Activist investor Icahn launches proxy fight at Illumina

Icahn claims the company could lose $800M in operating costs annually

Activist investor Carl Icahn on Monday launched a proxy fight at Illumina Inc, saying the life sciences company's takeover of Grail Inc had cost shareholders about $50 billion since the closing of the deal.

Shares of Illumina jumped more than 20% to $233.50 in morning trade, and have declined 7.2% since the deal closed in August 2021.

ILLUMINA TO APPEAL AFTER EUROPEAN COMMISSION PROHIBITS $7.1 BILLION GRAIL ACQUISITION

Illumina, Inc.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ILMN | ILLUMINA INC. | 120.00 | -0.09 | -0.07% |

Icahn plans to nominate three people to Illumina's board at the company's upcoming shareholder meeting, he said in a letter sent to shareholders.

The billionaire also said he had been working privately with Illumina's board for the last few weeks but could not come to an agreement.

ILLUMINA WINS FTC GRAIL CASE IN $7.1 BILLION DEAL

A sign at the front entrance to the global headquarters of Illumina is pictured in San Diego, Calif., Nov. 28, 2022. (Reuters/Mike Blake)

The company did not immediately respond to a Reuters request for comment.

According to the latest regulatory filings, Icahn beneficially owns about 2.2 million shares, or about 1.4%, of the company.

Illumina is in the process of opposing a European Union order to divest cancer-detection test maker Grail, after the life sciences company jumped the gun and closed the deal in August 2021 without securing regulatory approval.

In December, the European Commission ordered Illumina to unwind the deal, three months after it had blocked the merger on concerns that it would hurt competition and stifle innovation.

"We have therefore determined to launch a proxy contest to attempt to gain board representation," Icahn said, adding he feared the company's board will continue to pursue the Grail transaction.

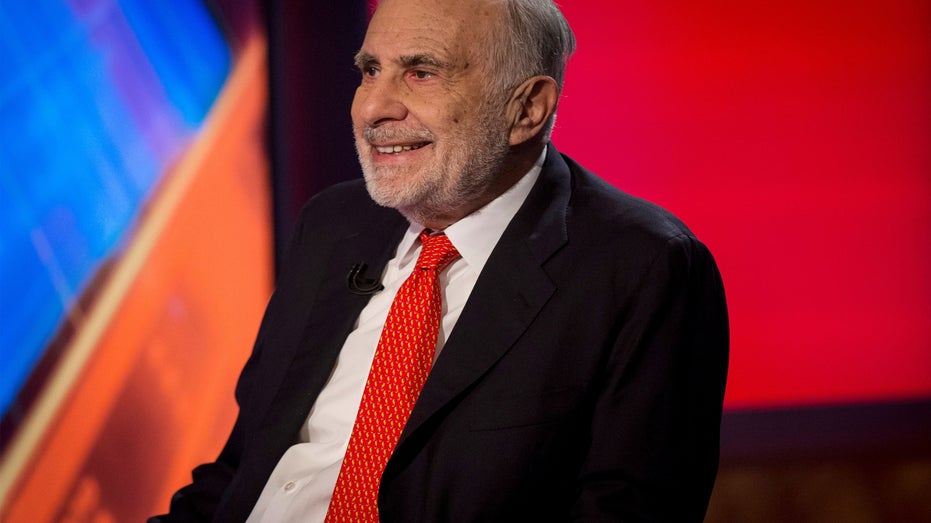

Billionaire activist-investor Carl Icahn gives an interview on FOX Business Network's Neil Cavuto show in New York Feb. 11, 2014. (Reuters/Brendan McDermid / Reuters Photos)

Icahn said his nominees — Vincent Intrieri, Jesse Lynn and Andrew Teno — would help keep Illumina from "sinking further". The company could lose $800 million in operating costs annually even though it does not yet have direct control over Grail, the investor added.

CLICK HERE TO READ MORE ON FOX BUSINESS

He is the latest activist investor to take on a poorly performing biotech company. In recent weeks, Irenic Capital Management pushed for changes at Theravance Biopharma and Caligan Partners urged Anika Therapeutics to consider strategic alternatives including a full sale.