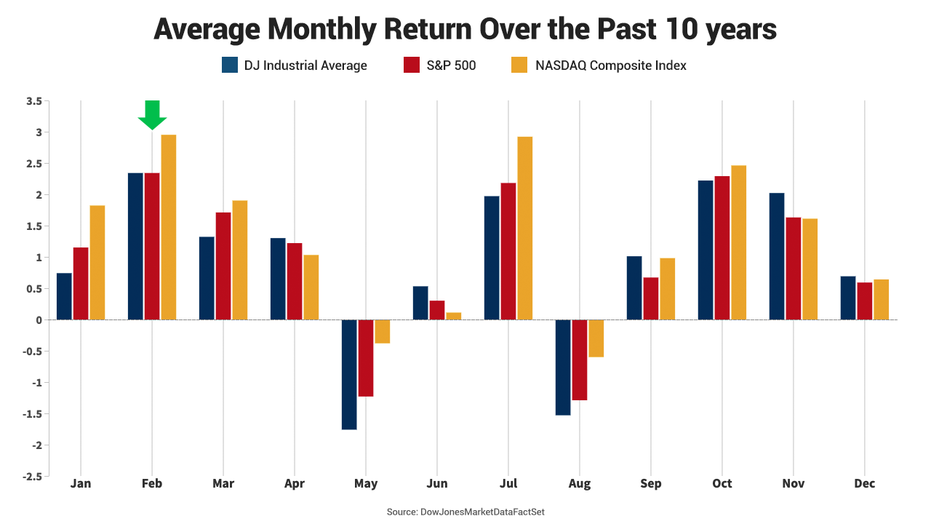

February is a stock love fest for investors

The three major averages make their biggest gains in the year's shortest month

Valentine’s Day is over, but investors' love affair with stocks may continue all month long and then some if history is any guide.

Over the past decade, the three major averages have produced their best monthly gains of the entire year in February, according to Dow Jones Market Data Group.

For the S&P 500 and Dow Jones Industrial Average, that’s 2.3 percent each; for the Nasdaq, it's 3 percent.

COULD THE CORONAVIRUS BE A BLACK SWAN?

With roughly two weeks left in the month, Wall Street is celebrating more than usual: Gains already are practically double those averages, despite the volatility in recent days tied to rising cases of the coronavirus.

What’s the driver?

Investors are looking beyond the global health crisis and focusing on the U.S.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Earnings growth for the S&P 500 is tracking at 0.9 percent for the fourth quarter, powered by heavy hitters such as JPMorgan Chase, Apple and Amazon. If that lasts, it will mark the first year-over-year growth since the fourth quarter of 2018, as noted by John Butters, senior earnings analyst with FactSet.

TRUMP TALKS MAGA ... STOCKS, THAT IS

A group of four companies with President Trump’s favorite acronym "MAGA" are leading the stock market’s charge. Microsoft, Apple, Google and Amazon are responsible for about 17 percent of the S&P 500 and almost 70 percent of the index’s gain in 2020.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 401.14 | +7.47 | +1.90% |

| AAPL | APPLE INC. | 278.12 | +2.21 | +0.80% |

| GOOGL | ALPHABET INC. | 322.86 | -8.39 | -2.53% |

| AMZN | AMAZON.COM INC. | 210.32 | -12.37 | -5.55% |

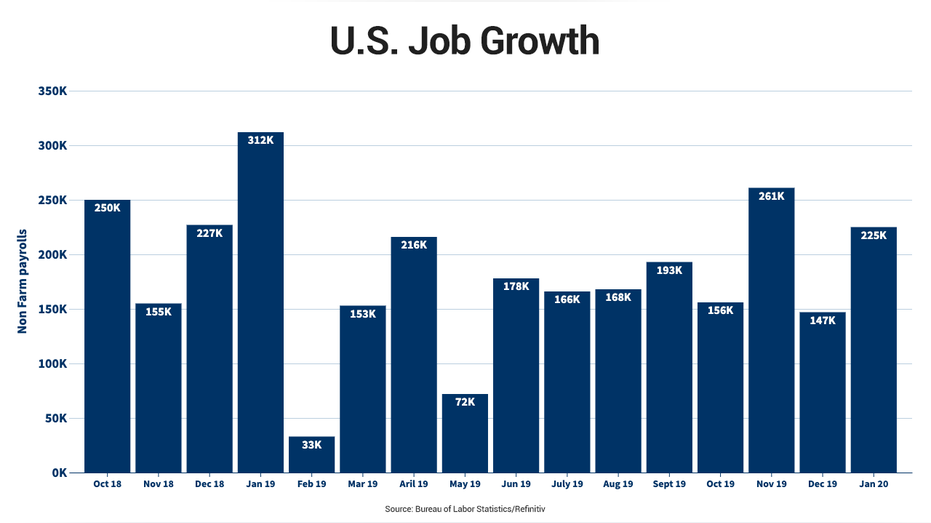

JANUARY JOBS REPORT SMASHES ESTIMATES

Also, U.S. economic data is solid. On Friday, consumer sentiment for February rose to 100.9, which is close to levels in March 2018, the “expansion peak” recorded by the University of Michigan. Retail sales for January rose 0.3 percent., and while the gain was modest, economists suggest that's a sign consumers are still spending.

Plus, January’s jobs report smashed records, with 225,000 positions created.

This month, victories by Sen. Bernie Sanders -- a self-described democratic socialist seeking the Democratic nomination for president -- in Iowa and New Hampshire primaries boosted speculation that the party would be unable to wrest the White House away from President Trump.

“The market is thinking he's a relatively easy target for Trump,” Nuveen Chief Investment Strategist Brian Nick observed during an appearance on FOX Business’ Varney & Co.

TRUMP'S TAX CUTS 2.0 COULD INCLUDE RETIREMENT PERK

And on Friday the White House ramped up talk about another round of tax cuts that could include combining savings and retirement accounts that provide tax breaks.

CLICK HERE TO READ MORE ON FOX BUSINESS