K-pop's 'Black Swan' signaled coronavirus selloff

'Our new baseline forecast sees the global economy in recession'

The writing was on the wall for a stock-market selloff as early as Jan. 17, when the K-pop boy band BTS released its Top 100 hit “Black Swan."

While a video that accompanied the song suggests BTS was using "Black Swan" as a metaphor for artistic death, much as Natalie Portman's 2010 movie did, its release presaged a black swan of another sort.

Stock market professionals use the term to refer to an unforeseen event with an extreme impact -- the 2008 financial crisis, for example -- and have applied it to the new coronavirus, whose spread outside China was first reported on Jan. 20 – three days after the K-pop single was released.

In hindsight, as with most black swans, the single would be easy to interpret as a bad omen. But two months ago, anyone suggesting that would have been laughed off as a 21st-century Cassandra, the mythical seer cursed by the god Apollo so that her accurate prophecies would never be believed.

On the bright side, this particular hit to the stock market may be relatively short-lived, much like the K-pop single's stay on Billboard charts.

“A non-financial ‘black swan’ event – such as a terrorist attack or a global epidemic like COVID-19 – is likely to have a negative near-term impact on the affected region’s economy, but that effect usually rights itself within a quarter or two,” wrote Chris Konstantinos, chief investment strategist at the Richmond, Virginia-based Riverfront Investment Group, which has $7 billion in assets under management.

In China, where the COVID-19 outbreak began, Beijing ordered the lockdown of hundreds of millions of people to halt the disease's spread, causing companies to temporarily halt or reduce operations.

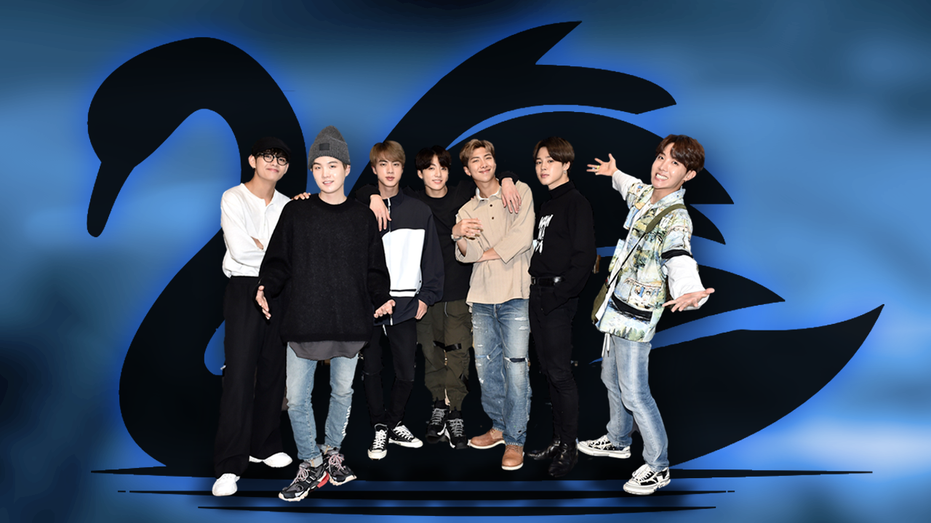

K-pop boy band BTS (Getty Images)

The resulting collateral damage was supply-chain disruptions and demand destruction, causing economists to lower their global growth forecasts for the first half of 2020 before a rebound in the second half of the year.

“Our new baseline forecast sees the global economy in recession in the first half of 2020, with the Euro area and Japan recording two quarters of moderately negative growth, the U.S. economy hovering near zero with a contraction in the second quarter, and China experiencing one quarter of decline,” wrote Peter Hooper, global head of economic research at Frankfurt-based Deutsche Bank.

“By the third quarter, the global economy enters a period of above-trend growth as people return to work and the shops, and the virus has not had a significant impact on potential growth,” he said.

CLICK HERE TO READ MORE ON FOX BUSINESS

As expectations for global growth have tumbled, at least for the near-term, so, too, has the stock market. The benchmark S&P 500 fell by as much as 15 percent during an eight-day selloff that encompassed the worst week for stocks since the 2008 crisis.

Strategists at Goldman Sachs predict the COVID-19 outbreak will erase S&P 500 profit growth this year, but the impact will be temporary.

“A scenario where the COVID-19 outbreak does not worsen significantly would be consistent with a year-end level of 3,400,” David Kostin, chief U.S. equity strategist at Goldman Sachs, wrote on Feb. 27.

The index was trading at 3,105 on Wednesday afternoon. In the meantime, as BTS vocalist Jungkook observes in "Black Swan," traders can probably expect some more bouts of "sinking slowly" where "every moment becomes eternity."