Fed speeches, Cyber Monday, and retail earnings will top week ahead

Hearings on FTX and Labor Department's review of the gig-economy will also dominate headlines.

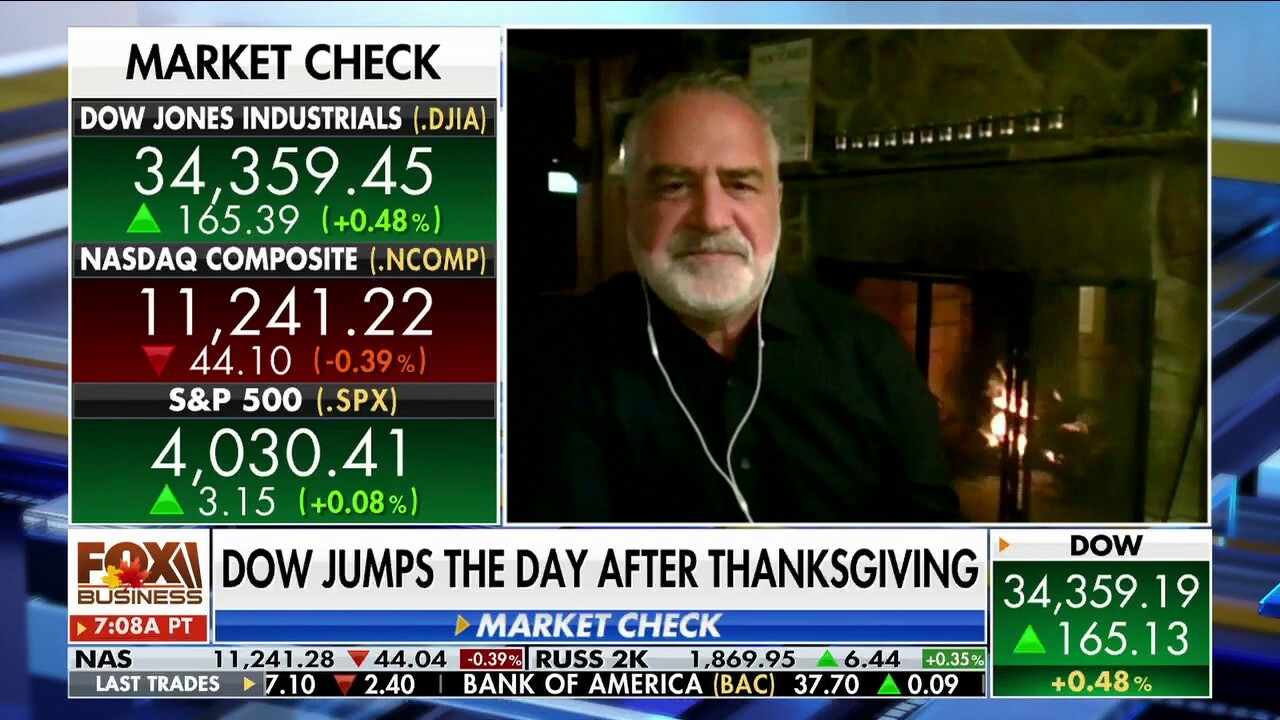

This holiday season consumers going for 'experience' rather than a 'physical' gift: Kenny Polcari

Slatestone Wealth chief market strategist Kenny Polcari provides an outlook on the stock market, the Federal Reserve slowing down rate hikes, and warns consumers on Black Friday retail discounts on ‘Varney & Co.’

11/27/22 – This week kicks off with Cyber Monday in a year when retail has been hit hard by inflation. Investors will be keeping an eye on online retail to see if it can help make up the difference.

The spectacular crash of cryptocurrency exchange FTX will also dominate financial news as hearings in Congress begin and bankruptcy proceedings continue.

Four important Federal Reserve speeches this week will also provide insight into the mindset of the Fed as they weigh further rate hikes to curb stubbornly high inflation.

Sam Bankman-Fried, founder and former chief executive officer of FTX Cryptocurrency Derivatives Exchange, speaks during an interview on an episode of Bloomberg Wealth with David Rubenstein in New York, US, on Wednesday, Aug 17, 2022. Crypto exchange (Photographer: Jeenah Moon/Bloomberg via Getty Images / Getty Images)

Monday, November 28

HOLIDAY SALES FLAT AT $64.5B, RETAILERS FORCED TO OFFER DEALS

Monday kicks off Cyber Monday, the online retail equivalent of Black Friday.

Monday is also the last day for public comment on the Labor Department’s proposed rule addressing whether a worker is an employee or independent contractor under the Fair Labor Standards Act. Classifying gig-workers as employees could have a chilling effect on the gig-economy affecting companies like Lyft, Uber, and Fiverr.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LYFT | LYFT INC. | 16.46 | +0.62 | +3.91% |

| UBER | UBER TECHNOLOGIES INC. | 74.77 | -0.44 | -0.59% |

| FVRR | FIVERR INTERNATIONAL LTD | 15.46 | +0.30 | +1.98% |

Monday also features the first of this week's four Federal Reserve speeches with the Federal Reserve Bank of New York's President John Williams participating in a virtual conversation organized by the Economic Club of New York at noon EST.

There will be no earnings of note on Monday as those who would have prepared them were off work for the Thanksgiving holidays.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Tuesday, November 29

Tuesday will see the Bank of England begin to sell off the $22.5 billion in bonds it used to quell the markets in England during Former Prime Minister Liz Truss’ time in office.

