environmental Protection Agency (EPA) had limited powers in regulating emissions, adding that the agency exceeded its authority when it issued a plan to restrict power plants in 2015 during the Obama administration. Proponents of strict regulations, though, said the ruling would severely handicap the federal government's efforts to prevent cataclysmic climate change.

U.S. stocks fell sharply as all three of the major averages sank over 1% as the final trading day of the second quarter wraps up. The S&P 500 is on pace for the worst first half of a year since 1970s as inflation and recession fears spook investors. In commodities, oil hovered around $108 per barrel.

For the S&P 500, we are wrapping the worst first half of a year since 1970.

The Fed's preferred measure of inflation, core PCE, fell to 4.7% from 4.8%. While it marks the third straight month of slower growth it remains near a 40-year high and consumer spending showed a troubling trend.

U.S. equity futures were trading drastically lower ahead of the final trading day of the first half of the year. This comes the day after the U.S. economy contracted more than expected.

The drama involving the potential airline merger between Spirit Airlines and Frontier Group will be stretched out for at least another week.

Spirit shares are trading 2% higher in the premarket. On Wednesday, the airlines pushed back a shareholder vote on Frontier's merger offer for the budget carrier until next week. Spirit shareholders had been scheduled to finalize their vote at a special meeting on Thursday.

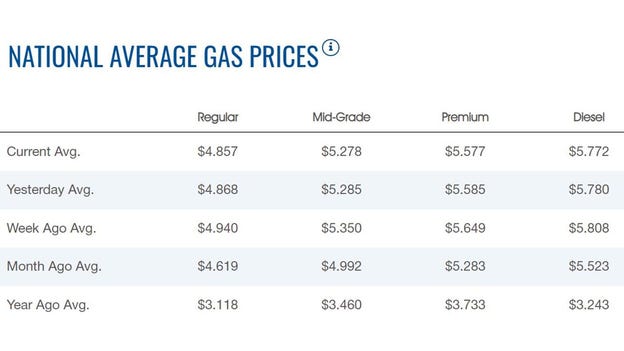

The price of a gallon of regular gasoline slipped on Thursday morning to $4.857, according to AAA. The price on Wednesday was at $4.868. Gas has declined for 13 straight days. Diesel slipped as well to $5.772 down from $5.78.

Oil prices traded choppy Thursday as the market examined concerns about global supply. U.S. West Texas Intermediate (WTI) crude futures traded around $109 per barrel. Brent crude futures were at $115 per barrel.

Crude inventories fell by 2.8 million barrels last week, exceeding analysts' expectations.

Bitcoin is trading below $20,000 after trading down for the three days heading into Thursday. The cryptocurrency is down more than 5% over this period.

Bitcoin is down more than 36% month-to-date and down more than 56% year-to-date.Bitcoin is also down more than 70% from its November high.

Ether is at $1,000. Dogecoin is at 6 cents.

Live Coverage begins here