Coronavirus causes turbulence for airlines

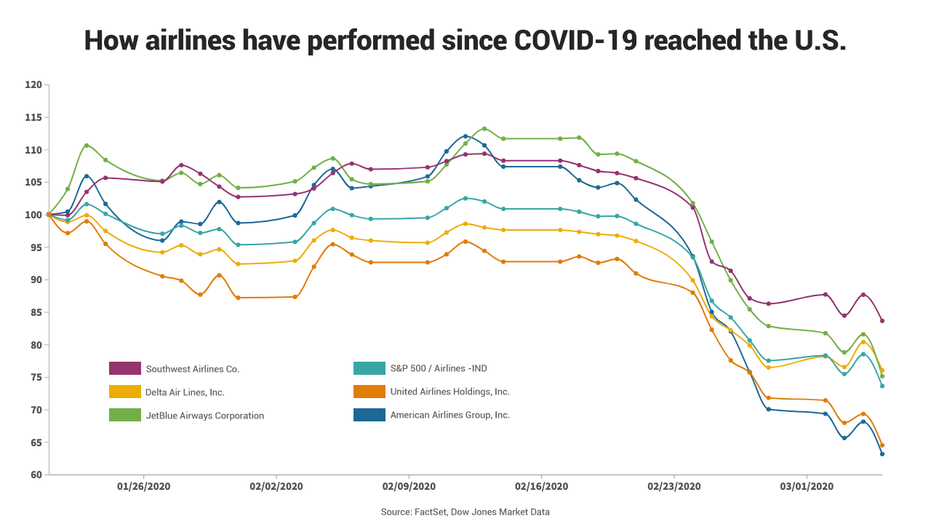

The S&P 500 Airlines Index has plunged 26.4% since COVID-19 was reported in the US

The outbreak of the new coronavirus has ravaged the airline industry, forcing carriers to reduce flights and trim their profit outlooks.

The one-two punch has knocked the S&P 500 Airlines Index down 26.4 percent since COVID-19 was first reported to have reached the U.S. on Jan. 21, according to FactSet data. Airlines are the second-worst performing industry group over that time, trailing only energy and equipment services.

Southwest Airlines warned Thursday that demand destruction caused by the COVID-19 outbreak would slice as much as $300 million from its first-quarter revenue. Earlier in the week, rivals United Airlines and JetBlue Airways announced plans to cut flights from their schedules.

President Trump warned during a Wednesday meeting with airline executives about COVID-19's impact on travel that if the outbreak worsens in certain areas, he may “close them up.”

Last month, his administration banned travel to China and Hong Kong and issued warnings about trips to parts of Italy and South Korea, two countries that have been hit hard by the disease.

K-POP'S 'BLACK SWAN' SIGNALED CORONAVIRUS SELLOFF

COVID-19 has infected 93,090 people worldwide and killed 3,198, according to the latest figures provided by the World Health Organization. Here in the U.S., there have been 100 reported cases spread between 13 states and 10 deaths, the Centers for Disease Control and Prevention said.

“So-called social distancing – a phenomenon playing out now where people avoid crowds, events, travel – could lead to a prolonged downturn in demand,” wrote Joseph DeNardi, a Baltimore-based analyst at Stifel.

“However, we see the demand impact as temporary versus structural. In order to get to a structural point, we would either need to see a more permanent change in travel trends (businesses alter travel requirements, demand to travel internationally is altered) or a bankruptcy.”

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LUV | SOUTHWEST AIRLINES CO. | 54.25 | +1.75 | +3.33% |

| AAL | AMERICAN AIRLINES GROUP INC. | 15.24 | +1.08 | +7.63% |

| UAL | UNITED AIRLINES HOLDINGS INC. | 115.91 | +9.82 | +9.26% |

| DAL | DELTA AIR LINES INC. | 75.30 | +5.53 | +7.93% |

| JBLU | JETBLUE AIRWAYS CORP. | 6.36 | +0.32 | +5.30% |

While no U.S. carrier has filed for bankruptcy so far, the British airline Flybe on Wednesday collapsed due to a sharp drop in travel demand caused by COVID-19. The airline had been brought to its knees earlier this year but COVID-19 delivered the knockout blow.

While DeNardi doesn’t see a more permanent change in travel trends or a U.S. carrier filing for bankruptcy as likely as of now, concern the outbreak will worsen has dragged broader markets down.

Last week, the S&P 500 tumbled into the fastest correction in its history. Seven days of heavy selling, including two from the prior week, pushed the benchmark average down by as much as 15.7 percent before it began to pare losses.

CLICK HERE TO READ MORE ON FOX BUSINESS

“If the tone around the virus becomes less severe, something that would likely need to be driven by improving data, we believe those travel restrictions would be lifted and pent-up travel demand could return,” DeNardi wrote. “We don’t assign 100% probability to this outcome, but we also don’t assign 0% - which we believe the market is.”