The Senate will also hold a hearing on the competitive impact of the proposed Kroger-Albertsons merger.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| KR | THE KROGER CO. | 67.50 | +0.83 | +1.24% |

| ACI | ALBERTSONS COS INC | 18.09 | +0.30 | +1.69% |

After the bell, Hewlett-Packard Enterprise, Intuit, and Workday will be the week's first big-name earnings reports. HP Enterprises is its own company while HP Inc. makes laptops and recently announced some woes over decreased PC demand.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| HPE | HEWLETT PACKARD ENTERPRISE CO. | 23.61 | +0.90 | +3.96% |

| INTU | INTUIT INC. | 443.77 | +8.86 | +2.04% |

| WDAY | WORKDAY INC. | 162.92 | +4.16 | +2.62% |

HP SAYS IT WILL CUT WORKFORCE BY 4,000-6,000 BY END OF FISCAL 2025

Economic data released on Tuesday will include the Federal Housing Finance Agency's (FHFA) monthly home price index, the Case-Shiller home price index, and CB's consumer confidence survey which is expected to fall short of the forecast.

Wednesday, November 30

Wednesday will see the second of this week's Fed speeches with Chairman Jerome Powell speaking at the Brookings Institution at 1:30 p.m. EST.

Federal Reserve Chairman Jerome Powell speaks during a news conference at the Federal Reserve Board building in Washington, Wednesday, July 27, 2022. Jerome Powell will speak to the Brookings Institution at 1:30 p.m. EST on Nov. 30, 2022 (AP Photo/Ma (AP Photo/Manuel Balce Ceneta / AP Images)

Earnings on Wednesday before market open will include Build-A-Bear Workshop and Petco.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BBW | BUILD A BEAR WORKSHOP INC | 55.43 | +1.07 | +1.97% |

| WOOF | PETCO HEALTH & WELLNESS COMPANY INC | 2.62 | +0.14 | +5.65% |

After the bell, Box, Five Below, La-Z-Boy, Okta, Salesforce, and Victoria’s Secret will update investors on their earnings.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BOX | BOX INC. | 24.66 | +0.36 | +1.50% |

| FIVE | FIVE BELOW INC. | 202.61 | +8.52 | +4.39% |

| LZB | LA-Z-BOY INC. | 38.80 | +0.29 | +0.75% |

| OKTA | OKTA INC. | 86.74 | +4.59 | +5.59% |

| CRM | SALESFORCE INC. | 191.37 | +1.45 | +0.76% |

| VSCO | VICTORIA'S SECRET & CO. | 62.44 | +3.42 | +5.79% |

Economic data on Wednesday will include mortgage applications, ADP national employment, corporate profits, preliminary Q3 GDP, Chicago PMI, JOLTS job openings, pending home sales, and EIA weekly crude stocks

Thursday, December 1

Thursday will see the Senate conduct a hearing on FTX's collapse with the CFTC Chair Rostin Behnam testifying. The focus will be on what lessons to take away from the cryptocurrency exchange's collapse, and how action from congress could reduce future risk.

Tesla will also deliver its much-anticipated semi truck with the first production version of an electric Class 8 truck going to Pepsi to support factories in Modesto and Sacramento, California.

Tesla's new electric semi truck is unveiled during a presentation in Hawthorne, California, U.S., November 16, 2017. (REUTERS/Alexandria Sage/File Photo / Reuters Photos)

The third of this week's four Fed speeches will kick off at 9:25 a.m. EST, with the Federal Reserve Bank of Dallas's President Lorie Logan participating in a moderated question-and-answer session hosted by the Dallas Breakfast Group.

FED OFFICIALS ANTICIPATE SLOWER INTEREST RATE HIKES COMING 'SOON,' MINUTES SHOW

Thursday's earnings kick off in the morning with Big Lots, Designer Brands (the owner of Designer Shoe Warehouse), Dollar General, Duluth Holdings, Kroger, and Lands’ End.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BIG | NO DATA AVAILABLE | - | - | - |

| DBI | DESIGNER BRANDS INC. | 6.95 | +0.21 | +3.12% |

| DG | DOLLAR GENERAL CORP. | 146.65 | +1.75 | +1.21% |

| DLTH | DULUTH HOLDINGS INC | 2.45 | +0.12 | +5.15% |

| KR | THE KROGER CO. | 67.50 | +0.83 | +1.24% |

| LE | LANDS END | 17.99 | +1.16 | +6.89% |

After the bell, American Outdoor Brands (which has a portfolio containing outdoor clothing brands as well as Smith & Wesson), ChargePoint Holdings (EV infrastructure), and Ulta Beauty will dominate investors' interests.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AOUT | AMERICAN OUTDOOR BRANDS INC | 9.21 | +0.20 | +2.22% |

| CHPT | CHARGEPOINT HOLDINGS INC | 6.09 | +0.51 | +9.14% |

| ULTA | ULTA BEAUTY INC. | 690.37 | +12.46 | +1.84% |

The economic reports of note will include the Challenger report on job cuts, personal income, personal consumption, initial jobless claims, vehicle sales, construction spending, and the ISM manufacturing PMI.

Friday, December 2

Friday will see the introduction of a new CEO at Kohl’s, as Tom Kingsbury will act as an interim CEO while the board searches for a new one.

The fourth and last of this week's Fed speeches will be by the Federal Reserve Bank of Chicago's President Charles Evans during the Kaufman Center for Financial and Policy Studies event on "The Role & Effectiveness of Financial Regulation," at 10:15 a.m. EST.

CLICK HERE TO GET THE FOX BUSINESS APP

Earnings will finish out this week before the market opens with Cracker Barrel and Kirkland’s (home decor store unaffiliated with Costco)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CBRL | CRACKER BARREL OLD COUNTRY STORE INC. | 33.81 | +1.02 | +3.11% |

| KIRK | NO DATA AVAILABLE | - | - | - |

This week will finish with reports on non-farm payrolls and the unemployment rate.