Defense stocks primed for 2020 triumph

Big names have a reward coming for earnings performance

Defense stocks are poised to outperform in 2020, as they typically do in election years, according to one Wall Street research firm.

“We think valuation is compelling,“ Richard Safran, analyst at the New York-based Buckingham Research Group, wrote in a note published before President Trump signed a $738 billion defense spending bill on Dec. 20, adding that “election risks are being overstated and stocks could rise as fears of a progressive candidate being elected begin to dissipate.”

TRUMP ECONOMY TO BOOM IN 2020: BIG-MONEY MANAGERS

He pointed to three reasons for a banner 2020.

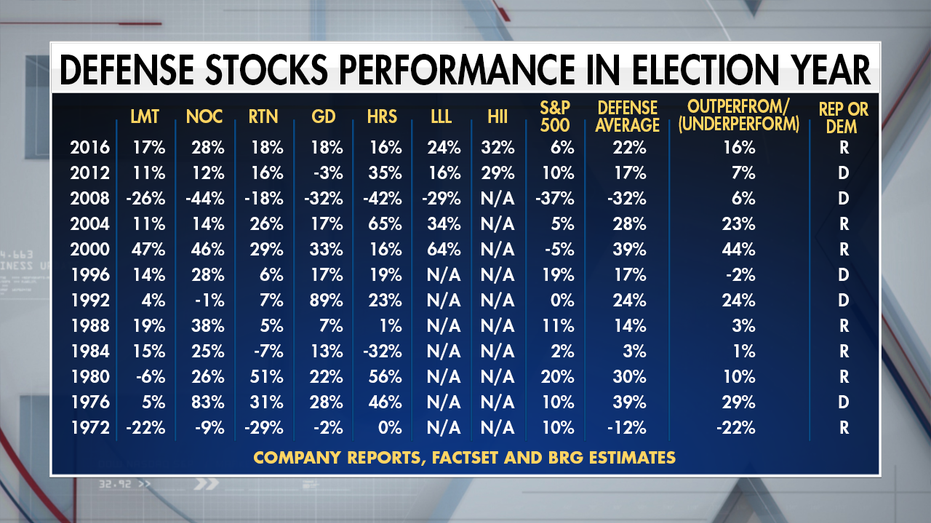

First, Safran says defense stocks typically do well in election years “due to a flight-to-safety track record.” Over the last 12 election cycles, the defense sector has lagged the S&P 500 just twice – in 1996 and 1972.

Another reason, according to Safran, is that the “risks are overstated and have hampered defense multiples from expanding despite continued end-market growth.” Finally, he says defense stocks are “not being rewarded for how much they are earning above their cost of capital,” setting up outperformance next year.

The SPDR S&P Aerospace & Defense ETF has climbed 39 percent year-to-date, outperforming the S&P 500’s 29 percent gain.

Safran says the “best-case scenario” for the sector would be a Trump win and the Republicans controlling either the House, the Senate or both.

On the flip side, he thinks the “knives would come out for defense companies and that defense budgets would likely be slashed” if a progressive candidate such as Sen. Bernie Sanders, I-Vt., or Sen. Elizabeth Warren, D-Mass., were to win the White House. Former Vice President Joe Biden would have a “more moderate view of defense,” Safran said.

His favorite stocks in the space are Lockheed Martin, Northrop Grumman and L3Harris Technologies.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LMT | LOCKHEED MARTIN CORP. | 623.58 | +14.40 | +2.36% |

| NOC | NORTHROP GRUMMAN CORP. | 709.11 | +12.61 | +1.81% |

| LHX | L3HARRIS TECHNOLOGIES INC. | 349.66 | +7.44 | +2.17% |

As for the broader stock market, it typically tends to move sideways in the first half of an election year before clarity on the winner drives action during the second half, according to the Wells Fargo Investment Institute.

CLICK HERE TO READ MORE ON FOX BUSINESS

“In years when the incumbent party wins the presidential election, the equity market rally has been stronger than for the average of all U.S. election years," the institute said. "Stock prices tended to stumble into the year’s second half when the incumbent party lost the presidential election.”