Coronavirus fears batter bank stocks by creating cheap credit

Lenders 'are really at the nexus of this in many ways'

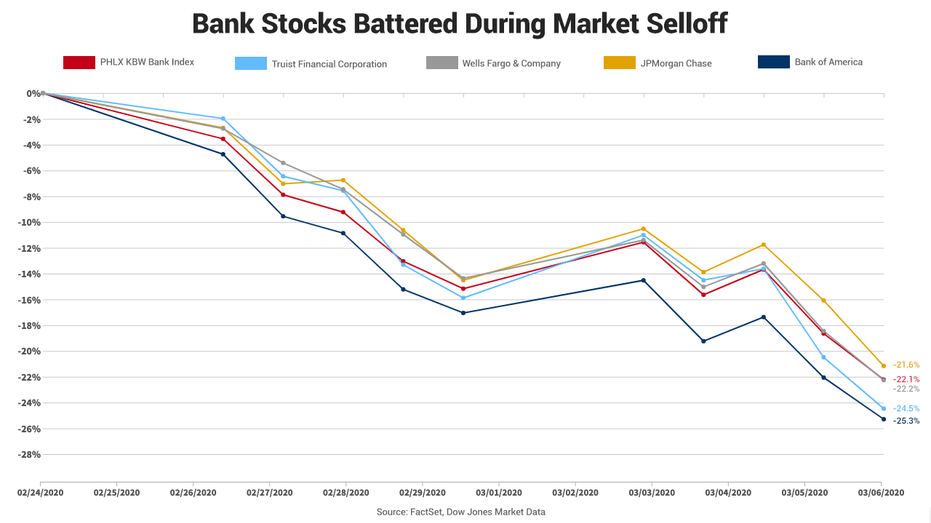

America’s biggest banks have borne the brunt of the stock-market turbulence surrounding the Federal Reserve’s emergency interest-rate cut.

The KBW Bank Index, which includes JPMorgan Chase, Bank of America, Wells Fargo and 21 other banking stocks such as regional giant Truist, has plunged by more than 22 percent over the past two weeks, a decline exacerbated by the Fed lowering its key interest rate. By comparison, the S&P 500 is down just 11 percent.

The Fed slashed its key lending rate by 50 basis points to a range of 1 percent to 1.25 percent at an emergency meeting on Wednesday. A rate cut is detrimental to a bank’s earnings as it slices the profit margin on loans.

Lenders are “really at the nexus of this in many ways, suffering from ultra-low interest rates,” Jonathan Hoenig, managing member at the Chicago-based Capitalistpig Hedge Fund, told FOX Business’ Stuart Varney on Friday. Banks were hit the hardest of all industry groups within the S&P 500, according to Dow Jones Market Data.

MORGAN STANLEY, BANK OF AMERICA RELOCATE TRADERS AMID CORONAVIRUS

What’s hurting them is the effect on net interest income, the industry's term for the difference between interest paid to depositors -- who supply the money a bank lends -- and interest charged to borrowers. That money typically makes up 50 to 75 percent of a bank's net revenue.

Lower rates mean more customers will borrow money, but banks will earn less per loan.

Stocks In This Article:

“Volumes are going to be good, but they're going to be doing business at lower rates,” said Kenneth Leon, research director of industries and equities at CFRA Research. “And that's a big part of why the banks are down.”

Even before the COVID-19 outbreak, which has paralyzed supply chains and caused people to avoid crowds, events and travel, banks were lowering their performance targets for this year due to a slowdown in borrowing and three Fed rate cuts at the end of last year.

Couple that with the uncertainty presented by the coronavirus, and you have a recipe guaranteed to produce a hangover.

“This sector is probably more vulnerable to uncertainty than other sectors in the market,” Robert Albertson, a New York-based managing director at Piper Sandler, told FOX Business.

The steep slide in banking stocks shows the sector is “looking ahead for another round of rate cuts,” Leon said.

FED'S REVISED BANK RULE A BONUS FOR DIVIDENDS, BUYBACKS

Fed fund futures traded at the Chicago Mercantile Exchange were pricing in a 72 percent chance on Saturday that the central bank would cut interest rates by another 50 basis points at its March meeting.

Its efforts may be buoyed by a consumer or business stimulus from Washington.

President Trump, who signed an $8.3 billion package to provide public agencies with money for vaccines, tests and potential treatments, has said his administration is considering further measures.

White House economic adviser Larry Kudlow told Varney on Friday that the administration is looking into a “timely and targeted micro approach” to pump money into distressed parts of the economy.

But if bank stocks are getting pinched, their capital remains healthy, enabling a dividend yield of just below 3 percent, which according to Bank of America is the most attractive versus U.S. Treasurys since 2009. The yield on the 10-year note touched a record low below 0.67 percent this week.

Sooner or later, the market will look past the turbulence from COVID-19, however, and when it does, financials will likely be a beneficiary, according to Piper Sandler's Albertson.

CLICK HERE TO READ MORE ON FOX BUSINESS

“When there's a global discontinuity of this magnitude, financials always get hit the hardest,” he told FOX Business. “But it's not fundamental. It's psychological. So if you're looking for a trade coming out of it and you feel like we're seeing not the end so much, but the diminution of the crisis, financials is where you want to go.”