Coronavirus drives government spending toward WWII levels

'Houston, we've got a problem'

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

Government spending is surging by epic proportions as Congress deploys a “whatever it takes” approach to combat the economic carnage of COVID-19, but some economists are worried about what will happen when the bill comes due.

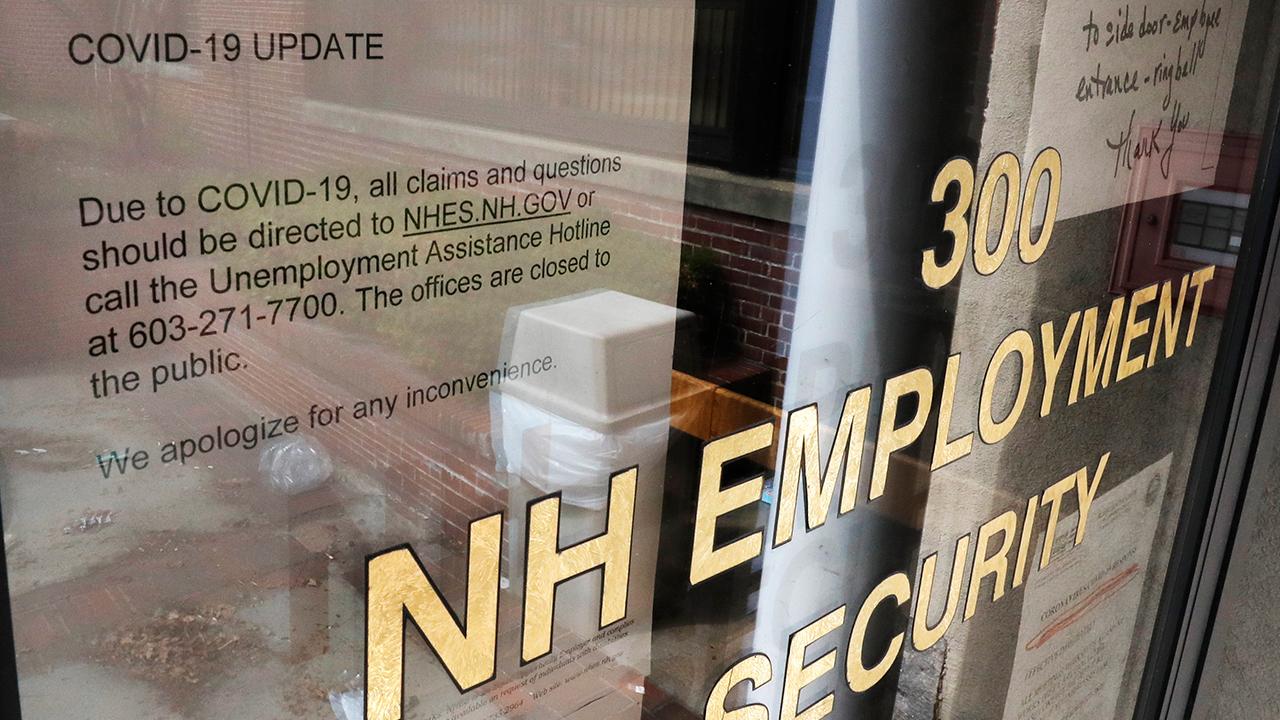

“Stay-at-home” orders issued by more than 40 U.S. governors have brought economic activity to a grinding halt, putting more than 26 million Americans out of work over the past five weeks.

To cushion the blow, the government has enacted three separate coronavirus aid packages, totaling more than $2 trillion, that provide aid to the individuals and businesses most impacted by the pandemic. Spending from all levels of government is on track to reach almost 50 percent of U.S. gross domestic product this year, something that has only previously happened during World War II.

“We've got to get government spending under control,” Stephen Moore, an economist at the conservative think tank The Heritage Foundation, told FOX Business. “When you've got the government spending almost more than the private sector is now, you know, Houston, we've got a problem.”

US CONSTITUTION GIVES CONGRESS POWER TO CURE ECONOMY FROM CORONAVIRUS SHUTDOWNS

The massive outlays, most of which are deficit spending, mean the U.S. national debt is set to rise from its current level of $24.6 trillion, or 114.54 percent of GDP, according to the U.S. National Debt Clock. The debt amounts to $198,125 per taxpayer.

COVID-19 “couldn’t have come at a worse time,” given already high debt levels and the implications for government borrowing and GDP, wrote Stephen King, senior economic adviser at the London-based investment bank HSBC.

There's only one way to stimulate the economy right now.

The debt-interest burden has been kept at a minimum, though, due to “persistently-low interest rates,” suggesting there is “plenty of room for government debt to rise” in the months ahead, he wrote.

It appears likely to do so, considering President Trump, much to the chagrin of Senate Majority Leader Mitch McConnell, R-Ky., has come out in support of giving aid to state and local governments blindsided by the pandemic.

The economic research team at Goldman Sachs expects an additional $1.5 trillion of fiscal relief through 2022, including the small-business relief signed into law on Friday.

CLICK HERE TO READ MORE ON FOX BUSINESS

For fiscal conservatives, the worry is that more spending will only delay the economic recovery.

“There's only one way to stimulate the economy right now, and that is with the payroll tax cut,” Moore said, adding that taking such action would reduce employment costs by 7.5 percent and increase wages and salaries by the same amount per worker.

“No more spending,” Moore said. “Spending is going to make the problem worse, not better.”