Boeing eyes tapping $12B line of credit

Coronavirus is creating another layer of woes for Boeing

As ramifications from the new coronavirus outbreak pummel U.S. financial markets, Boeing is caught in the crosshairs as it continues to deal with the fallout from the 737 Max crisis.

Shares tumbled more than 10 percent Wednesday and weighed on the Dow Jones Industrial Average as the plane-maker moved to draw on its previously established $12 billion line of credit, FOX Business confirmed with sources familiar with the developments. The stock is hovering near levels not seen since July 2017.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BA | THE BOEING CO. | 243.03 | +6.08 | +2.57% |

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

GET FOX BUSINESS ON THE GO BY CLICKING HERE

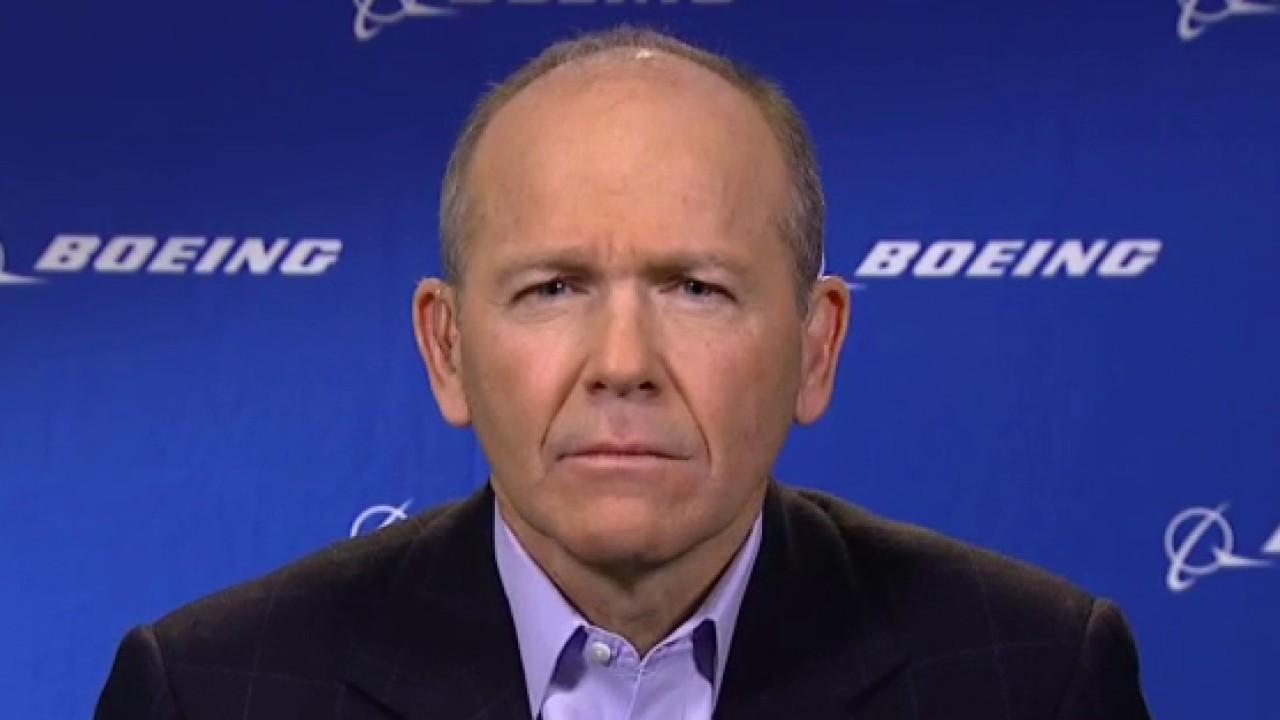

Boeing's new CEO David Calhoun confirmed the loan on the company's January earnings call.

"We've received commitment from a syndicate of banks sufficient to entry into $12 billion term loan facility," he said.

This followed reports that Citigroup, Bank of America Merrill Lynch, Wells Fargo and JPMorgan Chase were all working to help shore up funds for the planemaker.

BOEING CONFIRMS WORKER INFECTED WITH CORONAVIRUS

Boeing has been hammered by lost orders as the Max jet remains out of commission as regulators work to re-certify the aircraft once it receives approval from regulators to fly again. The Boeing model was involved in two fatal crashes prompting the aircraft to be grounded worldwide.

Boeing did not immediately return an inquiry from FOX Business.

CLICK HERE TO READ MORE ON FOX BUSINESS