Bud Light backlash to boost Truly, seltzers: analyst

The Bud Light controversy kicked off in April

Bud Light boycott causing spike in sales of major beer competitors

FOX Business’ Lydia Hu reports on the fallout from Bud Light’s controversial partnership with transgender influencer Dylan Mulvaney.

The backlash Bud Light parent Anheuser-Busch has gotten from consumers in recent weeks may end up helping Boston Beer Company’s Truly and other seltzers.

Truly, released by the Massachusetts-based company in 2016, and other hard seltzers will see a boost in the summer due to Bud Light's loss of market share, Roth MKM senior research analyst Bill Kirk wrote Tuesday in a note. He said the "substitutability between Bud Light and seltzers should increase" along with the season’s warmer temperatures.

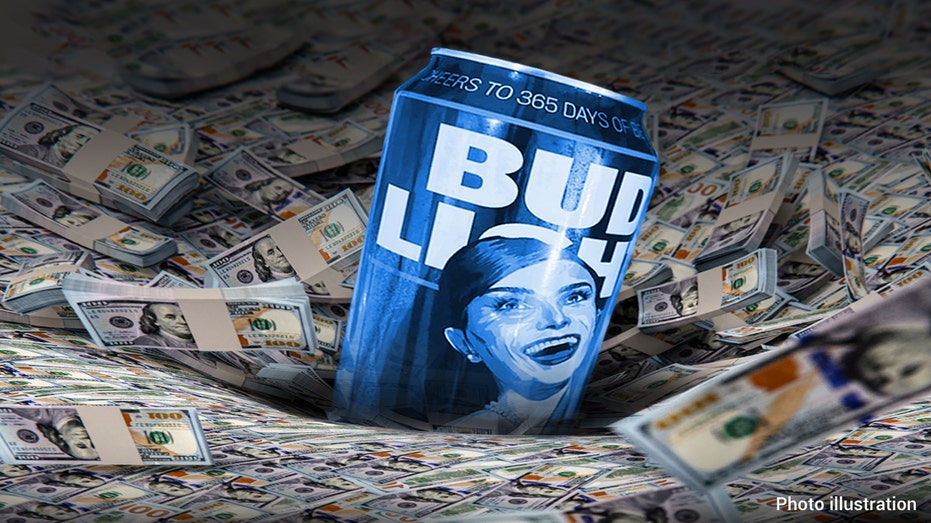

Anheuser-Busch and its brand Bud Light have faced a deluge of backlash since early April, when the company created custom cans for transgender influencer Dylan Mulvaney.

Anheuser-Busch and its brand Bud Light have faced a deluge of backlash since early April, when the company created custom cans for transgender influencer Dylan Mulvaney.

BUD LIGHT PARENT ANHEUSER-BUSCH SEES $27 BILLION GONE, SHARES NEAR BEAR MARKET

FOX Business reached out to Anheuser-Busch and Boston Beer Company for comment.

During the Bud Light controversy, the brand has been targeted by conservatives as "woke," and some have boycotted the beer. The boycotts have hurt Anheuser-Busch’s sales, with data provided to Newsweek by Bump Williams Consulting and Nielsen IQ showing Bud Light lost 24% of its sales in the four weeks ending May 20.

Boycotts have hurt Anheuser-Busch’s sales. (Jason Kempin/Getty Images for Bud Light / Getty Images)

BUD LIGHT SALES DOWN NEARLY 30% COMPARED TO 2022 AFTER PARTNERSHIP WITH TRANSGENDER INFLUENCER

In May, shares of Anheuser-Busch InBev have dropped over 17% in price.

Being "part of a discussion that divides people" was something the company never intended, Anheuser-Busch CEO Brendan Whitworth said in mid-April.

"I care deeply about this country, this company, our brands and our partners. I spend much of my time traveling across America, listening to and learning from our customers, distributors and others. Moving forward, I will continue to work tirelessly to bring great beers to consumers across our nation."

During the Bud Light controversy, the brand has been targeted by conservatives as "woke." (Roberto Machado Noa/LightRocket via Getty Images / Getty Images)

Anheuser-Busch InBev CEO Michel Doukeris also has discussed the controversy, saying it "has impacted our people and especially our frontline workers."

Kirk of Roth MKM wrote Tuesday that "with the prospect of Truly stabilizing (thanks to Bud Light share loss) and gross margins improving," the investment bank "believe[s] focus will return to the aspects of the [Boston Beer Company] portfolio that are growing (Twisted Tea)."

He linked the projected gross margin improvement to a "production shift" that "will be realized in 2Q (given inventory days timing)."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The combination of the Bud Light consumers potentially shifting to Truly and Boston Beer Company’s gross margins improving prompted Roth MKM to change its stance on the stock, which trades on the New York Stock Exchange under the ticker SAM, to "buy."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BUD | ANHEUSER-BUSCH INBEV NV | 75.80 | +0.88 | +1.17% |

| SAM | BOSTON BEER CO. INC. | 247.11 | +8.34 | +3.49% |

In addition to Truly and Twisted Tea, Boston Beer Company counts Samuel Adams, Dogfish Head and Angry Orchard among its brands. The company, whose market capitalization hovered around $4.14 billion as of Wednesday afternoon, has produced some 111 million cases.

FOX Business contributed to this report.